ICICI Bank Mortgage Loan For NRI In India

ICICI Bank NRI mortgage loans are available for all eligible NRIs & PIOs at attractive mortgage loan rate of interest ICICI Bank starting from 8.35%* p.a. with lower EMIs and comfortable repayment tenures.

An NRI can avail of a loan in India to fulfill his various money requirements against the pledge of his commercial/residential property in India. An NRI who owns a property in his name or joint name can apply for an NRI mortgage loan in India with ICICI Bank provided the property is free from any charge i.e., the property has no ongoing loan on it and has a clear and marketable title. It is an instant loan for NRI in India obtained against the collateral of a property and is also referred to as Loan Against Property (LAP).

Prominent Features Of ICICI NRI Loans For Property Mortgage

- Both residential and commercial properties can be mortgaged.

- Quick, easy & hassle-free processing of ICICI Bank NRI Loan for LAP.

- Nil or minimum prepayment charges.

- Online application of the loan from the comfort of your home.

- Mortgage pre-approval loans available.

- Can be availed for your business and personal needs.

- Lower EMIs with longer repayment tenures upto 10 years.

- Loan up-to 60% of the market value available.

- Joint applications can be made to enhance loan eligibility.

- Mortgage loan balance transfers available at attractive ICICI Bank LAP loan interest rates.

- ICICI Bank loan top-ups available on LAP loans.

Details Of NRI Property Loan Against Property Mortgage

NRI loan eligibility for property mortgage is assessed based on the financials of an NRI and the value of the property being offered as collateral. Given below are the details of the NRI loan ICICI Bank for a property mortgage.

NRI Loan Against Property Eligibility ICICI Bank Ltd.

| Eligible Profiles | Salaried & Self-employed. |

| Age | Minimum – 25 years & Maximum – 60 years or retirement age whichever is earlier. |

| Loan Amount | Rs.10 Lakhs – Rs.5 Crores |

| NRI LAP Interest Rate ICICI | * NRI loan interest rates for property mortgage range from 8.35% p.a. – 10% p.a. * ICICI Bank loan against property rate of interest can be floating or fixed. |

| Loan Tenure | Up-to 10 years. |

| End-Use | Business & Personal Utility. |

| Property Type | Residential & Commercial. |

| Loan Type | NRI mortgage loan, NRI mortgage loan balance transfer, NRI top-up loan on a mortgage loan. |

| Minimum Income | * For GCC – 84,000 AED p.a. * Other Countries – 42,000 USD p.a. * Merchant Navy – 26,000 USD p.a. |

| LTV (Loan To Value) | 60% of the property value. |

| FOIR (Fixed Obligation To Income Ratio) | 60% of net income per month. |

| Processing Fees | Up-to 1% on the loan amount + applicable GST. |

| Administrative Charges | Rs.5000/- + applicable GST or 0.25% + applicable GST – whichever is low. |

| Part Payment Charges | Nil |

| Foreclosure Charges | 4% on the outstanding loan amount + applicable GST. |

Note: ICICI LAP loan interest rates and charges listed above are subject to change without prior notice.

Also Read: NRI Loan Against Property In India.

NRI LAP Rate Of Interest In ICICI Bank

| Slabs | Loan Against Property Interest Rate ICICI Bank | |

| Priority Sector Lending (PSL) | Non- Priority Sector Lending (Non-PSL) | |

| Up-to Rs.50 Lakhs | 8.85% p.a. – 9.50% p.a. | 9.35% p.a. – 10% p.a. |

| Rs.50 Lakhs – Rs.1 Crore | 8.60% p.a. – 9.25% p.a. | 9.10% p.a. – 9.75% p.a. |

| Above Rs.1 Crore | 8.35% p.a. – 9% p.a. | 8.85% p.a. – 9.50% p.a. |

Note: (i) ICICI LAP rate of interest is subject to change without prior notice.

List Of Other Charges

| CIBIL Report Charges | Rs.50/- + applicable GST. |

| Conversion Charges | * For Floating To Floating, Dual Fixed Rate To Floating, Floating To Dual Fixed Rate> 0.50% of outstanding loan amount + applicable GST. * For Lifetime Fixed To Floating> 1.75% of outstanding loan amount + applicable GST. |

| Repayment Mode Swap charges | Rs. 500/- |

| Documents retrieval charges | Rs. 500/- |

| Cheque / AD / ECS / Bounce Charges | Rs. 500/- |

| Duplicate No Objection Certificate / No Due Certificate | Rs. 100/- |

| Revalidation of No Objection Certificate | Rs. 100/- |

| Late payment charges | 2% per month. |

Also Read: Mortgage Loan Income Tax Benefits.

Important Eligibility Criteria For NRI

- An NRI must have a valid Indian passport.

- An NRI must have regular employment for a minimum of 1 year.

- An NRI must hold a valid job contract/ work permit for a minimum of 2 years in the foreign country.

- An NRI is not a citizen of the countries namely- Iran, North Korea, Cuba, Syria, Sudan, and Creamia regions of Ukraine, Pakistan, Bangladesh, Sri Lanka, Afghanistan, China, Nepal, Macau, Nigeria, Hongkong, or Bhutan.

- An NRI must hold an NRE/NRO account in India

- A co-applicant in NRI loans must be a resident in India.

- An NRI must appoint a POA holder of Indian citizenship to manage his property-related matters in his absence who also has to be a co-applicant to the loan.

ICICI Bank Loan Against Property Documents Required For NRI

Following are the NRI documents required for loan against property in ICICI Bank.

- KYC – Pan Card, Aadhar Card, Indian & Overseas address proof.

- Income Documents – Last 4 months salary slips, 6 months bank account statements, Appointment letter, Employment continuity Proof.

- Property Documents – Property chain agreement, OC/CC + Plan copy, Index 2, Share certificate, Society registration certificate, latest property tax & maintenance bill.

- Additional Documents Required For Balance Transfer – LOD (list of documents), copy of outstanding letter from the lender & 12-18 months repayment track record.

Click to get the complete list of documents.

Also Read: The NRI List Of Documents For Applying For A Home Loan.

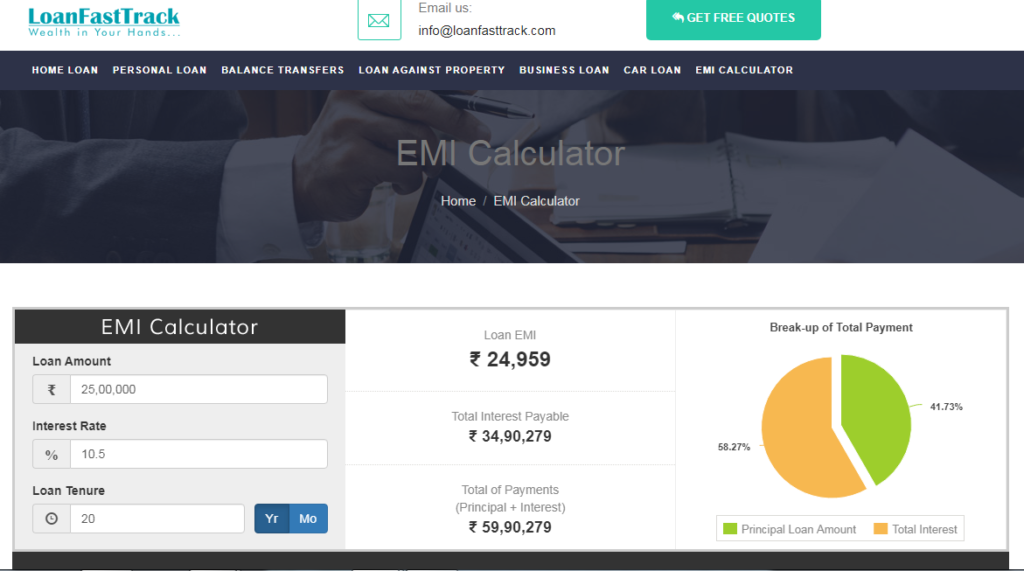

NRI Mortgage Loan Calculator ICICI Bank

You can calculate your monthly LAP installments with the help of a mortgage EMI calculator. The ICICI Bank mortgage loan EMI calculator is easily available online on its portal. Alternatively, you may also refer to the loan against property interest rate calculator of Loanfasttrack to know your EMI and the interest outgo.

Loanfastrack’s LAP EMI calculator.

By,

Loanfasttrack

Loanfasttrack is a Mumbai-based loan provider company since 2015 offering loan services in Mumbai on– housing loan in Mumbai, mortgage loan in Mumbai, personal loan in Mumbai, unsecured business loans, home loan transfer, top-up loans, loan transfers and apply for a business loan in Mumbai. Loanfasttrack is a direct sales associate with leading banks namely, ICICI Bank, HDFC Ltd, Canara Bank, Citi Bank, Piramal Housing Finance, etc.

Contact Loanfasttrack:

Website – www.loanfasttrack.com

Email – info@loanfasttrack.com

Tel – 9321020476

Loanfasttrack specialized services include providing:

- The best bank for home loans.

- Best Banks For Mortgage Loan In India.

- Assured low-interest rates for loan against property in Mumbai.

- Lowest home loan rates in Mumbai.

- Instant loan in Mumbai &home loan in Mumbai.

- Instant personal loan in Mumbai & business loan in Mumbai

- Low-cost home loan balance transfer.

Additional Read