Home Loan EMI Calculator

Purchasing a home can be a challenge without an external source of income i.e. borrowings from the financial lender Banks/NBFCs. It is therefore important that you access your repayment capacity before opting for a housing loan with the lender to avoid any financial mess in the future. An EMI calculator is of therefore vital importance since it makes your personal budgeting easier. It is an online tool for computing your per month housing loan instalments. The EMI calculator is important and advantageous because:

- It exactly shows how much EMI you will pay as your monthly loan instalments.

- It saves your time by calculating the EMIs in seconds.

- It improves your chances for making right decisions because the manual complex formula for calculating the EMI becomes futile.

- It calculates the total interest payable on your loan amount which helps you to choose a suitable loan tenure.

- It also helps you to compare multiple EMIs with different loan tenures and interest rates and choose the one which is best within your budget.

- The EMI calculator App also helps you with the amortization chart (monthly & yearly), which gives you a fair understanding about the ratio of the principal amount to the interest due, based on the loan tenure and interest rates.

What Is Home Loan EMI?

An EMI i.e. an Equated Monthly Instalment is a repayment method of the loan lenders (Banks/NBFCs) in which the principal amount and the interest amount is paid to the lender in equal instalments every month until the loan tenure. With every EMI paid the interest component decreases while the principal component increases. The interest outgo during the initial periods of the loan tenure is high while the principal outgo is relatively low. The equation changes with every passing month and towards the end of the tenure the principal outgo is higher than the interest outgo. Click to get additional details on What Is Home Loan EMI?

Additional Read: IS PRE – EMI BETTER THAN FULL EMI. FIND OUT YOURSELF.

Factors That Affect Home Loan EMI

Knowing the EMI is important for calculating your home loan eligibility. The lower the EMI, the lighter it will weigh on your wallets and therefore it is important to understand the factors that affect your EMI. The home loan EMI amount largely depends on the following 3 important factors:-

- Principal Loan Amount – It is the loan amount that you avail from the lender, which is determined on the basis of your income eligibility and the cost of the property. The principal amount is directly proportional to the EMI amount. The higher the loan amount the higher will be the EMIs and vice-a-versa.

- Rate Of Interest – It is the rate of interest at which the lender (Bank/NBFC) offers you the loan. The rate of interest is also directly proportional to the EMI. The higher the interest rates, the higher are your equated monthly instalments and vice-a-versa. The interest rate can either be fixed or floating. In fixed interest rates your EMI remains EMI throughout the fixed tenure of the loan, while in floating interest rates your EMI will vary as per the fluctuations in the interest rates.

- Loan Tenure – It is the period for your repayment of the housing loan. Home loans usually come with longer repayment tenures of up-to 30 years. The longer repayment tenures are beneficial because the loan tenures are inversely proportional to the loan EMIs. The longer the tenure the lower is your EMI and vice-a-versa. Since the repayment is done every month, the tenure is calculated in months and not in years. Therefore a longer tenure of 30 years is equal to 360 months.

- Other – There are various other indirect factors which have an impact on your home loan EMI, such as your profile, income, age, credit score, repayment history, employment details, property details, etc. which have a direct impact on the interest rates and loan amount offered to you, which further fluctuates your loan EMIs.

Additional Read: What Do You Mean By Loan Eligibility In Home Loan?

Home Loan EMI Formula – How Home Loan EMI Calculator Works?

All online EMI calculators use a specific formula for calculating your home loan EMI amount, which is as follows: –

EMI = [P x R x (1+R) ^N] / [(1+R) ^ N-1]

Where P, R & N are variable, which means the EMI value will change every time you change any of the 3 variables.

P stands for principal amount. It is the original loan amount given.

R stands for rate of interest per month. (If the rate of interest per month is 7% then the value of R will be 7 / (12 x 100).

N stands for loan tenure in months.

Assuming that you have taken a loan of Rs.60lakhs for a tenure of 20 years at an interest rate of 7%, the EMI will be calculated as follows: –

[P=60 lakhs, R= 7%p.a. i.e. 7/ (12×100) p.m & N=20 years or 240 months]

EMI= [60, 00,000 x 7/ (12×100) x (1+7/ (12×100)) ^ 240] / [(1+7/ (12×100)) ^ 240-1]

EMI= Rs. 46,518/-

| CALCULATE YOUR EMI |

Home Loan Per Lakh EMI For Different Tenures @ 6.95% Using EMI Calculator

| Tenure | ||||||

| 5 Years | 10 Years | 15 Years | 20 Years | 25 Years | 30 Years | |

| Per Lakh EMI | Rs.1,978/- | Rs.1,159/- | Rs.896/- | Rs.772/- | Rs.704/- | Rs.662/- |

| Total Interest Payable | Rs.18,666 | Rs.39,021/- | Rs.61,286/- | Rs.85,352/- | Rs.1,11,078/- | Rs.1,38,301/- |

| Total amount payable including principal and interest | Rs.1,18,666/- | Rs.1,39,021/- | Rs.1,61,286/- | Rs.1,85,352/- | Rs.2,11,078/- | Rs.2,38,301/- |

Home Loan EMI Calculator For Different Loan Amounts & Loan Tenures @ 6.95% Interest Rates Using EMI Calculator

| Loan Amount | 10 Years | 15 Years | 20 Years | 25 Years | 30 Years |

| 25 Lakhs | Rs.28,963/- | Rs.22,401/- | Rs.19,308/- | Rs.17,590/- | Rs.16,549/- |

| 50 Lakhs | Rs.57,925/- | Rs.44,804/- | Rs.38,615/- | Rs.35,180/- | Rs.33,095/- |

| 75 Lakhs | Rs.86,888/- | Rs.67,203/- | Rs.57,923/- | Rs.52,769/- | Rs.49,646/- |

| 1 Crore | Rs.1,15,851/- | Rs.89,604/- | Rs.77230/- | Rs.70,359/- | Rs.66195/- |

Amortization Schedule

An amortization schedule is a systematic table which provides details on your periodic repayment of loans presenting the principal and interest amount that comprise each payment until the loan is repaid. While each monthly payment remains the same, the payment is made up of parts that vary over time. The amortization schedule determines the percentage of EMI outgo towards the interest component versus principal component. It provides the necessary information on your loan repayments such as loan amount, period of scheduled payments, outstanding loan principal amount, breakup of your monthly repayment towards principal amount and interest amount and total interest payable. The amortization schedule helps the lenders to keep a track of the funds owed to you as well as forecast the outstanding balance or interest at any point of the repayment schedule. This is generated through an amortization calculator.

Home Loan Amortization Schedule For 25 Lakhs Housing Loan For 10 Years @ 6.95% Using Home Loan Amortization Calculator

(Assuming your loan is disbursed in the month of August)

| Year | Total EMI | Principal | Interest | Balance |

| 1 | 1,44,815 | 73,262 | 71,553 | 24,26,738 |

| 2 | 3,47,556 | 1,84,704 | 1,62,852 | 22,42,034 |

| 3 | 3,47,556 | 1,97,959 | 1,49,597 | 20,44,076 |

| 4 | 3,47,556 | 2,12,163 | 1,35,393 | 18,31,912 |

| 5 | 3,47,556 | 2,27,389 | 1,20,167 | 16,04,525 |

| 6 | 3,47,556 | 2,43,704 | 1,03,852 | 13,60,820 |

| 7 | 3,47,556 | 2,61,192 | 86,364 | 10,99,629 |

| 8 | 3,47,556 | 2,79,934 | 67,622 | 8,19,694 |

| 9 | 3,47,556 | 3,00,022 | 47,534 | 5,19,673 |

| 10 | 3,47,556 | 3,21,550 | 26,006 | 1,98,123 |

| 11 | 2,02,741 | 1,98,121 | 4,620 | 0 |

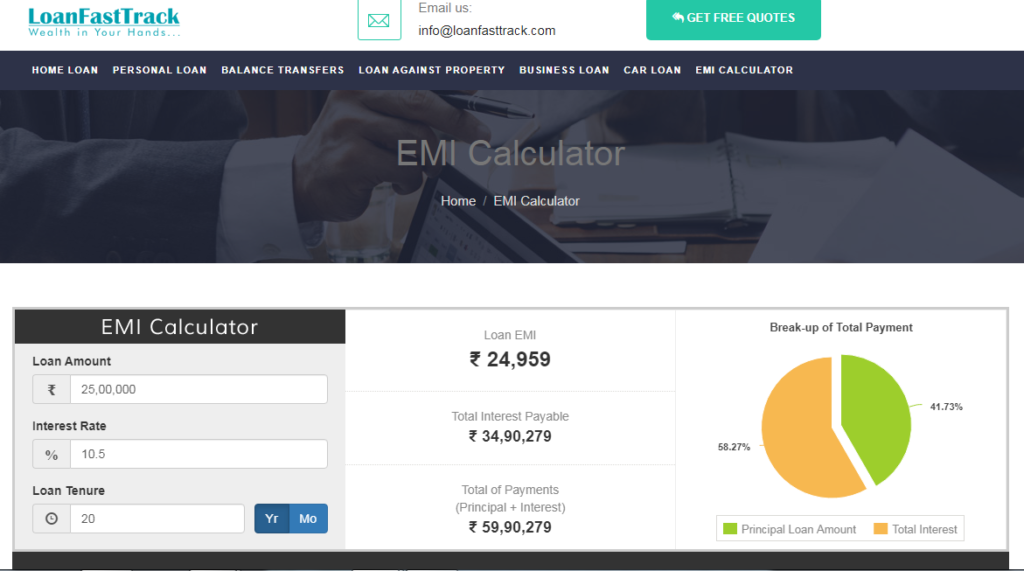

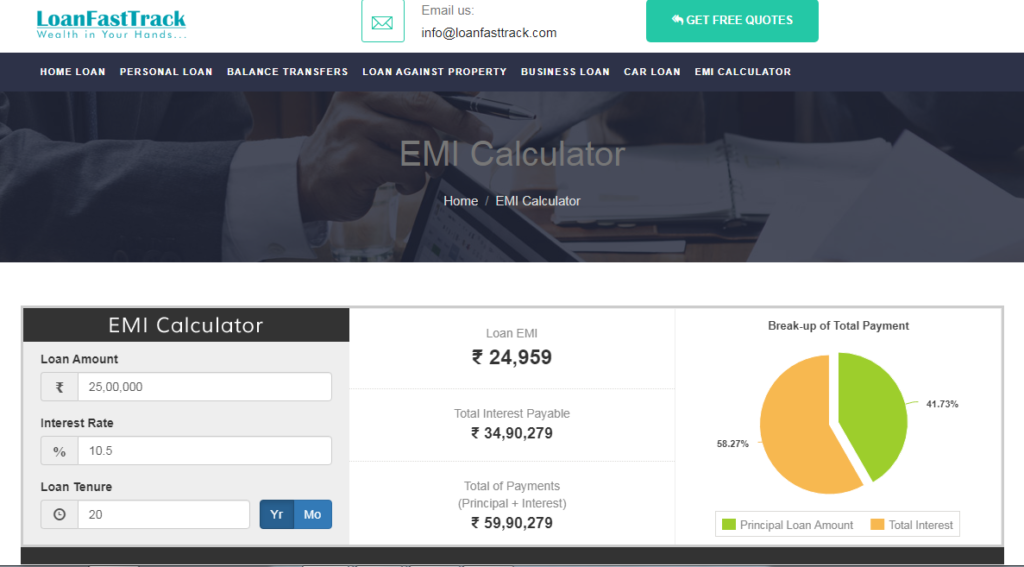

Loanfasttrack’s EMI Calculator

Loanfasttrack’s home loan EMI calculator is a hassle-free simple generic calculator. The online calculator is free for unlimited use. It gives you an accurate estimate, which is pivotal for your financial budgeting. You can check your EMIs for various loan amounts and loan tenures and determine the best suitable loan amount and EMI to your pocket. It is easy to use. All you have to do is enter the 3 simple variables i.e. the loan amount, rate of interest and the loan tenure, and the calculator will calculate for you the loan EMI and the total interest payable. You do not have to register on the website to use the EMI calculator. But for knowing your exact home loan eligibility and its corresponding EMI it is suggested you register on the website.

Why Loanfasttrack?

Loanfasttrack is the best online user friendly platform to compare and evaluate the best bank for home loan in India. Loanfasttrack is a Mumbai based loan provider company since 2015 offering loan services in Mumbai on– housing loan in Mumbai, mortgage loan in Mumbai, personal loan in Mumbai, business Loan in Mumbai, unsecured business loans,home loan transfer, top-up loans, car loans, educational loans and loan transfers.

It also helps you:

√ To find the best bank for home loan

√ To get lowest home loan rates in Mumbai

√ To get an instant loan in Mumbai

√ To get instant personal loan in Mumbai & business loan in Mumbai

√ To make you qualify for the maximum loan against property eligibility

√ To get a low cost home loan balance transfer

√ To get assured low interest rates for loan against property in Mumbai

Speak to our experts on 9321020476 or log on to https://www.loanfasttrack.com/ for additional details. You can also email on info@loanfasttrack.com.

Additional Read:

- Know How To Deal With The Increasing Interest Rates Of Housing Loans

- Best Banks For Home Loan In India

- Home Loan Interest Rates꘡Compare Rates Of Top Banks

- Why Choose ICICI Bank Home Loans?

- Why Choose HDFC Ltd. Home Loan?

- Canara Bank Home Loan

- Top Up Loans – Loanfasttrack

- Best Banks For Mortgage Loan In India