Home Loan Provisional Certificate

The term housing loan provisional certificate sounds familiar, especially when the Chartered Accountant (CA) demands the home loan interest certificate for income tax filing. Home loan tax certificate or a provisional home loan interest certificate is nothing but a housing loan statement indicative of the loan repayments made or to be made by the home loan borrower.

What Is A Home Loan Statement?

A house loan statement is a statement issued by the lender of the home loan borrower stipulating the principal and the interest amount repaid by him in a financial year. It acts as a borrower’s repayment proof and is of utmost importance especially in foreclosing a home loan via home loan balance transfers. Since the statement shows the latest outstanding home loan balance as on date, tracking of monthly/yearly repayments towards the home loan becomes quite easy for a borrower.

What Is a Home Loan Provisional Certificate?

Provisional home loan certificate is a home loan statement provided by the home loan lender Bank/NBFC/HFC to the borrower at the beginning of the financial year summarizing the principal repayment and the interest amount to be payable by the borrower towards the home loan in that financial year.

What Does The Home Loan Statement Specify?

The borrower can come to know the status of his home loan through the home loan statement. The housing loan balance statement describes the loan’s repayment record for the home loan tenure taken. The home loan statement is indicative of the following:

- Name of the applicants and the co-applicants in case of joint home loan taken.

- The start and the end date of the home loan period/tenure.

- The loan amount taken, the loan amount repaid till date and the balance outstanding loan amount.

- Total interest paid, type of home loan interest rate i.e. floating/fixed home loan rates and the applicable interest rate.

- The actual principal and interest paid during the year. (Provisional Certificate shows the amount payable for the current financial year while the final certificate shows the actual amount paid during the previous financial year).

- Part or pre-payment made towards the home loan, the date on which it is paid and the date on which it is credited to the loan account.

- Unpaid monthly installments or EMI bounce.

Why Is a Home Loan Statement Of Vital Important?

An home loan account statement is of vital importance for the following reasons:

- It provides the EMI break-up of the interest paid and the principal repaid by the borrower, easy enough for the borrower to track his repayments.

- The statement shows the outstanding due amount, balance home loan tenure, upcoming home loan EMIs and the amount paid, thus helping the borrower to track his home loan activities.

- Since a borrower can also claim income tax benefits on home loan principal repayment as well as on the interest paid, the home loan statement is essential to claim the tax rebate.

- Tax deduction of up-to Rs.1.5 Lakhs p.a. for principal repayment can be claimed under section 80C of Income Tax Act,1961.

- Tax deduction of up-to Rs.2 Lakhs p.a. for interest paid can be claimed under section 24(b) of Income Tax Act,1961.

The borrower is required to submit the home loan certificate to the income tax department for filling of his income tax returns.

- For home loan balance transfers lenders require a clear repayment track record which is easily obtainable from the home loan statements.

- Home loan statements also act as a proof for the home loan repayments made. A clear repayment track forms a base for future borrowings for the borrowers since the lenders are certain of timely repayments from them.

How To Obtain A Home Loan Provisional Interest Certificate / Home Loan Statement?

The borrower gets a loan account number once his loan is disbursed with the lender. The loan account remains the identity of the home loan borrower. With the help of this loan account number the borrower can easily track his loan details and his loan activities online by login to the lender’s loan portal/ official website using the loan account number or alternately by downloading the mobile app. By simply login to the loan account the borrower can get access to view, print as well as download the home loan account statement/statements, provisional home loan certificate, home loan summary, etc. The borrower can download the final home loan interest certificate only at the end of the financial year. He can also request for a provisional certificate but remember the provisional loan certificate will not be available for partial loan disbursement.

Accessing the loan statements online is easy for the borrowers who are tech/internet-savvy. Others can also visit their lender branch in person to request for the loan statement & provisional loan certificate. (Know more on online v/s offline home loans)

How To Apply For ICICI Bank Home Loan Statement/ ICICI Home Loan Provisional Certificate

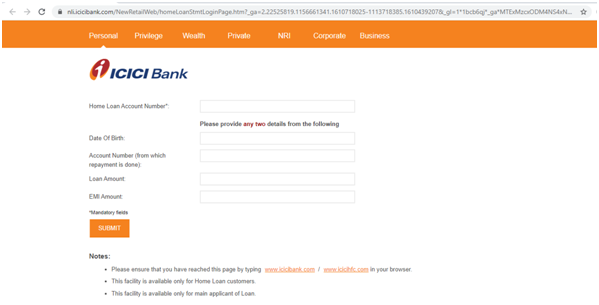

Remember to follow the following steps to obtain the ICICI home loan statement/ ICICI provisional certificate.

i) Reach ICICI Bank Ltd. official website, under the home loan tab find the option of home loan statement, alternately you may also visit the following link for generating ICICI Bank loan provisional certificate online.

Click on continue to login.

ii) The borrower will be redirected to the above page requiring him to submit the necessary details namely the loan account number, DOB (date of birth of the borrower), loan amount, EMI amount & the account number.

iii) Click on ‘Submit’ to view, print or download the ICICI home loan statement online, final ICICI home loan certificate as well as ICICI Bank provisional home loan certificate.

If you need assistance for generating the ICICI home loan account statement or ICICI Bank home loan provisional certificate online or final ICICI Bank home loan certificate get in touch with Loanfasttrack on 9321020476 or Visit www.loanfasttrack.com.

How To Apply For HDFC Home Loan Provisional Certificate

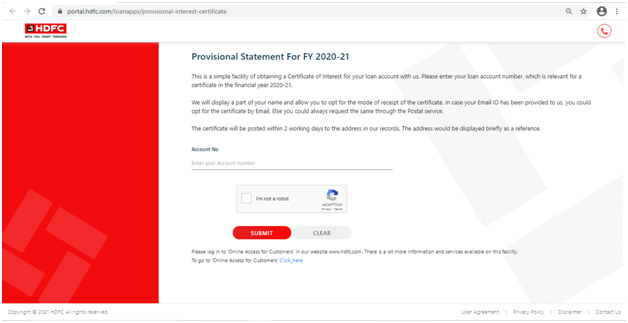

Remember to follow the following steps to obtain the HDFC home loan certificate of interest/HDFC home loan statement.

i)Visit HDFC online portal on https://portal.hdfc.com/loanapps/provisional-interest-certificate

ii) Enter the HDFC loan account number.

iii) Enter the captcha (privacy-terms) proving you are not a robot and click on the submit button.

iv) The borrower can opt for receiving the HDFC housing loan statement/ HDFC provisional statement via email or through the postal service (the HDFC home loan certificate will be posted within 2 working days of the request given and will be delivered on the postal address in HDFC records).

If you need assistance for generating HDFC home loan account statement or HDFC home loan provisional statement or final HDFC housing loan interest certificate get in touch with Loanfasttrack on 9321020476 or Visit www.loanfasttrack.com.

Loanfasttrack is a Mumbai based loan provider company since 2015 offering loan services in Mumbai on– housing loan in Mumbai, mortgage loan in Mumbai, personal loan in Mumbai, business Loan in Mumbai, unsecured business loans,home loan transfer, top-up loans and loan transfers. Loanfasttrack is a direct sales associate with leading banks namely, ICICI Bank, HDFC Ltd, Canara Bank, Citi Bank, Piramal Housing Finance, etc.

Contact Loanfasttrack on: www.loanfasttrack.com or call on 9321020476 or email on info@loanfasttrack.com.

Loanfasttrack’s specialized services includes providing:

- The best bank for home loan.

- Best Banks For Mortgage Loan In India

- Assured low interest rates for loan against property in Mumbai.

- Lowest home loan rates in Mumbai.

- Instant loan in Mumbai.

- Instant personal loan in Mumbai & business loan in Mumbai

- Low cost home loan balance transfer.

Click to know more on home loan with