(BOB) BANK OF BARODA HOME LOAN

| Bank Of Baroda Is Rated As One Of The Top Nationalized Banks In India. Home loan Baroda Bank is available for all eligible borrowers with EMIs starting from ₹655 per lakh. Bank Of Baroda current home loan interest rate starts from 6.85% p.a. over extended loan tenures up to 30 years with processing fees starting from 0.25% of the loan amount. |

Key Features Of Bank Of Baroda Housing Loan:

- BOB is the lowest interest rate home loan provider.

- Bank Of Baroda home loan interest rate today starts from 6.85% p.a.

- Lowest per lac EMI starting from Rs.655/-

- Uniform Bank Of Baroda ROI for home loan for salaried, self-employed, self-employed professionals & NRIs.

- Longer repayment tenure for 30 years available.

- Pre-approved home loan facility available.

- Home loan interest in Bank Of Baroda is calculated on daily reducing balance.

- Home loan BOB interest rate is linked to repo rate.

- Nil prepayment charges for floating Bank Of Baroda loan interest rates.

- Top-up loans can be applied up-to five times during the loan tenure.

- Loan applicant can add a close relative as a co-applicant to increase his home loan eligibility (co-applicant necessarily need not be a joint owner of the property).

- Loan applicants receive a complimentary Bank of Baroda Credit Card.

- Loan applicants get a free Bank Of Baroda home loan insurance cover with every home loan.

- Loan applicants also get rewarded with a concession of 0.25% on Car Loans.

- Loan applicants get access to high-end banking technology for easy repayment of housing loans.

- PMAY credit linked subsidy schemes available with subsidy up-to Rs.2.67 lakhs.

Bank Of Baroda Home Loan Interest Rates 2020 Of Various Home Loan Schemes

| Baroda Home Loan | 6.85% p.a. – 8.20% p.a. |

| Baroda Home Improvement Loan | 6.85% p.a. – 8.20% p.a. |

| Baroda Home Loan Advantage | 6.85% p.a. – 8.20% p.a. For loans up-to Rs.75 Lakhs. 7.10% p.a. – 8.45% p.a. For loans above Rs.75 Lakhs. |

| Baroda CRE Home Loan | 7.10% p.a. – 8.45% p.a. |

| Baroda CRE Home Loan (Advantage) | 7.10% p.a. – 8.45% p.a. For loans up-to Rs.75 Lakhs. 7.35% p.a. – 8.70% p.a. For loans above Rs.75 Lakhs. |

| Baroda Top Up Loan | 7.45% p.a. – 8.80% p.a. |

| Baroda Mortgage Loan | 8.05% p.a. – 13.20% p.a. |

| Baroda Ashray (Reverse Mortgage Loan) | 9.20% p.a. |

Note: (i) Housing loan interest rates Bank Of Baroda are subject to change without prior notice.

(II) Home loan rate of interest bank of baroda is linked to the Baroda Repo Linked Lending Rate (BRLLR) of the bank.

Bank Of Baroda Home Loan Details

| Eligible Profile | Salaried, Self-Employed Professionals, Self-Employed Non-Professionals, NRIs, OCI & PIOs, firms & companies. |

| Age Criteria | Minimum age is 21 years (co-applicant-18 years) & the maximum age is 70 years. |

| Loan Amount | Maximum up-to Rs.10 Crores. |

| Repayment Tenure | Maximum up-to 30 years. |

| Collateral Accepted | Constructed or purchased homes, (at times also) insurance policies, government promissory notes, shares and debentures, gold ornaments etc. |

| Who Can Be The Loan Co-Applicants | Spouse, Father, Mother (including Step Mother), Son (including Step Son), Son’s wife, Daughter (Including Step Daughter), Daughter’s husband, Brother/sister (Including step brother/sister), Brother’s wife, sister (including step sister) of spouse, Sister’s husband, Brother (including step brother) of spouse. Click to get complete information on Co-Applicant in home loans. |

| Bank Of Baroda Types Of Loans: – | Bank Of Baroda repo linked Home Loan, Bank Of Baroda Top Up Loan, Bank Of Baroda NRI Home Loan, Bank Of Baroda Pre Approved Home Loan, Bank Of Baroda Home Renovation Loan, Bank Of Baroda Home Improvement Loan, Bank Of Baroda Home Loan Takeover, Bank Of Baroda Plot Loan/Bank Of Baroda Land Loan, Bank Of Baroda Mortgage Loan, BOB Reverse Mortgage Loan. |

| BOB Per Lakh EMI | Bank Of Baroda home loan EMI starts from Rs.655/- per lakh. |

| BOB Bank Home Loan Interest Rate | Bank Of Baroda bank home loan interest rate starts from 6.85% p.a. |

| Bank Of Baroda Home Loan ROI | Bank Of Baroda housing loan rate is linked to repo rate. |

| Bank Of Baroda Repo Rate Home Loan Interest Rate Package Available | Floating home loan interest Bank Of Baroda. |

| Housing Loan Interest Rate In Bank Of Baroda | Housing loan interest in Bank Of Baroda is charged on daily reducing balance. |

| LTV (% on the market value of the property) | 90%- for loan amount up-to Rs.30 Lakhs.80% – for loan amount from Rs.30 Lakhs – Rs.75 Lakhs.75% – for loan amount above Rs. 75 Lakhs. |

| FOIR (Fixed Obligation Against Income Ratio) | Maximum FOIR of up-to 80%. |

| Bank Of Baroda Home Loan Charges | Unified Bank Of Baroda home loan processing charges i.e. inclusive of processing charge, documentation charge, document verification/vetting charge, pre-sanction inspection charge, legal & technical cost, CIBIL cost, CERSAI cost as well as ITR verification charge. |

| Bank Of Baroda Home Loan Processing Time | Minimum 30 – 45 working days. |

| Bank Of Baroda Home Loan Charges | Processing fees of up-to 0.50% of the home loan amount + applicable GST. (Minimum Rs.8500/- & Maximum Rs.25,000/-) (Read to know the complete list of charges on home loans – Click) |

| Bank Of Baroda Home Loan Prepayment Charges | Nil on floating home loan interest of Bank Of Baroda. |

| Bank Of Baroda Loan Schemes | Baroda Home Loan, Baroda Home Loan Advantage, Baroda Pre-Approved Home Loan, Bank Of Baroda Home Improvement Loan, Baroda Top UP Loan, Baroda Home Loan Takeover Scheme, ISHUP Schemes, CRGFS Schemes, Bank Of Baroda PMAY Schemes & Baroda Ashray Reverse Mortgage Loan. |

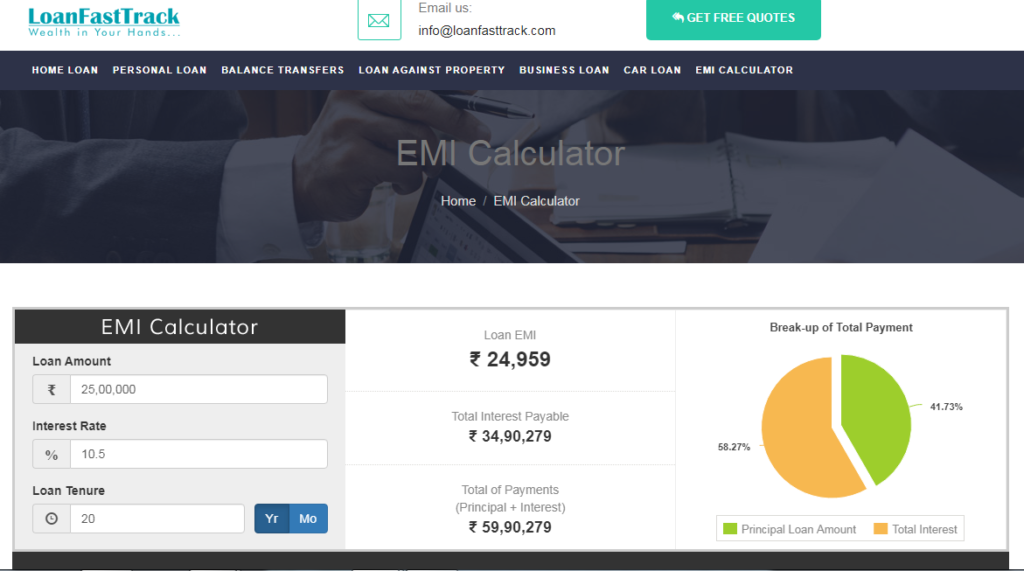

Bank Of Baroda Home Loan Calculator

Use Loanfasttrack’s Bank Of Baroda Home Loan EMI calculator to calculate your EMI outgo. Loanfasttrack’s Bank Of Baroda EMI calculator is a hassle free simple generic calculator which gives accurate estimates of the EMI for various loan amounts for various loan tenures. It also displays the total interest payable on the home loan amount. The interest payable varies with the loan tenures. The longer the loan tenure the higher is the interest payable to the bank & vice-a-versa.

The home loan EMI depends largely on the rate of interest, loan amount & loan tenure. Simply enter these 3 variables to get the desired EMI amount.

- The higher the loan amount the higher will be the interest paid on housing loan and therefore higher will be the EMIs & vice-a-versa.

- The longer the tenure the less will be the EMIs. & vise-a-versa.

- The higher the interest rate of home loan in Bank Of Baroda the higher will be the EMIs & vice-a-versa.

EMI Amortization Chart

The amortization schedule determines the percentage of EMI outgo towards the interest component versus principal component.

An amortization chart details the periodic loan repayments consisting of the principal & the interest amount till the loan is repaid. Each monthly payment remains the same & the payment is made up of parts that vary over time. The interest deduction in the EMI will be higher than the housing loan principal deduction during the initial period of tenure followed by lower interest deduction and higher home loan principal deduction towards the end of the tenure.

Home Loan Amortization Chart For Rs.60 Lakhs Housing Loan For 20 Years

(Assuming your loan is disbursed in the month of November @ 6.85% p.a.)

Yearly Chart

| Year | Total EMI | Principal | Interest | Balance |

| 2020 | 91,958 | 23,525 | 68,433 | 59,76,475 |

| 2021 | 5,51,748 | 1,46,918 | 4,04,830 | 58,29,556 |

| 2022 | 5,51,748 | 1,57,306 | 3,94,442 | 56,72,252 |

| 2023 | 5,51,748 | 1,68,425 | 3,83,323 | 55,03,828 |

| 2024 | 5,51,748 | 1,80,329 | 3,71,419 | 53,23,497 |

| 2025 | 5,51,748 | 1,93,077 | 3,58,671 | 51,30,419 |

| 2026 | 5,51,748 | 2,06,729 | 3,45,019 | 49,23,691 |

| 2027 | 5,51,748 | 2,21,342 | 3,30,406 | 47,02,349 |

| 2028 | 5,51,748 | 2,36,990 | 3,14,758 | 44,65,361 |

| 2029 | 5,51,748 | 2,53,739 | 2,98,009 | 42,11,619 |

| 2030 | 5,51,748 | 2,71,679 | 2,80,069 | 39,39,393 |

| 2031 | 5,51,748 | 2,90,886 | 2,60,862 | 36,49,054 |

| 2032 | 5,51,748 | 3,11,447 | 2,40,301 | 33,37,606 |

| 2033 | 5,51,748 | 3,33,465 | 2,18,283 | 30,04,141 |

| 2034 | 5,51,748 | 3,57,039 | 1,94,709 | 26,47,102 |

| 2035 | 5,51,748 | 3,82,278 | 1,69,470 | 22,64,823 |

| 2036 | 5,51,748 | 4,09,302 | 1,42,446 | 18,55,521 |

| 2037 | 5,51,748 | 4,38,236 | 1,13,512 | 14,17,284 |

| 2038 | 5,51,748 | 4,69,216 | 82,532 | 9,48,067 |

| 2039 | 5,51,748 | 5,02,387 | 49,361 | 4,45,681 |

| 2040 | 4,59,790 | 4,45,679 | 14,111 | 0 |

Bank Of Baroda Home Loan Schemes

1) Baroda Home Loan

- Available for purchasing a plot (Bank Of Baroda plot purchase loan), for construction of a house on plot, purchasing a resale/ready to move/under-construction property and also for improving/extending the existing property. (Click to know the difference in home loan for resale & builder case)

- Available for all salaried, self-employed, self-employed professionals, NRIs (Read About NRI Home Loans), PIOs & OCIs from 21 years to 70 years.

- Available for home loan transfer to Bank Of Baroda. (Get complete knowledge on home loan balance transfer-CLICK)

- Maximum loan amount ranges from Rs.5 Crore – Rs.10 Crore.

- Longer repayment tenure of up-to 30 years.

- BOB home loan interest rates range from 6.85% p.a. – 8.20% p.a.

- Bank Of Baroda home loan top up interest rate is charged on daily reducing balance.

- Bank Of Baroda home loan top up can be availed up-to maximum of 5 times during the BOB home loan tenure.

- Bank Of Baroda home loan processing fee

* Up-to Rs.50 Lakhs – 0.50% of the loan amount plus applicable GST subject to minimum of Rs.8,500/- and maximum of Rs.15,000/-

* Above Rs.50 Lakhs – 0.25% of the loan amount plus applicable GST subject to minimum of Rs.8,500/- and maximum of Rs.25,000/-

* Flat Rs.8,500/- for home loan transfer Bank Of Baroda. - FOIR (Fixed Obligation Against Income Ratio)percentage:

| For Salaried Loan Borrowers (Bank Of Baroda home loan eligibility based on salary) | For Self-Employed Loan Borrowers | ||

| Gross Monthly Income | FOIR % | Latest 2 Years Average Gross Annual Income | FOIR % |

| < Rs.20,000/- | 50% | Up-to Rs.6 Lakhs | 70% |

| Rs.20,000/- to Rs. 50,000/- | 60% | Above Rs.6 Lakhs | 80% |

| Rs.50,000/- to Rs.2 Lakhs | 65% | ||

| Rs.2 Lakhs to Rs.5 Lakhs | 70% | ||

| Above Rs.5 Lakhs | 75% |

- Maximum funding of up-to 90% on the value of the property.

- Bank Of Baroda home loan eligibility:

* For salaried residents – minimum 1 year of employment.

* For self-employed- minimum 2 years of business vintage.

* For NRIs/PIOs/OCI –

(a) minimum 2 years valid job contract / work permit OR must be staying abroad for at least 2 years.

(b) Minimum gross annual income of Rs.5 Lakhs.

(c) Should not be the citizens of the countries- Bangladesh / Pakistan / Sri Lanka / Afghanistan / China / Iran / Nepal & Bhutan.

- A close relative (Spouse, Father, Mother (including Step Mother), Son (including Step Son), Son’s wife ,Daughter (Including Step Daughter), Daughter’s husband, Brother/sister (Including step brother/sister), Brother’s wife, sister (including step sister) of spouse, Sister’s husband, Brother (including step brother) of spouse) can be added to the home loan application as an co-applicant in order to enhance the BOB home loan eligibility.

- Nil prepayment charges on home loan by Bank Of Baroda.

- Free credit card with every home loan.

- 0.25% concessions on car loans.

Compare BOB Home Loan With ICICI Bank Home Loan, HDFC Ltd. Home Loan, Canara Bank Home Loan, SBI Home Loan, Axis Bank Home Loan & Bank Of India Home Loan.

For the latest BOB Bank Home Loan, Bank Of Baroda Home Loan Transfer interest rates & processing fees offer call on 9321020476 or login to Loanfasttrack.

2) Baroda Home Loan Advantage

- Available for all salaried, self-employed, self-employed professionals, NRIs, PIOs & OCIs from 21 years to 70 years for purchasing a residential plot, for purchase + construction of the plot, for construction of house, for purchasing a resale/ready to move/under-construction property and also for improving/extending the existing property. (Read: Everything You Must Know Before Purchasing A Land & Availing The Land Loans)

- Also available for Bank Of Baroda-BOB home loan transfer.

- Key features of Baroda Home Loan

* Sanctioned home loans are linked to the borrower’s BOB saving account (zero rate of interest on this savings account).

* The borrowers can deposit his savings in the linked SB account to avail maximum benefit of interest in the Home Loan account.

* BOB home loan interest is calculated on daily reducing balance i.e. on the daily outstanding balance in the borrower’s BOB savings account.

* EMI’s are auto recovered from the linked savings account. - Maximum loan amount is Rs.10 Crore.

- Longer repayment tenure of up-to 30 years.

- Bank Of Baroda home loan rate ranges from 6.85% p.a. – 8.45% p.a.

- Processing fees of up-to 0.50% on the home loan amount.

- Bank Of Baroda loan eligibility:

* For salaried residents – minimum 1 year of employment.

* For self-employed- minimum 2 years of business vintage.

* For NRIs/PIOs/OCI –

(a) minimum 2 years valid job contract / work permit OR must be staying abroad for at least 2 years.

(b) Minimum gross annual income of Rs.5 Lakhs.

(c) Should not be the citizens of the countries- Bangladesh / Pakistan / Sri Lanka / Afghanistan / China / Iran / Nepal & Bhutan.

- FOIR (Fixed Obligation Against Income Ratio)percentage:

| For Salaried Loan Borrowers (Bank Of Baroda home loan eligibility based on salary) | For Self-Employed Loan Borrowers | ||

| Gross Monthly Income | FOIR % | Latest 2 Years Average Gross Annual Income | FOIR % |

| < Rs.20,000/- | 50% | Up-to Rs.6 Lakhs | 70% |

| Rs.20,000/- to Rs.50,000/- | 60% | Above Rs.6 Lakhs | 80% |

| Rs.50,000/- to Rs.2 Lakhs | 65% | ||

| Rs.2 Lakhs to Rs.5 Lakhs | 70% | ||

| Above Rs.5 Lakhs | 75% |

- LTV up-to 90% on the market value of the property.

- Nil prepayment charges on BOB housing loan.

Compare Baroda Home Loan Advantage with BOI’s Star Smart Home Loan with SBI’s Maxgain Product, Axis Bank Super Saver Home Loan & ICICI Bank Home Overdraft Product.

3) Baroda Pre-Approved Home Loan

- Available for all salaried, self-employed, self-employed professionals, NRIs, PIOs & OCIs from 21 years to 70 years.

- Bank Of Baroda pre-approved home loan provides in-principle approval for home loan which enables the loan applicant to get home loan sanctioned even before finalizing the property.

- In-principle approval will be valid for 4 months from the date of its issue.

- Maximum loan amount is Rs.10 Crore.

- Maximum LTV of up-to 90% on the market value of the property.

- Longer repayment tenure of up-to 30 years.

- Bank Of Baroda housing loan interest rate ranges from 6.85% p.a. – 8.70% p.a.

- Bank Of Baroda home loan processing charges range from 0.25% – 0.50% on the loan amount plus applicable GST. Upfront applicable fees is Rs.7500/- + GST, rest to be collected after the loan is sanctioned.

- Nil prepayment charges.

4) Bank Of Baroda Home Improvement Loan

- Available for all salaried, self-employed, self-employed professionals, NRIs, PIOs & OCIs from 21 years to 70 years for repairs and renovation of the home, for purchase of new furniture, fittings and furnishings, etc.

- Maximum loan amount is Rs.10 Crore.

- BOB home loan rates range from 6.85% p.a. – 8.20% p.a.

- Longer repayment tenures of up-to 30 years.

- BOB home loan processing fee

* Up-to Rs.50 Lakhs – 0.50% of the loan amount plus applicable GST subject to minimum of Rs.8,500/- and maximum of Rs.15,000/-

* Above Rs.50 Lakhs – 0.25% of the loan amount plus applicable GST subject to minimum of Rs.8,500/- and maximum of Rs.25,000/- - FOIR (Fixed Obligation Against Income Ratio)percentage:

| For Salaried Loan Borrowers (Bank Of Baroda home loan eligibility based on salary) | For Self-Employed Loan Borrowers | ||

| Gross Monthly Income | FOIR % | Latest 2 Years Average Gross Annual Income | FOIR % |

| < Rs.20,000/- | 50% | Up-to Rs.6 Lakhs | 70% |

| Rs.20,000/- to Rs.50,000/- | 60% | Above Rs.6 Lakhs | 80% |

| Rs.50,000/- to Rs.2 Lakhs | 65% | ||

| Rs.2 Lakhs to Rs.5 Lakhs | 70% | ||

| Above Rs.5 Lakhs | 75% |

- LTV up-to 90% on the market value of the property.

- Bank Of Baroda housing loan eligibility:

* For salaried residents – minimum 1 year of employment.

* For self-employed- minimum 2 years of business vintage.

* For NRIs/PIOs/OCI –

(a) minimum 2 years valid job contract / work permit OR must be staying abroad for at least 2 years.

(b) Minimum gross annual income of Rs.5 Lakhs.

(c) Should not be the citizens of the countries- Bangladesh / Pakistan / Sri Lanka / Afghanistan / China / Iran / Nepal & Bhutan.

- Nil foreclosure charges.

Additional Read: Difference In Applying Home Loan With Public Bank & Private Bank

5) Baroda Top UP Loan

- BOBO top up home loan is available for all existing home loan borrowers (salaried/self-employed/NRIs/PIOs) from 21 years to 70 years to meet their personal and professional requirement of funds.

- BOB home loan top up amount – minimum Rs.1 Lakh and Maximum Rs.2 Crores.

- Maximum funding of 90% of the market value of the property including the existing outstanding loan amount.

- Top-up tenure will be the outstanding tenure of the existing home loan.

- FOIR (Fixed Obligation Against Income Ratio)percentage:

| For Salaried Loan Borrowers (Bank Of Baroda home loan eligibility based on salary) | For Self-Employed Loan Borrowers | ||

| Gross Monthly Income | FOIR % | Latest 2 Years Average Gross Annual Income | FOIR % |

| < Rs.20,000/- | 50% | Up-to Rs.6 Lakhs | 70% |

| Rs.20,000/- to Rs. 50,000/- | 60% | Above Rs.6 Lakhs | 80% |

| Rs.50,000/- to Rs.2 Lakhs | 65% | ||

| Rs.2 Lakhs to Rs.5 Lakhs | 70% | ||

| Above Rs.5 Lakhs | 75% |

- Bank Of Baroda top up loan interest rate range from 7.45% p.a. – 8.80% p.a.

- Unified processing charges of 0.25% on the loan amount plus applicable GST (Minimum Rs.5,000/- & Maximum Rs.12,500/-).

- Click to know the detailed list of documents required for applying top up loan for salaried loan borrowers.

Compare BOB Top Up Loan With BOI Star Top Up Loan & ICICI Bank home loan top up.

6) Baroda Home Loan Takeover Scheme

- Bank Of Baroda home loan balance transfer available for all borrowers (salaried/self-employed/NRIs/PIOs/OCIs) from 21 years to 70 years for transfer of the home loan along with the top-up loans. (Compare home loan transfer details of BOB with other leading banks.)

- BOB housing loan interest rate for home loan balance transfer to Bank Of Baroda starts from 6.85% p.a.

- Longer repayment tenures of up-to 30 years.

- Flat Bank Of Baroda home loan transfer charges of Rs.8,500/- plus applicable GST.

- Top-up loans can be applied for a maximum 5 times during the tenure of the home loan.

- Maximum loan amount is up-to Rs.10 Crores.

- Home loan transfer terms and conditions:

* For Individuals

=> Minimum CIBIL score required is 701. (Click to understand the significance of CIBIL in home loan & to know how your home loan inquiry can impact your CIBIL score.)

=> Home loan should be minimum 12 months old.

=> Must have a good repayment track record.

Learn How To Apply For Home Loan With Bad CIBIL Score – By Loanfasttrack

* For Non-Individuals i.e. Firms/Companies

=> Mandatory to have an individual applicant in the home loan application.

=> Minimum 18 months EMI must have been paid.

=> The company must have been incorporated for a minimum 5 years.

=> Minimum 2 years business vintage required.

=> The company must be profitable for the minimum last 2 years.

=> Company’s net worth must be positive.

=> Good CIBIL score of the company.

Additional Read Home Loan Transfer For NRIsFOIR (Fixed Obligation Against Income Ratio)percentage

| For Salaried Loan Borrowers (Bank Of Baroda home loan eligibility based on salary) | For Self-Employed Loan Borrowers | ||

| Gross Monthly Income | FOIR % | Latest 2 Years Average Gross Annual Income | FOIR % |

| < Rs.20,000/- | 50% | Up-to Rs.6 Lakhs | 70% |

| Rs.20,000/- to Rs.50,000/- | 60% | Above Rs.6 Lakhs | 80% |

| Rs.50,000/- to Rs.2 Lakhs | 65% | ||

| Rs.2 Lakhs to Rs.5 Lakhs | 70% | ||

| Above Rs.5 Lakhs | 75% |

- LTV up-to 90% on the market value of the property.

- Free credit card with every home loan.

- 0.25% concessions on car loans.

Also Read: Home loan transfer requirements, Benefits of home loan transfer.

For the latest BOB HL interest rates for home loan transfer in Bank Of Baroda & processing fees offer call on 9321020476 or login to Loanfasttrack.

7) Interest Subsidy Scheme For Housing The Urban Poor (ISHUP)

- The ISHUP scheme is applicable for the urban LIG (Low Income Group having income of up-to Rs.5,000/- pm) & EWS (Economically Weaker Sections having income up-to Rs.10,000/- pm) borrowers only from 21 years to 70 years for the purchase/construction of a house or to extend the existing house.

- 5% interest subsidy (Net Present Value) available for a maximum principal amount of Rs.1 Lakh.

- Maximum loan tenure of up-to 20 years.

- Home loan eligibility:

=> For salaried – 48 X (average gross salary for last 3 months)

=> For others – (Max) 4 X (average annual income of last 2 years) - Maximum funding of 80% on the market value of the property.

| Category | Maximum Loan Amount | Maximum House Area |

| For EWS | Rs.1 Lakh | 25 Sq. Meter |

| For LIG | Rs.1.6 Lakhs | 40 Sq. Meter |

8) Credit Risk Guarantee Funds Scheme For Low Income Housing (CRGFS)

- Available only for the borrowers belonging to EWS & LIG categories in the urban area.

- The scheme provides loans to the borrowers without any collateral/security or third party guarantor according to the Credit Risk Guarantee Fund Trust established by Indian Government’s Ministry of Housing and Urban Poverty Alleviation.

- Under this scheme the Trust will provide credit risk guarantee to lending institutions (Banks) for the home loans they provide to the EWS & LIG category borrowers for acquisition and purchase of new/resale home, home construction and improvement.

Click to find out the merits and demerits for investing in resale & builder property.

- Maximum house area is up-to 430 sq. ft. carpet i.e. 40 sq. meter.

- Maximum loan amount is Rs.5 Lakhs.

- For loans up-to Rs.2 Lakhs guarantee cover provided is 90% of the loan amount & for loans from Rs.2 Lakhs-Rs.5 Lakhs guarantee cover provided is 85%.

- Tenure for guarantee cover is maximum up-to 25 years or loan termination date whichever is earlier.

9) (PMAY) Pradhan Mantri Awas Yojana Bank Of Baroda

- Interest subsidy on housing loans of 3% – 6.50% for all eligible borrowers (salaried/self-employed/NRI/PIO/OCI) from 21 years to 70 years having yearly income from Rs.3 Lakhs to Rs.18 Lakhs & belonging to the EWS, LIG & MIG segment for either acquiring or purchasing a new house or to upgrade an existing kuccha or semi-pucca house.

- Maximum subsidy amount of up-to Rs.2.67 lakhs.

- Maximum income to avail the benefits of this scheme is maximum up-to Rs.18 Lakhs p.a.

- Maximum carpet areas of the house under PMAY Bank Of Barodascheme is up-to 200 sq meter i.e. 2153 sq. ft.

- Maximum loan amount is Rs.10 Crores while maximum loan amount eligible for the subsidy is up-to Rs.12 Lakhs..

- Maximum loan tenure of up-to 30 years with subsidy up-to 20 years of the loan tenure.

- Maximum funding of 90% on the market value of the property.

- Bank Of Baroda housing loan interest starts from 6.85% p.a.

- Bank Of Baroda home loan eligibility criteria:

=> For salaried residents – minimum 1 year of employment.

=> For self-employed- minimum 2 years of business vintage.

=> For NRIs/PIOs/OCI –

(a) minimum 2 years valid job contract / work permit OR must be staying abroad for at least 2 years.

(b) Minimum gross annual income of Rs.5 Lakhs.

(c) Should not be the citizens of the countries- Bangladesh / Pakistan / Sri Lanka / Afghanistan / China / Iran / Nepal & Bhutan.

- FOIR (Fixed Obligation Against Income Ratio)percentage:

| For Salaried Loan Borrowers (Bank Of Baroda home loan eligibility based on salary) | For Self-Employed Loan Borrowers | ||

| Gross Monthly Income | FOIR % | Latest 2 Years Average Gross Annual Income | FOIR % |

| < Rs.20,000/- | 50% | Up-to Rs.6 Lakhs | 70% |

| Rs.20,000/- to Rs. 50,000/- | 60% | Above Rs.6 Lakhs | 80% |

| Rs.50,000/- to Rs.2 Lakhs | 65% | ||

| Rs.2 Lakhs to Rs.5 Lakhs | 70% | ||

| Above Rs.5 Lakhs | 75% |

- Processing fees up-to 0.50% of the loan amount plus applicable GST.(Minimum Rs.8,500/- & Maximum Rs.25,000/-)

- Nil prepayment charges.

10) Mortgage Loan Bank Of Baroda

- Available for all borrowers (salaried/self-employed/NRIs) to meet their immediate personal & professional fund requirement against the mortgage of residential/ commercial property and non-agricultural plots.(Click to learn more on mortgage loans)

- Also available in the form of overdraft facility. (CLICK to know more on mortgage overdraft loans)

- Minimum loan amount for mortgage loan is Rs.2 Lakhs & maximum loan amount is up-to Rs.10 Crores.

- Maximum funding of 60% on the market value of the property.

- Maximum loan tenure of up-to 10 years. (Check out mortgage loan balance transfer @ lowest interest rates in India)

- FOIR (Fixed Obligation Against Income Ratio)percentage:

| Gross Monthly Income (GMI) | FOIR % |

| Up-to Rs.75,000/- | 50% |

| Rs.75,000/- to Rs.3 Lakhs | 60% |

| Above Rs.3 Lakhs | 70% |

Compare Bank Of Baroda home loan against property with ICICI Bank’s Loan Against Property.

- Bank Of Baroda mortgage loan interest rate ranges from 8.05% p.a. – 13.20% p.a.

(Check out mortgage loan balance transfer @ lowest interest rates in India)

- Unified processing charges.

| For Term Loan | For Overdraft Loan | |

| 1% on the loan amount plus applicable GST | Up-to Rs.3 Crores | 0.35% of the limit. (Maximum Rs.7,500/-) |

| (Minimum Rs.7,500/- & Maximum Rs.1,50,000/-) | Above Rs.3 Crore | 0.25% of the limit. |

Click to know the documents required for applying for a mortgage loan for salaried, self employed – Pvt. Ltd Company, Partnership firm, Proprietorship Firm, mortgage loan balance transfer for salaried.

Click to find out the lowest interest rate loan against property with Loanfasttrack.

Additional Read: Difference Between Home Loan & Mortgage Loan

For the latest Bank Of Baroda LAP interest rate call on 9321020476 or login to Loanfasttrack.

11) Baroda Ashray Reverse Mortgage Loan

- Ashray reverse mortgage loan is a mortgage loan for senior citizens of India above 60 years (spouse 55 years in case of joint loans) to meet their post retirement expenses, day-to-day expenses, medical expenses, etc. against the mortgage of their self-occupied and self-owned residential property (commercial property not allowed).

- Maximum tenure is 15 years. (The tenure may further be extended till survival of the borrower subject to advance value of the property.)

- Maximum loan amount inclusive of interest is up-to Rs.1 Crore (subject to value of the property).

- Property insurance needs to be taken by the borrower regularly.

- Reverse mortgage interest rate applicable is 9.20% p.a.

- Processing fees 0.20% of the loan amount, maximum of Rs.10,000/-

- Processing charges are waived 100% on all Bank of Baroda’s home loans and top-up loans.

Click to get complete information on reverse mortgage.

Bank Of Baroda Home Loan Tax Benefits

Income tax benefit on home loan is available on both interest paid as well as on the principal amount repaid by the borrower.

Exemption on home loan, as per the Indian Income Tax Act, 1961:

- The principal repaid can be claimed for home loan tax deduction under section 80C of the Income Tax Act up-to Rs.1.5 Lakhs p.a.

- Interest on housing loan deduction –

=> The interest paid can be claimed for income tax exemption on home loan as deduction under section 24 of Income Tax Act up-to Rs.2 Lakhs p.a. for the property ready to move/self-owned by the borrower.

=> Home loan interest exemption of Rs.30,000 if construction is not completed within five years.

=> For home loans up-to Rs.35 Lakhs & cost of the properties up-to Rs.50 Lakhs, an additional housing loan tax exemption on interest of up-to Rs.50,000 is applicable on the interest paid for first time home buyers.

=> Housing loan interest exemption for rented properties-

Entire interest amount can be claimed in a year for the property which is rented out by the borrower subject to the maximum exemption limit of Rs.2 Lakhs for the interest paid.

Bank Of Baroda Home Loan Documents List

| SR. No. | Documents Required | For Salaried | For Self-Employed |

| 1 | KYC | Pan CardAadhar CardLatest Passport size photographOffice proof Residence Proof | Pan CardAadhar CardLatest Passport size photographOffice proof Residence Proof |

| 2 | Income Documents | 4 months Salary Slips6 months Bank Account Statement2 years From 16 | 3 years ITR with Saral Copy, Balance Sheet, P&L Account, Capital Account – CA certified12 months bank account statements of all bank accounts savings + current account |

| 3 | Property Documents | Prior Chain of AgreementOC/CC + approved plansIndex 2Share CertificateSociety Registration CopyProperty Tax Receipt | Prior Chain of AgreementOC/CC + approved plansIndex 2Share CertificateSociety Registration CopyProperty Tax Receipt |

| 4 | Additional Documents for home loan transfer | LOD Outstanding Balance Letter18 months repayment track record | LOD Outstanding Balance Letter18 months repayment track record |

| 5 | Other Documents | Duly signed Bank Of Baroda home loan application formProcessing fees cheque | Duly signed BOB home loan application form Processing fees cheque |

| 6 | For NRI Home Loan | Please refer to the link – “https://www.loanfasttrack.com/blog/blog/finance/nri-list-of-documents-for-applying-home-loan/”. | |

| 7 | Refer to the links for a detailed Bank Of Baroda home loan checklist. | Documents required for resale case | Documents required for resale case: Proprietorship firmPrivate Ltd. CompanyPartnership Firm |

| Documents required for builder case | Documents required for builder case: Proprietorship firmPrivate Ltd. CompanyPartnership Firm | ||

| Documents required for home loan balance transfer | Documents required for home loan balance transfer for: Proprietorship FirmPrivate Limited CompanyPartnership Firm |

Click to know housing loan interest rates of different banks and to know which bank has the lowest home loan interest rate.

Similar Banks Offering Home Loans

| ICICI Bank | HDFC Ltd. | Canara Bank | SBI Bank | Axis Bank | Bank Of India |

| Click For The Latest Bank Of Baroda Home Loan Offers |

Loanfasttrack is a Mumbai based loan provider company since 2015 offering loan services in Mumbai on– housing loan in Mumbai, mortgage loan in Mumbai, personal loan in Mumbai, business Loan in Mumbai, unsecured business loans,home loan transfer, top-up loans, car loans and loan transfers. Loanfasttrack is a direct sales associate with leading banks namely, ICICI Bank, HDFC Ltd, Canara Bank, Citi Bank, Piramal Housing Finance, etc.

Visit www.loanfasttrack.com.

Seek expert advice on 9321020476.

You can also email on info@loanfasttrack.com.

Loanfasttrack’s specialized services includes providing:

- The best bank for home loan.

- Best Banks For Mortgage Loan In India

- Assured low interest rates for loan against property in Mumbai.

- Lowest home loan rates in Mumbai.

- Instant loan in Mumbai.

- Instant personal loan in Mumbai & business loan in Mumbai

- Low cost home loan balance transfer.

Additional Read: