Axis Bank Home Loan

| Customized Axis home loan available to meet the various needs of the loan borrowers be it Salaried, Self-Employed or Corporate Entities at competitive home loan interest rates in Axis Bank starting from 7.75% p.a. & flat 12% p.a. in floating and fixed interest rates respectively for home loan starting from Rs.3 Lakhs. |

Key Benefits & Features Of Axis Bank Housing Loan

(Axis Bank Home Loan Information)

- Axis housing loans available for the purchase, construction, repairs, improvements & renovations of the house.

- Axis Bank repo rate linked home loan starts from Rs.3 Lakhs.

- Longer repayment tenures up-to 30 years.

- Fixed and floating housing loan interest rate in Axis Bank.

- Axis Bank home loan rate starts from 7.75% p.a. for floating interest rates.

- Axis home loan interest rate of flat 12% p.a. on any loan amount for fixed interest rate home loans.

- Axis NRI home loan product available for NRIs.

- Nil Axis Bank foreclosure charges for floating interest rate home loans.

- 12 months EMI waiver to the borrowers.

- Home loan available in the form of overdraft.

- PMAY credit linked subsidy schemes available with subsidy up-to Rs.2.67 lakhs.

Axis Bank Home Loan Interest Rates 2020

| Axis Bank Loan Schemes | Interest Rates for Salaried | Interest Rates Self-Employed | Fixed Interest Rates (Salaried & Self-Employed) |

| Axis Home Loan | 7.75% p.a. – 8.40% p.a. | 7.95% p.a. – 8.55% p.a. | 12% p.a. |

| Axis Asha Home Loan | 10.05% p.a. – 11% p.a. | 10.30% p.a. – 11.50% p.a. | 12% p.a. |

| Axis Bank Quikpay Home Loan | 7.75% p.a. – 8.40% p.a. | 7.95% p.a. – 8.55% p.a. | – |

| Axis Shubharambh Home Loan | 7.75% p.a. – 8.40% p.a. | 7.95% p.a. – 8.55% p.a. | – |

| Axis Bank Fast Forward Home Loan | 7.75% p.a. – 8.40% p.a. | 7.95% p.a. – 8.55% p.a. | – |

| Axis Bank Home Loan Top Up | 8.65% p.a. onwards | 8.90% p.a. onwards | 12% p.a. |

| Axis Super Saver Home Loan | 7.75% p.a. onwards | 7.95% p.a. onwards | – |

| Axis Bank Power Home Loan | 8% p.a. onwards | 8.50% p.a. onwards | 8.40% p.a. |

Note: Interest rates are subject to change without prior notice.

Axis Bank Home Loan Details

Axis Bank home loans are available for constructions of property, purchase of resale or ready to move/ under-construction property, Axis top up loan on existing loans and redevelopment, Axis bank home loan balance transfer, etc.

Axis Bank Home Loan Criteria

| Eligible Profile | Salaried, Self-Employed Professionals, Self-Employed Non-Professionals, NRIs, PIOs, Corporate Entities |

| Age Criteria | Minimum 21 years and Maximum 65 years. |

| Loan Amount | Starts from minimum of Rs.3 Lakhs. |

| Home Loan Tenure | Axis Bank home loan maximum tenure is up-to 30 years. |

| Minimum Income For Home Loan | Minimum salary for home loan is Rs.12,000/- p.m. |

| Rate Packages Available | Floating & Fixed rate AXIS Bank housing loan rate. |

| Axis Bank Current Home Loan Interest Rate | Axis Bank housing loan interest rates start from 7.75% p.a. 7.75% p.a. – 11.50% p.a. – Axis Bank home loan floating interest rate12% p.a. – Axis Bank home loan fixed interest rate |

| Interest Rates Linked To | Repo Rate |

| Axis Bank Home Loan Types | Types of home loan in Axis Bank: – Home Renovation Loan Axis Bank, Home Improvement Loan Axis Bank, Pre Approved Home Loan, Axis Bank Home Construction Loan/Axis Bank Construction Loan, Axis Bank Plot Loan, Axis Bank Overdraft Home Loan, Axis Bank Home Loan For Women, Axis Bank Home Loan Take Over, Axis Bank Top Up Loan, Axis Bank NRI Home Loan, Axis Bank Loan Against Property. |

| Axis Bank Home Loan Charges | Axis Bank Home Loan Processing Fee of Up-to 1% of the loan amount subject to minimum of Rs. 10,000/-Stamp duty charges – 0.20% of the loan amount. (Read to know the complete list of charges on home loans- CLICK) |

| Axis Bank Home Loan Foreclosure Charges | Nil – Floating interest rate home loan.Up-to 2% on the outstanding loan amount – Fixed interest rate home loan. |

| LTV | Up-to 90% of the property market value. |

| Axis Bank Home Loan Eligibility | Depends on the borrower’s age, income, profile, CIBIL score, co-borrower’s details and property details. |

| Minimum CIBIL Score For Home Loan In Axis Bank | 750 and above. (Understand the significance of CIBIL in home loan) |

For the latest Axis Bank Home Loan Offers call on 9321020476.

Axis Bank Home Loan Processing Charges Schedule List

| Particulars | Applicable Charges |

| Axis Home Loan Processing Fee | Up to 1% of the loan amount subject to minimum of Rs 10,000/- |

| Prepayment Charges | Nil – Floating interest rate. 2% of the amount prepaid – Fixed interest rate. |

| CERSAI Charge | Rs 50/- for loans up-to Rs.5 Lakhs. Rs 100/- for loans above Rs.5 Lakhs. |

| Valuation fee in Construction Linked Loan cases | Nil – Within 60 km. Rs. 500 (for first visit) and Rs. 750 (for subsequent visits) – Beyond 60 km. |

| Penal Interest Rate | 24% per annum (2% per month) |

| Switching Fees | Floating to Fixed Rate -1% on the outstanding principal with a minimum of Rs.10,000/- (Not Applicable on Shubh Aarambh, Fast Forward and Empower Home Loan variants) Higher Floating to lower Floating Rate – 0.5% on outstanding principal with minimum of Rs.10,000/- for Shubh Aarambh and Fast Forward Home Loans.Higher Fixed to Lower Fixed Rate – 0.5% on outstanding principal with minimum of Rs. 10,000/-. (Not applicable on Fast Forward Home Loan & Shubh Aarambh Home Loans) Fixed to Floating Rate – 2% on the outstanding principal (Not applicable under Fast Forward Home Loan & Shubh Aarambh Home Loans) |

| Equitable Mortgage Creation Charge | As applicable in the state. |

| Other Charges | |

| Cheque Bounce Charges | Rs.500/- per instance. |

| Cheque/Instrument Swap Charges | Rs.500/- per instance. |

| Duplicate NOC | Rs.500/- per instance. |

| Duplicate Statement Issuance Charges | Rs.250/- per instance. |

| Duplicate Amortization Schedule Issuance Charge | Rs.250/- per instance. |

| Duplicate Interest Certificate (Provisional/Actual) Issuance Charge | Rs.250/- per instance. |

| For Issuing Title Documents | Rs.250/- per document set. |

| Documents copies | Rs.250/- per document set. |

| GST will be applicable on all the charges and fees (wherever GST is applicable). |

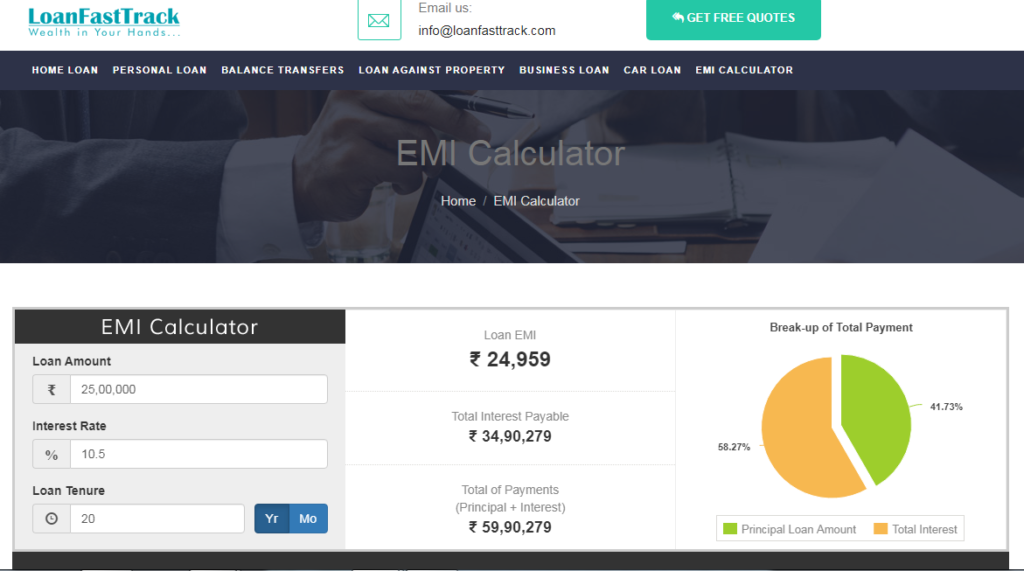

Axis Bank Home Loan Calculator

Loanfasttrack’s Axis Bank Home Loan EMI calculator is a hassle free simple generic calculator. It gives you an accurate estimate of the EMI for various tenures and loan amounts. You can calculate your monthly EMI outgo easily with the help of Loanfasttrack’s housing loan EMI calculator by entering only 3 simple variables i.e. the loan amount, interest rates and loan tenure. The calculator also shows you the total interest payable for the said home loan tenure.

Axis Bank Home Loan Eligibility Calculator For Different Loan Amount And Tenure @ Axis Bank HL Rate (Floating Interest Rate) Of 7.75% p.a.

| Loan Amount | EMI For 10 Years | EMI For 15 Years | EMI For 20 Years | EMI For 25 Years | EMI For 30 Years |

| Rs.25 Lakhs | Rs.30,003/- | Rs.23,532/- | Rs.20,524/- | Rs.18,883/- | Rs.17,910/- |

| Rs.30 Lakhs | Rs.36,003/- | Rs.28,238/- | Rs.24,628/- | Rs.22,660/- | Rs.21,492/- |

| Rs.50 Lakhs | Rs.60,005/- | Rs.47,064/- | Rs.41,047/- | Rs.37,766/- | Rs.35,821/- |

| Rs.75Lakhs | Rs.90,008/- | Rs.70,596/- | Rs.61,571/- | Rs.56,650/- | Rs.53,731/- |

| Rs.1 Crore | Rs.1,20,011/- | Rs.94,128/- | Rs.82,095/- | Rs.75,533/- | Rs.71,641/- |

Axis Bank Home Loan Interest Rate Calculator For EMI Calculation @ 7.75% P.A. Interest Rate For Rs.50 Lakhs Housing Loan.

| Loan Tenure | EMI For 50 Lakhs | Total Interest | Total Amount Payable (Principal + Interest) |

| 10 Years | Rs.60,005/- | Rs.22,00,638/- | Rs.72,00,638/- |

| 15 Years | Rs.47,064/- | Rs.34,71,482/- | Rs.84,71,482/- |

| 20 Years | Rs.41,047/- | Rs.48,51,383/- | Rs.98,51383/- |

| 25 Years | Rs.37,766/- | Rs.63,29,931/- | Rs.1,13,29,931/- |

| 30 Years | Rs.35,821/- | Rs.78,95,420/- | Rs.1,28,95,420/- |

Home Loan Amortization Chart For Rs.50 Lakhs Housing Loan For 20 Years

(Assuming your loan is disbursed in the month of October @ 7.75% p.a.)

Yearly Chart

| Year | Total EMI | Principal | Interest | Balance |

| 2020 | 1,23,141 | 26,437 | 96,704 | 49,73,563 |

| 2021 | 4,92,564 | 1,11,007 | 3,81,557 | 48,62,557 |

| 2022 | 4,92,564 | 1,19,921 | 3,72,643 | 47,42,635 |

| 2023 | 4,92,564 | 1,29,552 | 3,63,012 | 46,13,083 |

| 2024 | 4,92,564 | 1,39,956 | 3,52,608 | 44,73,126 |

| 2025 | 4,92,564 | 1,51,198 | 3,41,366 | 43,21,928 |

| 2026 | 4,92,564 | 1,63,340 | 3,29,224 | 41,58,587 |

| 2027 | 4,92,564 | 1,76,460 | 3,16,104 | 39,82,128 |

| 2028 | 4,92,564 | 1,90,631 | 3,01,933 | 37,91,497 |

| 2029 | 4,92,564 | 2,05,943 | 2,86,621 | 35,85,555 |

| 2030 | 4,92,564 | 2,22,481 | 2,70,083 | 33,63,074 |

| 2031 | 4,92,564 | 2,40,349 | 2,52,215 | 31,22,725 |

| 2032 | 4,92,564 | 2,59,651 | 2,32,913 | 28,63,073 |

| 2033 | 4,92,564 | 2,80,506 | 2,12,058 | 25,82.567 |

| 2034 | 4,92,564 | 3,03,035 | 1,89,529 | 22,79,533 |

| 2035 | 4,92,564 | 3,27,372 | 1,65,192 | 19,52,161 |

| 2036 | 4,92,564 | 3,53,665 | 1,38,899 | 15,98,497 |

| 2037 | 4,92,564 | 3,82,068 | 1,10,496 | 12,16,429 |

| 2038 | 4,92,564 | 4,12,751 | 79,813 | 8,03,677 |

| 2039 | 4,92,564 | 4,45,902 | 46,662 | 3,57,775 |

| 2040 | 3,69,423 | 3,57,774 | 11,649 | 0 |

Axis Bank Home Loan Schemes

1) Axis Bank Home Loan (Regular Home Loan)

- Available for all borrowers from 21years to 65 years for constructions of property, purchase of constructed residences (resale/builder property) and loan for top-ups for existing loans and redevelopment etc., also including options for repayment and subsidy benefits. (Click to know the difference in home loan for resale & builder case)

- Axis Bank current home loan rate starts from 7.75% p.a.

- Axis Home loan rates available are Fixed & floating interest rates.

- Axis Bank floating home loan rates are available from 7.75% p.a. – 8.55% p.a.

- 12% p.a. is the fixed rate of interest of home loan in Axis Bank.

- Longer repayment tenure up-to 30 years.

- Minimum loan amount is Rs.3 Lakhs & maximum is Rs. 5 Crores.

- No prepayment penalty on floating home loan interest of Axis Bank.

- LTV funding up-to 90%.

- Axis Bank home loan processing fee charges -up-to 1% on the loan amount plus applicable GST subject to minimum of Rs.10,000/-.

Compare Axis Bank Home Loan with SBI Home Loan, ICICI Bank Home Loan, HDFC Ltd. Home Loan & Canara Bank Home Loan.

2) Quickpay Home Loan Axis Bank

- Available for all borrowers from 21years to 65 years to purchase under-construction / ready to move/ resale house, self-construction, Axis Bank land purchase loan plus construction loan or home extension or improvement. (Also Read: Everything You Must Know Before Purchasing A Land & Availing The Land Loans)

- Axis housing loan interest rate available with reducing monthly instalments.

- Higher amount of principal repaid earlier in the loan tenure. The principal proportion in EMI amount will be higher than the interest portion during the earlier loan tenure thus reducing the monthly instalments and making savings on interest.

- Longer repayment tenure up-to 30 years.

- Minimum loan amount is Rs.3 Lakhs & maximum is Rs. 5 Crores.

- Only floating housing loan rate of interest in Axis Bank Quickpay Home Loan.

- Nil prepayment charges on floating rate of interest in Axis Bank for home loan.

- Option to avail home loan balance transfer facility.

- Current Axis Bank home loan interest rate for Quickpay Home Loan starts from 7.75% p.a. Onwards.

- Home loan processing fee of up-to 1% on the loan amount plus applicable GST subject to minimum of Rs.10,000/-.

3) Axis Bank Shubh Aarambh Home Loan

- Available for all salaried and self-employed borrowers from 21years to 65 years to purchase under-construction / ready to move/ resale house, self-construction, Axis Bank land loan plus construction loan or home extension or improvement.

- Not available for NRI home buyers.

- 12 months EMI waiver. 4 EMI each waived at the end of 4th, 8th & 12th year provided:

- The loan should remain with Axis Bank for at least 48 months from the date of disbursement.

- Clear track record must be maintained during the lifetime of the loan. (Only 3 instances of dues pending for 30 days and above will be allowed but not over 90 days.)

- Minimum loan amount is Rs.1 Lakh and maximum loan amount is Rs.30 Lakhs.

- Minimum tenure is 20 years & maximum loan tenure is 30 years.

- Only floating home loan rate of interest of Axis Bank’s Shubh Aarambh Home Loan.

- Current home loan interest rate of Axis Bank’s Shubh Aarambh Home Loan ranges from 7.75% p.a. – 8.55% p.a.

- Processing fees of up-to 1% on the loan amount plus applicable GST. (Minimum Rs.10,000/-)

- Nil prepayment charges for Shubharambh Home Loan Axis Bank.

- Prepayment of the loan can be done as long as the loan tenure does not fall below 4 years in order to avail the benefits of the EMI moratorium.

- EMI cycle date available is only 5th of every month for all loan borrowers.

- PMAY credit linked subsidy schemes available with subsidy up-to Rs.2.67 lakhs.

- Balance transfer facility available for Shubh Aarambh Home Loan Axis Bank.

4) Fast Forward Home Loan Axis Bank

- Available for all salaried and self-employed borrowers from 21years to 65 years to purchase under-construction / ready to move/ resale house, self-construction, plot purchase loan Axis Bank plus construction loan or home extension or improvement.

- Not available for NRI home buyers.

- EMI waiver for 12 months. 6 EMI each waived at the end of 10th, 15th year provided:

- The loan should remain with Axis Bank for 10 years from the date of disbursement.

- Clear track record must be maintained during the lifetime of the loan. (Only 3 instances of dues pending for 30 days and above will be allowed but not over 90 days.)

- Minimum loan amount is Rs.30 Lakh and maximum loan amount is Rs.5 Crores.

- Minimum tenure is 20 years & maximum loan tenure is 30 years.

- Only floating Axis Bank home loan percentage.

- Today Axis Bank home loan interest rate for Fast Forward Home Loan starts from 7.75% p.a. onwards.

- Processing fees of up-to 1% on the loan amount plus applicable GST. (Minimum Rs.10,000/-)

- Nil prepayment charges.

- Prepayment of the loan can be done as long as the loan tenure does not fall below 10 years in order to avail the benefits of the EMI moratorium.

- The Fast Forward Home Loans cannot be clubbed with any other schemes such as subvention scheme, etc.

- EMI cycle date remains 5th of every month for all loan borrowers.

5) Axis Bank Asha Home Loan

Axis Bank Asha Home Loan Details: –

- Customized loan scheme on the basis of banking behavior or previous repayment track history. Specially designed for those who are buying their first house.

- Affordable housing loan scheme for the purchase of under-construction / ready to move/ resale property, plot purchase and construction of house thereon or construction of house on a plot already purchased.

- Asha Home Loan Eligibility:

- Available for all salaried and self-employed borrowers from 21years to 65 years.

- Minimum income required – combined salary of the family- Rs.8,000/- pm or Rs.10,000/- pm depending upon the location.

- Cash salary of the borrower counted.

- Minimum loan amount is Rs.1 Lakh and maximum loan amount is Rs.35 Lakh.

- Minimum tenure is 20 years & maximum loan tenure is 30 years.

- Loan funding of 90% of the market value of the property for the property value up-to 30 Lakhs.

- Home loan available for properties with minimum built up area starting from 200 sq.ft.

- 12 EMIs waived off. 4 EMI each waived at the end of 4th, 8th & 12th year provided:

- The loan should remain with Axis Bank for at least 48 months from the date of disbursement.

- Clear track record must be maintained during the lifetime of the loan. (Only 3 instances of dues pending for 30 days and above will be allowed but not over 90 days.)

- Axis Bank Asha Home Loan interest rate:

- Fixed & floating interest rates available.

- Fixed interest rates offered only for tenure up-to 20 years.

- Axis Bank Asha Home Loan rate of interest for floating rate home loans start from 10.05% p.a.to 11.50% p.a.

- 12% p.a. flat Asha Home Loan rate of interest for fixed rate home loan.

- Processing fees of up-to 1% on the loan amount plus applicable GST. (Minimum Rs.10,000/-)

- Nil prepayment charges for floating interest rates. Foreclosure charges of up-to 2% on the outstanding loan amount for fixed interest rate home loans.

- Prepayment of the loan can be done as long as the loan tenure does not fall below 4 years in order to avail the benefits of the EMI moratorium.

- PMAY credit linked subsidy schemes available with subsidy up-to Rs.2.67 lakhs.

- Balance transfer facility available for Asha Loan Axis Bank.

6) Axis Home Loan Top Up

- Available for all existing borrowers and for borrowers with balance transfer of home loan at competitive Axis Bank top up loan interest rate.

- Top up loan in Axis Bank can be used for personal and business requirements, for construction of residential/commercial property, etc.

- Maximum Axis Bank home loan top up amount is Rs.50 Lakhs.

- Maximum tenure for Axis top up loan will be the same as outstanding home loan tenure.

- Axis Bank home loan top up interest rate starts from 8.65% p.a. Onwards.

- Processing fees of up-to 1% on the loan amount plus applicable GST. (Minimum Rs.10,000/-)

- Axis Bank home loan top up criteria:

- Top up loan on home loan Axis Bank is available for all salaried, self-employed & NRI borrowers.

- Axis Bank top up loan eligibility – 21years to 65 years.

- Home loan top up Axis Bank for the existing borrowers can be applied after completion of the 6 months tenure for home loan.

- Clear repayment track for 6 months is mandatory for existing borrowers and 12 months for the borrowers seeking Axis Bank home loan balance transfer and top up.

- Only 1 EMI bounce is allowed provided the bounced EMI is cleared before the next EMI due.

Compare Axis Home Loan Top Up with ICICI Bank home loan top up.

7) Axis Bank Super Saver Home Loan

- It is an overdraft facility loan available for all borrowers from 21 years to 65 years.

- Super saver home loan Axis Bank – is not available for NRI home buyers.

- Excess funds are parked in the Super Saver Account to save on the interest.

- The monthly installment will be debited from the funds parked in the Super Saver Account itself.

- Minimum loan amount is Rs.50 Lakhs & maximum loan amount is Rs.5 Crores.

- Maximum tenure for super saver Axis Bank is 20 years for full loan disbursement/ ready possession property & 22 years for partial loan disbursements/under construction properties.

- Alterations in the loan tenure (increase or decrease) is not allowed.

- Only floating interest rates are available.

- Axis Bank Super Saver Home Loan interest rate is charged on the outstanding principal amount i.e. the principal loan amount – (minus) the excess funds parked. The excess funds parked can be withdrawn whenever required.

- Cheque book, ATM card and online banking plus phone banking facility are provided to the loan borrowers who wish to manage their saving’s account while dealing with the home loan.

- Nil prepayment charges.

- Home loan balance transfer facility available.

- Top up facility also available, but the benefits of this plan will not be extended to the top up loan.

- Existing home loan borrowers can also shift their loan to Super Saver Home Loan scheme.

- Interest rates starting from 7.75% p.a. onwards.

- Interest rate is charged on daily reducing balance.

- Processing fees of up-to 1% on the loan amount plus applicable GST. (Minimum Rs.10,000/-)

- EMI cycle date will be 10th of every month for all loan borrowers.

- No tax deductions under section 80C for the money parked in the super saver account and section 24 for the unpaid interest amount i.e. the interest saved.

8) Axis Bank Power Advantage Home Loans

- Available for all borrowers salaried, self-employed as well as NRIs from 21 years to 65 years for the purchase of under-construction / ready to move/ resale house, self-construction, plot plus construction or home extension or improvement.

- Interest rate is fixed for the first 2 years and then floating interest rates applicable for the balance loan tenure.

- Longer repayment tenure up-to 30 years.

- Maximum loan amount of Rs. 5 Crores.

- Interest rate starting from 8% p.a. onwards.

- Processing fees of up-to 1% on the loan amount plus applicable GST. (Minimum Rs.10,000/-)

- Nil foreclosure & part payment charges if paid during the floating rate tenure. Pre & part payment charges of 2% plus applicable GST if the loan is closed during the first 2 years of fixed interest rate tenure.

- PMAY credit linked subsidy schemes available with subsidy up-to Rs.2.67 lakhs.

- Home loan balance transfer facility available.

Click to read Is pre-EMI is better than full EMI. Also find out the merits and demerits for investing in resale & builder property.

9) Pradhan Mantri Awas Yojana (PMAY)

- Interest subsidy on housing loans for all eligible borrowers (salaried/self-employed/NRI) from 21 years to 65 years belonging to the EWS, LIG & MIG segment for the purchase / construction of their first house.

- Subsidy amount of up-to Rs.2.67 lakhs provided the borrower does not own any pucca house in his name.

- Maximum income to avail the benefits of this scheme is maximum up-to Rs.18 Lakhs p.a.

- Longer repayment tenure up-to 30 years with subsidy up-to 20 years of the loan tenure.

- Processing fees of up-to 1% on the loan amount plus applicable GST. (Minimum Rs.10,000/-)

10) Axis Bank NRI Home Loan

- Available for NRI, PIO (Person of Indian origin), OCI (Overseas Citizen of India) & Merchant Navy employees.

- Minimum loan tenure is 1 year and maximum loan tenure of 25 years.

- Axis Bank NRI home loan eligibility:

- Minimum age is 24 years and maximum 60 years or retirement age whichever is earlier for Axis Bank NRI loan.

- The NRI, PIO & OCI should not be the citizens of Pakistan, Bangladesh, Sri Lanka, Afghanistan, China, Iran, Nepal, or Bhutan.

- Total work experience required is 2 years with minimum 6 months overseas work experience required for Axis NRI loan.

- Minimum income required is 5000 AED pm for GCC countries & 3000 USD pm for USA & other countries and 2000 USD pm for 9 months for merchant navy.

- Fixed and floating Axis Bank NRI loan interest rates available for housing loans.

- Axis Bank NRI home loan interest rate:

- Floating interest rates starting from 7.75% p.a.

- Flat fixed interest rate of 12% p.a.

- Processing fees of up-to 1% on the loan amount plus applicable GST. (Minimum Rs.10,000/-)

- NRI can also apply for top up loans. Benefits and terms and conditions will remain same as per the regular top-up loan product.

- Home Loan For Self-Employed NRIs:

- Self-employed NRIs can also apply for home loan for the purchase of ready to move/resale/under-construction property, self-construction, home extension or improvement and for balance transfer of the home loan.

- Self-employed NRI home loan is not available for the purchase of plot, commercial property and agricultural land.

- Minimum cost of the property purchased has to be Rs.30 Lakhs.

- Maximum loan tenure of 15 years.

- Minimum loan amount is Rs.20 Lakhs & maximum loan amount is Rs.50 Lakhs.

- 60% funding on the cost of the property for ready to move projects and 90% for under-construction property while 50% for cases other the two.

- The NRI, PIO & OCI should have their own office set up with minimum 5 years of work experience out of which 3 years should be in 1 country.

Click to get documents required for NRI Home Loans.

Additional Read On: NRI home loans & NRI home loan transfer.

Tax Benefits On Axis Bank Home Loan

The borrowers can enjoy the income tax benefits on the interest paid as well as on the principal amount repaid as per the Indian Income Tax Act.

- Tax deduction available up-to Rs.1.5 Lakhs per year on the principal repayment of the loan under section 80C of the Income Tax Act.

- Tax deduction up-to Rs.2 Lakhs towards the interest repayment in the year under section 24 of the Income Tax Act for the property self-owned by the borrower.

- Entire interest amount can be claimed in a year if the borrower has given the property on rent.

List Of Documents Required For Home Loan In Axis Bank

1) KYC – Pan Card, Aadhar Card, Latest Passport size photograph, Office proof & Residence Proof.

2) Income Documents

- Documents required for home loan for salaried person – 4 months Salary Slips, 6 months Bank Account Statement, 2 years Form 16.

- Documents required for home loan for self-employed – 3 years ITR with Saral Copy, Balance Sheet, P&L Account, Capital Account – CA certified, 12 months bank account statements of all bank accounts savings + current account.

3) Property documents

- Prior Chain of Agreement

- OC/CC + approved plans

- Index 2

- Share Certificate

- Society Registration Copy

- Property Tax Receipt.

4) Additional documents required for home loan transfer

- LOD

- Outstanding Balance Letter

- 18 months repayment track record.

5) Other documents

- Duly signed Axis Bank home loan application form.

- Processing fees cheque.

6) Click for documents required for NRI home loan

7) Please refer to the links for detailed documents for Axis Bank home loan apply.

- Home loan documents required Resale Case for salaried, for self-employed for Proprietorship firm, Private Ltd. Company, Partnership Firm.

- Documents required for home loan from builder for salaried, for self employed Proprietorship firm, Private Ltd. Company, Partnership Firm.

- Housing loan documents required for home loan balance transfer for salaried, self employed – Proprietorship Firm, Private Limited Company, Partnership Firm.

Click to know housing loan interest rates of different banks and to know which bank has the lowest home loan interest rate.

Similar Banks Offering Home Loans

| ICICI Bank | HDFC Ltd. | Canara Bank | SBI Bank |

For the latest home loan interest rates in Axis Bank & processing fees offer call on 9321020476.

Loanfasttrack is a Mumbai based loan provider company since 2015 offering loan services in Mumbai on– housing loan in Mumbai, mortgage loan in Mumbai, personal loan in Mumbai, business Loan in Mumbai, unsecured business loans,home loan transfer, top-up loans, car loans and loan transfers. Loanfasttrack is a direct sales associate with leading banks namely, ICICI Bank, HDFC Ltd, Canara Bank, Citi Bank, Piramal Housing Finance, etc.

Visit www.loanfasttrack.com.

Seek expert advice on 9321020476.

You can also email on info@loanfasttrack.com.

Loanfasttrack’s specialized services includes providing:

- The best bank for home loan.

- Assured low interest rates for loan against property in Mumbai.

- Lowest home loan rates in Mumbai.

- Instant loan in Mumbai.

- Instant personal loan in Mumbai & business loan in Mumbai

- Low cost home loan balance transfer.

Additional Read:

- How To Apply Online For Home Loan, Mortgage Loan & Loan Transfers – By Loanfasttrack

- Know How To Deal With The Increasing Interest Rates Of Housing Loans

- Know How Your Home Loan Inquiry Impacts Your CIBIL Scores

- Everything You Must Know Before Applying For A Housing Loan

- Loan Against Property At Lowest Interest Rate With Loanfasttrack

- Best Banks For Mortgage Loan In India