(LAP) Loan Against Property Top Up Loan

Mortgage top ups are the additional funds that you can avail of on your existing mortgage loan. The mortgage top up loan amount can be utilized for meeting a variety of your personal & professional needs. If you are planning for a small vacation with your family and have a shortage of money or you are planning to send your child for higher studies abroad and fall short of money, you can easily top up existing loan and raise the required funds. Similarly, you can also use the top up amount for refurbishing your house, your home repairs, children’s education, family marriage expenses, cost of medical treatment, and for a variety of other personal uses. Not only for the personal uses but the top up loan on mortgage loan can also be utilized to fund your business expenses such as marketing cost, advertising, and overhead cost, business expansions, office interiors, purchase of new machinery, office equipment, stationery, etc. You can also top up mortgage for home improvements, for buying a new house, for constructing a house, for purchasing land, etc. (Also read, everything you must know before purchasing a land & availing the land loans)

Since you already hold a mortgage loan,applying for a top-up loan is the easiest way to raise the funds required to meet your varied needs rather than applying for any other unsecured loans such as a personal loan or business loan. Moreover, because of your existing relationship with the lender-Banks/NBFCs/HFCs, the lender is sure of your repayments and this improves your chance of getting a mortgage loan top up loan. Top-up approval and disbursements are subject to your repayment history. A single bounce in the EMI or late payment in the last 12 -18 months reduces your chances of loan approvals and may reject your mortgage application even if you have years of relationship with the lender. Lenders follow stringent policies when it comes to assessing the lending risk. Hence loyalty with the lender is not the number of years of your relationship but holding a clear repayment track record with the lender.

Top Up Mortgage Loan Eligibility Criteria

You can apply for a top up mortgage loan with your existing lender or with a new lender by opting for a mortgage loan balance transfer subject to clear mortgage repayment records. Given below are the mortgage eligibility criteria for top up loans in India.

| Eligible Profile | * Existing mortgage loan borrowers. * Existing mortgage borrowers can be salaried, self-employed, self-employed professionals, NRIs, and a company. * Existing borrowers between 21 years – 70 years. * Existing mortgage borrowers having an uninterrupted flow of monthly income. * Borrowers having a good CIBIL score of 750 & above. |

| LAP Maximum Tenure For Top Up Loan | Maximum LAP tenure offered for top-up is up-to 20 years. |

| Mortgage Top-Up Loan Rate Of Interest | * Top-up rates can be fixed or floating. * Top-ups are offered at the mortgage rates. * Top-up interest rates mortgage today range from 7.50% p.a. – 14.50% p.a. |

| Maximum Top Up Loan Amount | 60% of the market value of the property subject to the outstanding mortgage amount and income eligibility of the borrower. |

| LAP Top Up Processing Fees | Top up mortgage loan processing fees are up-to 1% of the top up amount + applicable GST. |

| LAP Top Up Prepayment Charges | Differs from lender to lenders & ranges between 2% – 4% of the outstanding top-up amount. |

Also Read: A List of other charges in availing of a secured loan.

Preconditions To Apply For A Mortgage Top Up Loan

You can anytime apply for a top-up during the residual tenure of your loan against property. Following are the vital prerequisites for availing a top-up which you must know. A mortgage top up-loan is subject to:

- Income Eligibility

You must qualify to avail a top-up loan based on your income earnings. The FOIR for mortgage & its top up loans is not the same as in home loans. The maximum FOIR considered for LAP is 60% for salaried and 70% for self-employed.

- Loan To Value (LTV)

You cannot avail a top-up loan if your top-up requirement exceeds the LTV percentage of the lenders. The LTV suggests how much loan can be availed against the market value of the property. For mortgage & its top-up loans, the maximum LTV is restricted to 60% of the market value of the property.

For example, if your market value of the property is 75 Lakhs and you have a mortgage loan of 30 Lakhs, the maximum mortgage top up loan you can avail of is 15 Lakhs. (75 lakhs X 60% = 45 Lakhs – 30 Lakhs = 15 Lakhs).

- Clear Mortgage Repayment Track History

The lender will approve your application for top-up loan on loan against property only if you have done the timely repayment of your mortgage loan EMIs. The lenders may ask for a 12months – 18 months repayment history for transferring your mortgage loan along with a top-up loan or applying for a top-up loan with mortgage loan balance transfers.

Also Read: Know How To Deal With The Increasing Interest Rates Of Housing Loans.

- Good CIBIL Score

Your CIBIL score is important if you are applying for a bank loan top up. You must hold a clean CIBIL record with no overdue or outstanding dues of other obligations or credit cards, delayed payments or EMI bounces. Clear repayment history of all other obligations if any along with a CIBIL score of 750 & above will not only qualify you for a loan but will also fetch the best mortgage top-up loan interest rates.

Also Read: How to apply for a loan with bad CIBIL.

How multiple loan inquiries impact your CIBIL score.

- Closure Charges

Since the top up amounts can be used for a variety of personal purposes, they are charged with foreclosure charges ranging from 2% – 4% of the outstanding top-up loan amount.

- Closure Conditions By The Lenders

The approval & the disbursement for the top up loans are subject to the PSD conditions levied by the lenders (if any).

Mortgage Loan Top-Up Interest Rates Of Top Lenders

| ICICI Bank Ltd. | ICICI Bank top up loan interest rates range from 8.35% p.a. – 9.75% p.a |

| HDFC Bank | HDFC top up loan interest rates range from 7.50% p.a. – 11.10% p.a |

| Canara Bank | Canara Bank mortgage loan rate of interest for top up range from 9.95% p.a. – 12% p.a. |

| Kotak Mahindra Bank | Kotak LAP interest rate for top up starts from 9.25% p.a. onwards |

| Axis Bank | Axis Bank LAP loan interest rates for top up range from 10.50% p.a. 11.25% p.a |

| SBI Bank | SBI LAP loan interest rates for top up range from 8.80% p.a. – 9.65% p.a. |

Note: (i) Top up interest rates are subject to change without prior notice, (ii) Canara Bank top-up loans are not available with balance transfers of loans.

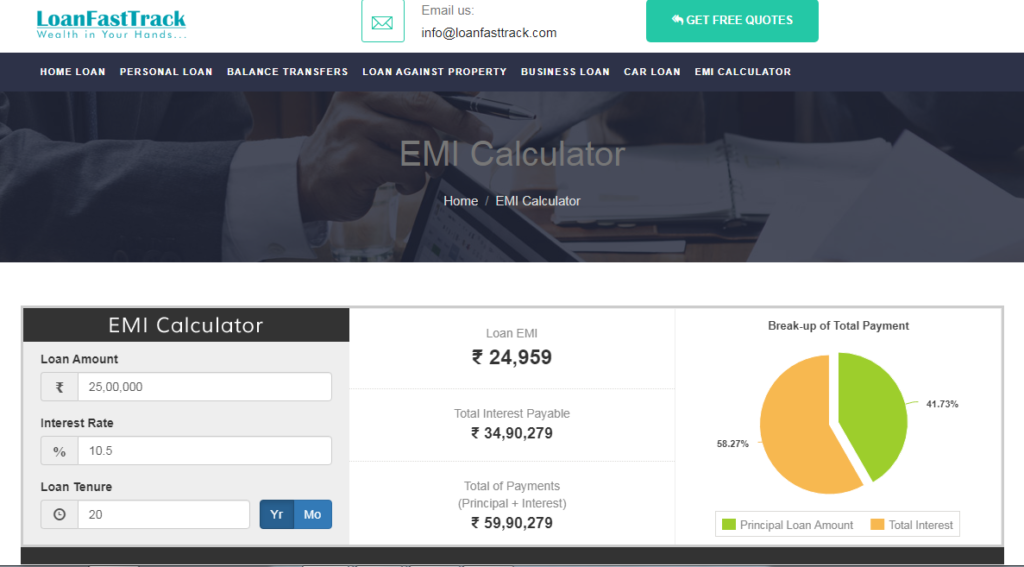

Mortgage Top Up Calculator

Use a mortgage loan EMI calculator to know how much will be your EMI for the top up loan. Calculate how much you will be paying towards your monthly outgo on top-ups using Loanfasttrack’s loan against property eligibility calculator.

Also, get to know your total interest payable on the top-up loan. You can also check your EMI affordability for the various loan amounts, at different interest rates of the lender @ varied loan tenures, by simply using a single mortgage loan eligibility calculator.

Mortgage Loan Top Up Process

It is simple to apply for a top-up on a mortgage loan. You can either apply online or offline. All you have to do is visit the nearest lender branch for applying offline or you may simply visit the lender portals or their loan app to apply online OR simply call Loanfasttrack a free service provider on – 9321020476, a one-stop solution for all your mortgage requirements.

LAP Top Up Process

- Apply for a top up loan.

- Submit the required set of documents, KYC, financial documents & loan statements.

- The lender checks your creditworthiness, income eligibility and calculates Loan to value.

- A loan is sanctioned.

- Sign the disbursement agreement.

The top up process is easy & is hassle-free. Your top-up amount is disbursed within 7 working days.

Documents Required For Applying Mortgage Top Up Loan

| KYC | |

| Pan Card, Adhar Card, Residence & Office Proof | |

| Income Documents | |

| Salaried | Self-Employed |

| 1) 4 Months Salary Slips 2) 2 Years Form 16 3) 6 Months Bank Account Statement. | 1) 3 Years ITR Copy with Saral Copy, Computation of Income, Balance Sheet, P&L account, Capital Account – CA certified with membership no. 2) 12 Months Bank Account Statements Of All Accounts. 3) Business Profile 4) Business Proofs. |

| DocumentsFor Technical Process | |

| Latest 12 months loan account statement. |

Check out the detailed document checklist of top-up loans for salaried customers & Self-employed customers.

For a mortgage loan top up with balance transfer check out the documentation links given below,

Salaried customers, self-employed – Partnership Firm, self-employed – Private Limited Company, self-employed – Proprietorship Firm.

By,

Loanfasttrack

Loanfasttrack is a Mumbai-based loan provider company since 2015 offering loan services in Mumbai on– housing loan in Mumbai, mortgage loan in Mumbai, personal loan in Mumbai, unsecured business loans, home loan transfer, top-up loans, loan transfers and apply for a business loan in Mumbai. Loanfasttrack is a direct sales associate with leading banks namely, ICICI Bank, HDFC Ltd, Canara Bank, Citi Bank, Piramal Housing Finance, etc.

Contact Loanfasttrack:

Website – www.loanfasttrack.com

Email – info@loanfasttrack.com

Tel – 9321020476

Loanfasttrack’s specialized services include providing:

- The best bank for home loan.

- Best Banks For Mortgage Loan In India.

- Assured low-interest rates for loan against property in Mumbai.

- Lowest home loan rates in Mumbai.

- Instant loan in Mumbai &home loan in Mumbai.

- Instant personal loan in Mumbai & business loan in Mumbai

- Low-cost home loan balance transfer.

Additional Read: