BANK OF INDIA (BOI) HOME LOAN

| Bank Of India offers home loans to eligible borrowers with EMIs starting from ₹655 per lac. Interest rates start from 6.85% p.a. overextended loan tenures up to 30 years with processing fees starting from 0.25% of the loan amount. |

Key Features Of Bank Of India Housing Loan:

- BOI is the lowest interest rate home loan provider.

- BOI home loan interest rates 2020 starts from 6.85% p.a.

- Lowest per lac EMI of Rs.655/-

- Longer repayment tenure available for 30 years.

- BOI housing loan interest is calculated on daily reducing balance.

- Discounted interest rates for women borrowers.

- BOI bank home loans are also available for NRIs.

- No administrative charges.

- Nil prepayment charges for floating interest rates.

- Free personal accident insurance cover.

- PMAY credit linked subsidy schemes available with subsidy upto Rs.2.67 lakhs.

Current Home Loan Interest Rates BOI 2020 Chart

| CIBIL Score | Salaried Borrowers | Self-Employed Borrowers | ||

| Womens | Others | Womens | Others | |

| 760 & Above | 6.85% p.a. | 6.85% p.a. | 6.85% p.a. | 6.85% p.a. |

| Between 725 – 759 | 7.% p.a. | 7.05% p.a. | 7.10% p.a. | 7.15% p.a. |

| Between 675 – 724 | 7.10% p.a. | 7.15% p.a. | 7.70% p.a. | 7.75% p.a. |

| For CIBIL Score of -1 & 0 | 7.% p.a. | 7.05% p.a. | 7.10% p.a. | 7.15% p.a. |

Note: (i) Interest rates are subject to change without prior notice.

(ii) Interest rates applicable only for Star Home Loan/Star Smart Home Loan/Star Diamond Home Loan

(iii) Interest rates are based on CIBIL scores of the borrowers.

(iii) 0.50% additional BOI housing loan interest rates for CRE-RH home loans i.e. for borrowers who own multiple properties i.e. 2 or more.

Click to understand the significance of CIBIL in home loan & to know how your home loan inquiry can impact your CIBIL score.

BOI Bank Home Loan Interest Rates For Various Home Loan Schemes

| BOI Star Home Loan | 6.85% p.a. – 7.75% p.a. |

| BOI Star Smart Home Loan | 6.85% p.a. – 7.75% p.a. |

| BOI Star Diamond Home Loan | 6.85% p.a. – 7.75% p.a. |

| BOI Star Top Up Loan | 7.35% p.a – 8.25% p.a. |

| BOI Star Pravasi Home Loan | 6.90% p.a. – 6.95% p.a. |

| BOI Earnest Money Deposit (EMD) Scheme | 6.85% p.a. – 11.85% p.a. |

| Pradhan Mantri Awas Yojana (PMAY) | 6.85% p.a. |

| BOI Star Loan Against Property | 8.85% p.a. – 9.35% p.a. |

BOI Home Loan Details

| Eligible Profile | Salaried, Self-Employed Professionals, Self-Employed Non-Professionals, Corporates (Proprietorship Firm, Partnership Firm, Private Ltd. Company), NRIs, PIOs & HUFs. |

| Age Criteria | Minimum 21 years & maximum 70 years. |

| Loan Amount | Maximum up-to Rs.5 Crores. |

| Repayment Tenure | Maximum up-to 30 years. |

| Loan Funding | Maximum up-to 85%* of the market value of the property. |

| Types Of BOI Home Loan | BOI Plot Loan, BOI Home Improvement Loan, BOI Plot Plus Construction Loan, BOI Home Loan, BOI Home Loan Balance Transfer, BOI Top Up Loan, BOI Home Repairs & Renovation Loan, BOI Loan Against Property. |

| BOI Home Loan Interest Rates | Starts from 6.85% p.a. (Discounted interest rates for womens) |

| BOI Per Lac EMI | Starts from Rs.655/- (Rs.655/- is the per lakh EMI calculated @ of 6.85% p.a. for 30 years) |

| Rate Package Available | Floating & Fixed interest rate. |

| BOI Home Loan Processing Fees | For individuals 0.25% of the loan amount + applicable GST (Minimum Rs.1,500/- & Maximum Rs.20,000/-) For Partnership Firms & Corporates – 0.50% of the loan amount + applicable GST (Minimum Rs.3,000/- & Maximum Rs.40,000/-) (Read to know the complete list of charges on home loans- CLICK) |

| Prepayment Charges | Floating interest rates – Nil. Fixed interest rates- 0.65% – 2.25% of the outstanding balance. |

| BOI Home Loan Schemes Available | BOI Star Home Loan, BOI Star Smart Home Loan, BOI Star Diamond Home Loan, BOI Star Pravasi Home Loan, BOI Earnest Money Deposit (EMD) Scheme, Pradhan Mantri Awas Yojana (PMAY), BOI Star Loan Against Property. |

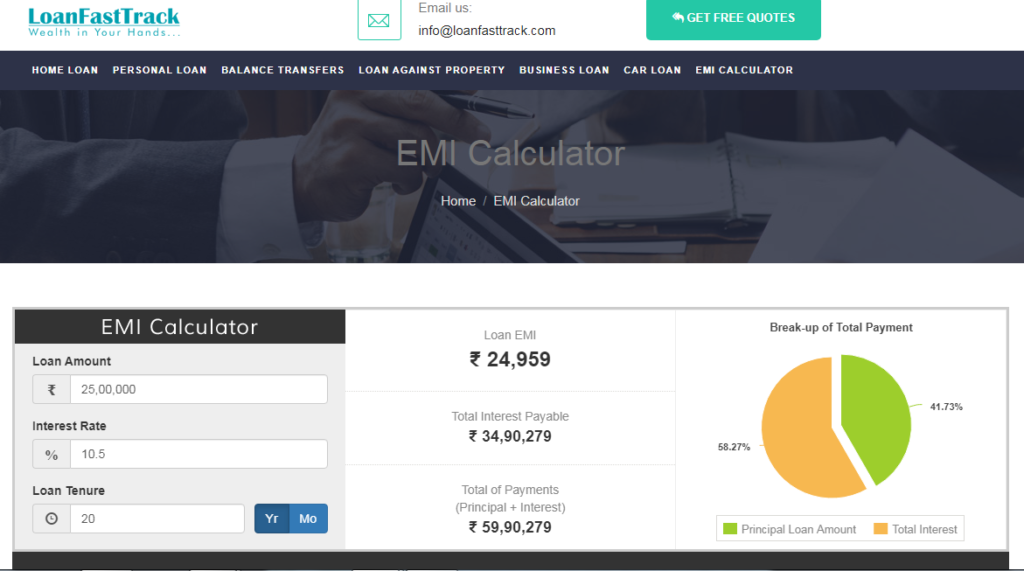

BOI Home Loan Calculator

Use Loanfasttrack’s BOI Home Loan EMI calculator to calculate your EMI outgo.It is a hassle free simple generic calculator which gives you accurate estimates of the EMI for various loan amounts as well as the loan tenures. The calculator also displays the total interest payable for the said home loan tenure.

Simply enter 3 variables to get the desired EMI amount i.e. the loan amount, home loan rate of interest & loan tenure.

EMI Amortization Chart

An amortization chart provides details on periodic loan repayments compromising the principal & the interest amount until the loan is repaid. While each monthly payment remains the same, the payment is made up of parts that vary over time. The amortization schedule determines the percentage of EMI outgo towards the interest component versus principal component.

Home Loan Amortization Chart For Rs.30 Lakhs Housing Loan For 20 Years

(Assuming your loan is disbursed in the month of October @ 6.85% p.a.)

Yearly Chart

| Year | Total EMI | Principal | Interest | Balance |

| 2020 | 68,970 | 17,695 | 51,275 | 29,82,306 |

| 2021 | 2,75,880 | 73,879 | 2,02,001 | 29,08,427 |

| 2022 | 2,75,880 | 79,099 | 1,96,781 | 28,29,326 |

| 2023 | 2,75,880 | 84,692 | 1,91,188 | 27,44,633 |

| 2024 | 2,75,880 | 90,678 | 1,85,202 | 26,53,953 |

| 2025 | 2,75,880 | 97,091 | 1,78,789 | 25,56,863 |

| 2026 | 2,75,880 | 1,03,954 | 1,71,926 | 24,52,909 |

| 2027 | 2,75,880 | 1,11,303 | 1,64,577 | 23,41,606 |

| 2028 | 2,75,880 | 1,19,172 | 1,56,708 | 22,22,436 |

| 2029 | 2,75,880 | 1,27,595 | 1,48,285 | 20,94,840 |

| 2030 | 2,75,880 | 1,36,617 | 1,39,263 | 19,58,225 |

| 2031 | 2,75,880 | 1,46,273 | 1,29,607 | 18,11,952 |

| 2032 | 2,75,880 | 1,56,613 | 1,19,267 | 16,55,339 |

| 2033 | 2,75,880 | 1,67,683 | 1,08,197 | 14,87,655 |

| 2034 | 2,75,880 | 1,79,538 | 96,342 | 13,08,117 |

| 2035 | 2,75,880 | 1,92,230 | 83,650 | 11,15,886 |

| 2036 | 2,75,880 | 2,05,820 | 70,060 | 9,10,067 |

| 2037 | 2,75,880 | 2,20,368 | 55,512 | 6,89,698 |

| 2038 | 2,75,880 | 2,35,949 | 39,931 | 4,53,750 |

| 2039 | 2,75,880 | 2,52,627 | 23,253 | 2,01,123 |

| 2040 | 2,06,910 | 2,01,123 | 5,787 | 0 |

BOI Home Loan Schemes

1) BOI Bank Home Loan

- Available for purchasing a plot, for construction of a house on plot, purchasing a resale/ready to move/under-construction property and also for repairs/renovation/alteration/addition of the house. (Click to know the difference in home loan for resale & builder case)

- Available for all salaried, self-employed, self-employed professionals, Corporates (Proprietorship Firm, Partnership Firm, Private Ltd. Company), NRIs, PIOs & HUFs from 21 years to 70 years.

- Home loan balance transfer available. (Get complete knowledge on home loan balance transfer-CLICK)

Compare home loan transfer details of BOI with other leading banks.

- Maximum loan amount of Rs.5 Crores.

- Additional 15% of the home loan amount maximum up-to Rs.5 Lakhs can be availed for furnishing the house which will be available at the same BOI home loan rate with the maximum repayment tenure of 10 years.

- Loans for the installation of the solar PVs are also available at the BOI housing loan rate of interest.

- LTV funding:

* 80% on the agreement value/ cost of the property (excluding stamp duty, registration and other documentation charges) for loan amount below Rs.75 Lakhs.

* 75% on the agreement value/ cost of the property (excluding stamp duty, registration and other documentation charges) for loan amount above Rs.75 Lakhs. - BOI home loan eligibility will be calculated as lower of the two.

| For Salaried Home Borrowers | 72 times of gross monthly salary or 6 times of gross annual income based on IT returns. |

| For Self-Employed Home Borrowers | 6 times of Gross annual income based on IT returns. |

| For HUF/Proprietorship /Partnership Firm/ Pvt. Ltd. Company | 6 times of cash accruals (Profit after tax + depreciation) as per Balance Sheet/P&L Account. |

or

| For Salaried Home Borrowers | Net Take Home Pay (NTH):- | ||

| Gross Monthly Income Up-to Rs.1 Lakh Rs.1 Lakh – Rs.5 LakhAbove Rs.5 Lakhs | NTH 40% 30% 25% | FOIR (Fixed Obligation Against Income Ratio) 60% 70% 75% | |

| For Self-Employed Home Borrowers | |||

| For HUF/Proprietorship /Partnership Firm/ Pvt. Ltd. Company | Minimum 1.5 DSCR (Debt-service Coverage Ratio). |

- For the borrowers purchasing the 2nd house, notional rental income from the property can be considered for higher home loan eligibility.

- BOI star home loan interest rates range from 6.85% p.a. To 7.75% p.a.

- Home loan interest rate in BOI is charged on daily reducing balance.

- BOI home loan processing fee

– For salaried/self-employed proprietor/ self-employed professional – 0.25% of the loan amount plus applicable GST subject to minimum of Rs.1,500/- and maximum of Rs.20,000/-

– For Partnership Firm & Pvt. Ltd. Comp – 0.50% of the loan amount plus applicable GST subject to minimum of Rs.3,000/- and maximum of Rs.40,000/- - Nil prepayment charges on floating BOI house loan interest rate.

- Step-up & Step-down EMI facility available.

- Free personal accident insurance cover.

Compare BOI Home Loan With ICICI Bank Home Loan, HDFC Ltd. Home Loan, Canara Bank Home Loan, SBI Home Loan & Axis Bank Home Loan.

For the latest BOI Home Loan, Home Loan Transfer interest rates & processing fees offer call on 9321020476 or login to Loanfasttrack.

2) BOI Star Smart Home Loan

- It is an overdraft home loan scheme of BOI which provides interest relief without compromising the liquidity.

- Eligible profiles from 21 years to 70 year:|

– BOI’s existing saving account customers or current deposit customers who have maintained an average balance of Rs.5000/- for the last 1 year.

– BOI’s new customer who opens a saving account or current deposit account with them with an opening balance of Rs.5000/-

– Salaried customers having salary accounts with BOI.

– Self-employed & self-employed professional with uninterrupted flow of income. - Minimum loan amount is Rs.5 Lakhs for salaried & for others is Rs.10 Lakhs.

- Maximum loan amount:

– For construction/purchase of home – Rs.5 Crores.

– For repairs, renovation & extension of home – Rs.50 Lakhs.

– For plot purchase – Rs.3 Crores. (Read: Everything You Must Know Before Purchasing A Land & Availing The Land Loans)

– For home furnishing – Rs.5 Lakhs. - Longer repayment tenures up-to 30 years.

- BOI rate of interest home loan for Star smart overdraft scheme range from 6.85% p.a – 7.75% p.a.

- Interest is charged on daily reducing balance.

- Processing fees 0.25% of the loan amount + applicable GST (Min Rs.1,500/- & Maxi Rs.20,000/-) – for individuals &

0.50% of the loan amount + applicable GST (Min Rs.3,000/- & Max Rs.40,000/-) – for Partnership Firms & Corporates.

- The surplus amount in savings/current deposit account automatically gets transferred to the home loan account thus reducing the interest burden.

- Drawing limit and sanction limit is simultaneously reduced on every repayment of EMI.

- Provides cheque book, debit card, mobile banking and online banking facility to the borrowers who wish to manage their saving’s account while dealing with the home loan.

- Loan funding of 80%.

- Nil prepayment charges on floating interest rate home loan.

Compare BOI’s Star Smart Home Loan with SBI’s Maxgain Product, Axis Bank Super Saver Home Loan & ICICI Bank Home Overdraft Product.

3) BOI Star Diamond Home Loan

- Available for all high net worth salaried, self-employed, self-employed professionals, firms/ corporates for residential accommodation of their partners/directors from 21 years to 70 years, only for cities of Mumbai, Pune, Ahmedabad, Delhi, Chennai, Kolkata, Bangalore, & Hyderabad.

- High net worth = individuals & firms/corporates with average minimum gross income of Rs.1 Crore and above as per the audited balance sheets for the last 3 years.

- Maximum loan amount available is Rs.5 Crores.

- Funding of 75% on the cost of the property / agreement value.

- Minimum income for individuals is 25% of the gross income & minimum 1.5 DSCR (Debt-service Coverage Ratio) for firms/ corporates.

- Maximum loan tenure of up-to 30 years.

- Interest rates range from 6.85% p.a. – 7.75% p.a.

- Interest is charged on daily reducing balance.

- Step-up & Step-down EMI facility available.

- One-time processing fees of Rs.50,000/- plus applicable GST.

- Nil prepayment charges on floating interest rate home loan.

4) BOI Star Top Up Loan

- Available only for existing loan borrowers (salaried, self-employed and self-employed professional) from 21 years to 70 years with good repayment track records of minimum 24 months.

- BOI loan top up amount can be used for any business or personal purposes except the speculative purposes.

- Minimum loan amount is Rs.2 Lakhs and maximum loan amount should not exceed 75% of the market value of the property inclusive of the existing outstanding home loan amount.

- Repayment tenure of maximum 12 years for BOI top up loan on home loan.

- Top up loan BOI interest rates range from 7.35% p.a. – 8.25% p.a.

- Processing fees 0.25% of the loan amount + applicable GST (Min Rs.1,500/- & Maxi Rs.20,000/-) – for individuals & 0.50% of the loan amount + applicable GST (Min Rs.3,000/- & Max Rs.40,000/-) – for Partnership Firms & Corporates.

- Nil prepayment charges on floating interest rate home loan.

- Click to know the detailed list of documents required for applying top up loan for salaried loan borrowers.

Compare BOI Star Top Up Loan with ICICI Bank home loan top up.

5) BOI Star Pravasi Home Loan

- It is an NRI Home Loan available for NRI, PIO (Person of Indian origin), OCI (Overseas Citizen of India) & Merchant Navy employees having steady flow of income and holding valid passports for construction/purchase of home, for repairs, renovation & extension of home, for purchase of plot for construction of home, for home furnishing and for balance transfer of home loan from other lender Banks/NBFCs.

(Also Read: Home loan transfer requirements, Benefits of home loan transfer)

- Minimum loan amount is Rs.1 Lakh & maximum loan amount is Rs.5 Crores.

- Longer repayment tenure of up-to 30 years.

- Interest rate of home loan for women borrowers is 6.90% p.a. and for others is 6.95% p.a.

- Interest is charged on daily reducing balance.

- Processing fees 0.25% of the loan amount (Min Rs.1,500/- & Maxi Rs.20,000/-) & 0.50% of the loan amount (Min Rs.3,000/- & Max Rs.40,000/-) + applicable GST.

- Home loan eligibility:

| For Salaried Home Borrowers | 72 times of gross monthly salary or 6 times of gross annual income based on IT returns. |

| For Self-Employed Home Borrowers | 6 times of Gross annual income based on IT returns. |

| For HUF/Proprietorship /Partnership Firm/ Pvt. Ltd. Company | 6 times of cash accruals (Profit after tax + depreciation) as per Balance Sheet/P&L Account. |

- Net take home pay (NTH)/ DSCR:

| For Salaried Home Borrowers | Net Take Home Pay (NTH): – | ||

| Gross Monthly Income Up-to Rs.1 Lakh Rs.1 Lakh – Rs.5 LakhAbove Rs.5 Lakhs | NTH 40% 30% 25% | FOIR (Fixed Obligation Against Income Ratio) 60% 70% 75% | |

| For Self-Employed Home Borrowers | |||

| For HUF/Proprietorship /Partnership Firm/ Pvt. Ltd. Company | Minimum 1.5 DSCR (Debt-service Coverage Ratio). |

- Nil prepayment charges on floating BOI house loan interest rate.

- Step-up & Step-down EMI facility available.

- Free personal accident insurance cover for loan up-to Rs.5 Crores.

Click to get the complete list of documents required for NRI Home Loans.

6) BOI (EMD) Earnest Money Deposit Scheme

- EMD are short term loans available for all eligible borrowers with a minimum age of 21 years to finance them to pay the booking amount for the residences/plots sold by the urban development authorities, housing boards and other government entities.

- Maximum loan amount is Rs.10 Lakhs.

- Loan Eligibility:

– For Salaried – Gross salary p.m. X 12 times.

– For others – Last year annual income as shown in the ITR.

- Maximum funding of 90% available.

- Interest rates applicable are 6.85% p.a. for loans below 1 year and for loans above 1 year 11.85% p.a.

- Processing fees of Rs.500/- (one time) per application.

- No prepayment charges.

Click to find out the merits and demerits for investing in resale & builder property.

7) Pradhan Mantri Awas Yojana (PMAY)

- Interest subsidy on housing loans of 3% – 6.50% for all eligible borrowers (salaried/self-employed/NRI) from 21 years to 70 years having yearly income from Rs.3 Lakhs to Rs.18 Lakhs & belonging to the EWS, LIG & MIG segment for the purchase / construction of their first house.

- Maximum subsidy amount of up-to Rs.2.67 lakhs provided for the borrower who does not own any pucca house in his name.

- Maximum carpet areas of the house under PMAY scheme is up-to 110 sq meter i.e. 1184 sq.ft.

- Maximum income to avail the benefits of this scheme is maximum up-to Rs.18 Lakhs p.a.

- Longer repayment tenure up-to 30 years with subsidy up-to 20 years of the loan tenure.

- Interest rate applicable for all is 6.85% p.a.

- Maximum loan amount eligible for the subsidy is up-to Rs.12 Lakhs.

- Processing fees – nil up-to maximum loan amount eligible for subsidy and above standard processing fees charges will be applicable which are- 0.25% of the loan amount (Min Rs.1,500/- & Maxi Rs.20,000/-) & 0.50% of the loan amount (Min Rs.3,000/- & Max Rs.40,000/-) + applicable GST.

- Nil prepayment charges.

8) BOI Star Loan Against Property (BOI Mortgage Loan)

- Available for all salaried, self-employed, self-employed professionals, Corporates (Proprietorship Firm, Partnership Firm, Private Ltd. Company), NRIs, PIOs & HUFs from 21 years to 70 years against the pledge of the property to fulfill their personal and professional needs.

- Mortgage loan can also be availed in the form of overdraft facility. (CLICK to know more on mortgage overdraft loans)

- Maximum loan amount is Rs.5 Crores.

- Maximum loan repayment tenure of up-to 15 years.

- BOI mortgage loan interest rates range from 8.85% p.a. – 9.35% p.a.

(Check out mortgage loan balance transfer @ lowest interest rates in India)

- Processing fees – maximum up-to Rs.20,000/- plus applicable GST.

Compare BOI Star Loan Against Property with ICICI Bank’s Loan Against Property.

- Processing fees for overdraft mortgage loan:

| For Loan Repayment By Instalment | For Mortgage OD (Reducible) | For Mortgage OD (Non-Reducible) |

| 1% of the loan amount + applicable GST | For 1st Year: 0.5% of the loan amount + applicable GST | 0.50% of the sanctioned amount /reviewed limit + applicable GST |

| (Minimum Rs.5,000/- & Maximum Rs.50,000/-) | (Minimum Rs.5,000/- & Maximum Rs.30,000/-) | (Minimum Rs.5,000/- & Maximum Rs.30,000/-on annual basis) |

| For Subsequent Years: 0.25% of the reviewed limit + applicable GST | ||

| (Minimum Rs.2,500/- & Maximum Rs.15,000/-) |

Click to know the documents required for applying for a mortgage loan for salaried, self employed – Pvt. Ltd Company, Partnership firm, Proprietorship Firm, mortgage loan balance transfer for salaried.

Click to find out the lowest interest rate loan against property with Loanfasttrack.

For the latest BOI Mortgage Loan interest rate call on 9321020476 or login to Loanfasttrack.

BOI Home Loan Income Tax Benefits

Income tax benefits are available on both- interest paid as well as on the principal amount repaid by the borrower.

As per the Indian Income Tax Act, 1961:

- The principal repaid can be claimed for tax deduction under section 80C of the Income Tax Act up-to Rs.1.5 Lakhs p.a.

- The interest paid can be claimed for tax deduction under section 24 of the Income Tax Act up-to Rs.2 Lakhs p.a. for the property self-owned by the borrower.

- Entire interest amount can be claimed in a year for the property which is rented out by the borrower.

BOI Home Loan Documents Required

1) KYC – Pan Card, Aadhar Card, Latest Passport size photograph, Office proof & Residence Proof.

2) Income Documents

- Documents required for home loan for salaried person – 4 months Salary Slips, 6 months Bank Account Statement, 2 years Form 16.

- Documents required for home loan for self-employed – 3 years ITR with Saral Copy, Balance Sheet, P&L Account, Capital Account – CA certified, 12 months bank account statements of all bank accounts savings + current account.

3) Property documents

- Prior Chain of Agreement

- OC/CC + approved plans

- Index 2

- Share Certificate

- Society Registration Copy

- Property Tax Receipt.

4) Additional documents required for home loan transfer

- LOD

- Outstanding Balance Letter

- 18 months repayment track record.

5) Other documents

- Duly signed BOI home loan application form.

- Processing fees cheque.

6) Click for documents required for NRI home loan

7) Please refer to the links for detailed documents for BOI home loan apply.

a) Home loan documents required Resale Case for salaried, for self-employed for Proprietorship firm, Private Ltd. Company, Partnership Firm.

b) Documents required for home loan from builder for salaried, for self-employed Proprietorship firm, Private Ltd. Company, Partnership Firm.

c) Housing loan documents required for home loan balance transfer for salaried, self-employed – Proprietorship Firm, Private Limited Company, Partnership Firm.

Click to know housing loan interest rates of different banks and to know which bank has the lowest home loan interest rate.

Similar Banks Offering Home Loans

| ICICI Bank | HDFC Ltd. | Canara Bank | SBI Bank | Axis Bank |

| Zero Processing Fees For Home Loan Balance Transfer. Click To Avail The Offer. |

Loanfasttrack is a Mumbai based loan provider company since 2015 offering loan services in Mumbai on– housing loan in Mumbai, mortgage loan in Mumbai, personal loan in Mumbai, business Loan in Mumbai, unsecured business loans,home loan transfer, top-up loans, car loans and loan transfers. Loanfasttrack is a direct sales associate with leading banks namely, ICICI Bank, HDFC Ltd, Canara Bank, Citi Bank, Piramal Housing Finance, etc.

Visit www.loanfasttrack.com.

Seek expert advice on 9321020476.

You can also email on info@loanfasttrack.com.

Loanfasttrack’s specialized services includes providing:

- The best bank for home loan.

- Best Banks For Mortgage Loan In India

- Assured low interest rates for loan against property in Mumbai.

- Lowest home loan rates in Mumbai.

- Instant loan in Mumbai.

- Instant personal loan in Mumbai & business loan in Mumbai

- Low cost home loan balance transfer.

Additional Read: