10 Important Home Loan Tips

Purchasing a home is a dream come true for many of us. Therefore, finding a perfect home is important whether you purchase a house for stay or for investment purposes and so is finding a perfect home loan important for making that dream come true. Since a home loan will be your long-term financial commitment, finding the perfect lender becomes equally important and hence the following house loan tips can help you to get a loan that is just right for you.

Top 10 Housing Loan Tips

- Make Good Research

Just because your friend or relative has applied with Bank X, it doesn’t mean you apply with the same bank with their experiences. Decision to select a lender Bank/NBFC/HFC depends on your unique financial circumstances and requirements. You must therefore make a good research on the existing housing loan deals matching your requirement (of higher home loan eligibility, lowest home loan interest rates, lowest home loan processing fees, etc.), home loan products (fixed rate, overdraft, floating rate, etc.) before you apply with any lender.

Home loan tips for first time buyers please refer to the link “Everything You Must Know Before Applying For A Housing Loan”.

2. Plan Your Budget, Plan Your OCR

Down payments are vital in a home purchase. You should save enough to make your down payments to the builder/reseller & make arrangements for your own contribution (OCR) amount for purchasing a house. The OCR contribution differs with the cost of your house. As per RBI guidelines the maximum funding allowable on the property is up-to 90%, which means you need to plan your budget for the rest 10% of your OCR. Use your savings or apply for a mortgage loan or instant personal loan if you are falling short of OCR.

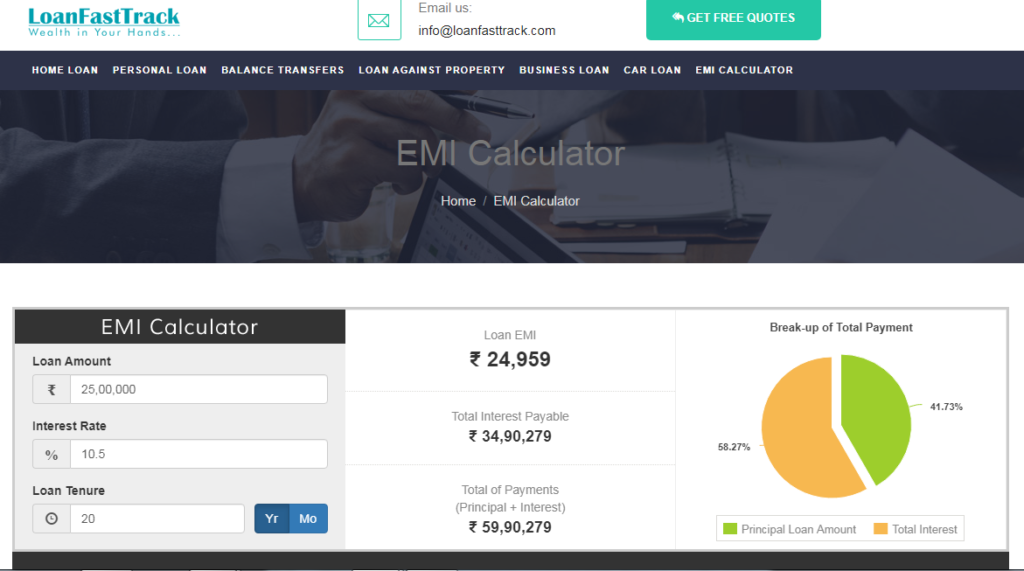

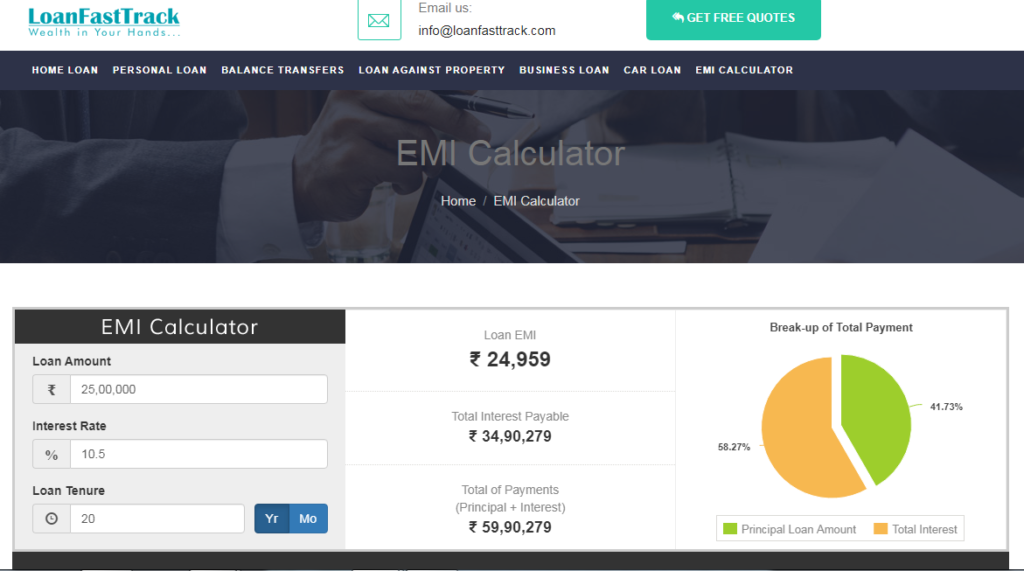

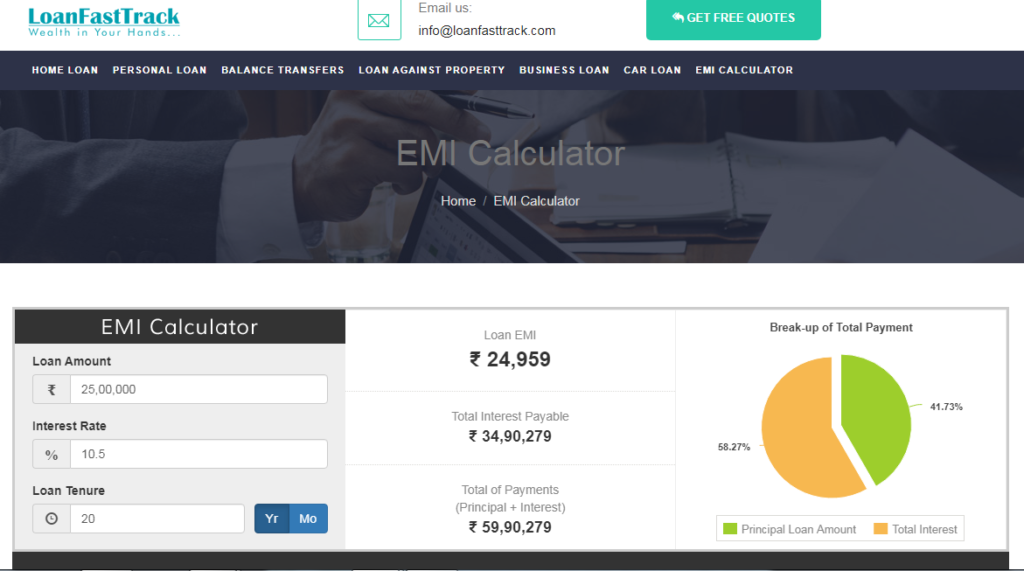

Remember the higher the down payments the lower will be your loan amount and therefore lower will be your home loan EMIs. Know how much monthly installments you can afford to pay using Loanfasttrack’s home loan EMI calculator.

3. Track Your CIBIL Score

The lender pulls your CIBIL report every time you apply for a home loan to ascertain your credit worthiness. A good credit score can earn you the best deal on home loans. A good CIBIL score above 750 can earn concessions on the home loan interest rates and also improves the chances of loan approvals. You must therefore maintain your credit history, make timely repayments of your bills, credit cards, etc. to avoid your CIBIL scores from diminishing, before you apply for a house loan. A poor CIBIL score not only lapses your chance for the best deal but also rejects your home loan application.

Also Read: How To Apply For Home Loan With Bad CIBIL Score – By Loanfasttrack

4. Know Your Eligibility

You must understand how much you can afford to pay prior to applying for a home loan. You must figure out what EMI amount is affordable which you can serve easily. A home loan calculator can be of great use. The calculators are easily available online. Use Loanfasttrack’s EMI calculator. Simply enter your desired loan amount, interest rate and desired loan tenure to check how much EMI you can afford to pay.

For higher loan eligibility you can apply for a joint home loan. Click to read the benefits of applying for a joint home loan.

5. Keep Your Documents Ready

Before applying for a housing loan, keep your required set of documents ready. This will help in faster processing of the loans. You have to submit the KYC, financial and property papers to the lenders to get your loan approved.

For the detailed list of documents please refer the links below:

- Home Loan Salaried List Of Documents – Resale Case / Builder Case.

- Home Loan List Of Documents For Self-Employed

| Proprietorship Firm | Partnership Firm | Private Ltd. Company | |||

| Builder Case | Resale case | Builder Case | Resale case | Builder Case | Resale case |

6. Compare and Evaluate The Offers

You must compare, evaluate and choose among the various home loan offers of the lenders that best suits your requirement. Don’t merely choose a lender Bank/NBFC/HFC because it is offering lower processing fee or a lowest interest rate for home loan. There are other factors which can make the home loan expensive for you, such as the loan repayment tenure, LTV funding norms, loan terms, foreclosure charges & conditions, other costs involved like legal, technical, administrative, etc. So don’t get fooled, and know all the costs involved in availing a home loan before you make a decision to apply for a loan.

Click to compare home loan offers of leading banks.

7. Apply For A Pre-Sanction Home Loan

Get yourself pre-approved for a home loan before you finalize the property. This will help you to know your exact eligibility and accordingly plan your budget for a house and you no longer have to worry to arrange for those shortfalls of funds if you go and buy an over budgeted property.

Click to know more on pre-approved home loans.

8. Carefully Read The Loan Agreements

Make sure you go through the entire loan agreements before signing it. It may be tedious and exhaustive to go through long pages of loan agreement but it is important that you know the bank clauses and terms and conditions with respect to home loan charges, instalments, rate change, notifications, hidden costs, etc. which if overlooked may cost you later.

Additional Read: 10 Common Home Loan Mistakes

9. Maintain Written Communications

Avoid making only verbal communications with the lenders. It is crucial you have a written proof of the verbal commitments & offers provided by the lender, because verbal commitments at times may not be honored by the lenders. Therefore, take the offer commitments in writing, prefer email communication for your safety.

10. Choose The Correct Home Loan Product

Choose the home loan product which is best suitable for you. Wisely choose among the products (fixed rate home loan, smart home loan, etc.) & repayment tenures that best suits your requirement. The tenure and EMI’s are inversely related. The higher the tenure the lower the EMI’s & vice-a-versa, but remember the longer the tenure the higher is the interest you pay to the bank.

For additional information on home loan Contact Loanfasttrack:

Website – www.loanfasttrack.com

Email – info@loanfasttrack.com

Tel – 9321020476

Loanfasttrack is a Mumbai based loan provider company since 2015 offering loan services in Mumbai on– housing loan in Mumbai, mortgage loan in Mumbai, personal loan in Mumbai, business Loan in Mumbai, unsecured business loans,home loan transfer, top-up loans and loan transfers. Loanfasttrack is a direct sales associate with leading banks namely, ICICI Bank, HDFC Ltd, Canara Bank, Citi Bank, Piramal Housing Finance, etc.

Loanfasttrack’s specialized services include providing:

- The best bank for home loan.

- Best Banks For Mortgage Loan In India

- Assured low interest rates for loan against property in Mumbai.

- Lowest home loan rates in Mumbai.

- Instant loan in Mumbai.

- Instant personal loan in Mumbai & business loan in Mumbai

- Low cost home loan balance transfer.