SBI Mortgage Loan

SBI is the leading largest public sector bank for home loans & mortgage loans in India. State Bank Of India loan against property (LAP) popularly referred to as SBI home mortgage loan is offered against the collateral of owned & jointly owned residential property & select commercial property at competitive SBI mortgage loan rates starting from 8.45% p.a. to meet your personal needs of healthcare, education, marriage, business, home repairs and renovations with flexible repayment tenures up-to 15 years & LTV funding of 65% on the property value. The loan can be accessed from SBI’s widely spread branches all over.

Prominent Features Of SBI Property Mortgage Loan

- Loans are available to meet your personal needs of children’s education/ marriage, home renovations, to fund your dream vacation & professional needs.

- Longer repayment tenures up-to 15 years.

- SBI Bank mortgage loan interest rate starts from 8.45% p.a. onwards.

- Rates for mortgage loan interest in SBI are levied on a monthly/daily reducing balance method.

- LAP loan in SBI is available against the pledge of residential & select commercial property.

- LTV mortgage loan percentage in SBI is up-to 65% of the property value.

- Future rental incomes can be considered to enhance the mortgage loan eligibility in SBI.

- Nil prepayment penalties for SBI Bank loan against property.

- Keep surplus funds in your account and reduce your loan liability and interest burden.

- LRD loans are available.

- No hidden costs or administrative charges.

Loan Against Property Eligibility SBI

| Eligible Profile | * Salaried * Self-Employed * Self-Employed Professionals * NRI |

| Age | * Minimum – 18 years. * Maximum – 70 years |

| Property To Mortgage | Residential and or select commercial property. |

| Minimum Business Vintage | 2 years. |

| LAP Interest Rate SBI | 8.45% p.a. – 10% p.a. |

| Tenure for SBI LAP Loan | * Minimum – 5 years. * Maximum – Up-to 15 years. |

| Loan Amount | * Minimum – Rs.10 Lakhs. * Maximum – Rs.7.5 Crores. |

| Minimum Income for SBI Loan On Property Mortgage | Rs.3 Lakhs p.a. |

| Type Of Loan | EMI- based term loan. |

| LTV | * 65% – for loans up-to Rs.1 Crores. * 60% – for loans Rs.1 Crore – Rs.7.5 Crores. |

| FOIR | * 50% – for net income of Rs.3 Lakhs p.a. – Rs.5 Lakhs p.a. * 55% – for net income of Rs.5 Lakhs p.a. – Rs.10 Lakhs p.a. * 60% – for net income above Rs.10 Lakhs p.a. |

| CIBIL Scores | 650 & above. |

| Processing Fees | Up-to 1% of the loan amount plus applicable GST subject to a maximum of Rs.50,000/- |

| Pre-Payment Charges | NIL |

| Mortgage Schemes | * House Mortgage Loan SBI. * Loan Against Commercial Property. * Loan Against Rental Income SBI receivables. * Loan Against Property Balance Transfer SBI. * SBI NRI Loan Against Property. * Lease Rental Discounting. * SBI Reverse Mortgage Loan. * Loan against land SBI. |

Note: The above-mentioned SBI home loan against property charges & loan against property SBI Bank interest rates are subject to change without prior notice.

Click to read more on loan against property eligibility.

State Bank Of India Mortgage Loan Interest Rate

Property mortgage loan interest rate in SBI is linked to its 1-year MCLR (Marginal Cost Of Funds Based Lending Rate) rate. The MCLR rate for 1-year is 7% (as of July 21). SBI home mortgage loan interest rates vary based on the eligible profiles and with their loan amounts. Given below are the details of the SBI interest rate on loan against property.

| Loan Amount | Salaried | Self-Employed |

| Up-to Rs.1 Crore | 8.45% p.a. | 9.10% p.a. |

| Rs.1 Crore – Rs.2 Crores | 9.10% p.a. | 9.60% p.a. |

| Rs.2 Crores – Rs.7.5 Crores | 9.50% p.a. | 10% p.a. |

Note:The mortgage loan SBI Bank interest rates are subject to change without prior notice.

SBI Mortgage Loan Details

1. SBI Loan Against Immovable Property

It is a term loan provided against the mortgage of a residential house to fulfill your personal needs for education, healthcare, marriage, etc. at an affordable rate of interest on loan against property in SBI. The term loan is repaid in the form of equated monthly installments.

- Eligible borrowers – salaried, self-employed, professionals, & NRIs.

- SBI Bank LAP loan interest rate ranges from 8.45% p.a. – 10% p.a.

- The maximum tenure for a home mortgage loan SBI is up-to 15 years.

- The maximum loan against house property SBI loan amount is Rs.5 Crores.

- The processing fee is 1% of the loan amount (maximum- Rs.50,000/-) plus applicable GST.

- You can apply jointly to enhance the SBI LAP eligibility. (read, more on joint loan benefits)

Also, read the best banks for mortgage loans in India

2. Rent Plus Scheme

SBI’s Rent Plus Scheme is a term loan provided against the assessment of the future rental income receivables from the rent-out residential or commercial property to meet your liquidity mismatch.

- Eligible Profile – Owner of residential buildings & commercial properties which are to be rented or already rented to Banks or MNCs or large & medium size corporates.

- The minimum loan amount is Rs.50,000/- and maximum Rs.5 Crores in non-metro cities & Rs.7.5 Crores in metro cities.

- The maximum tenure is for 10 years subject to the residual lease period (whichever is lower).

- The maximum LTV is up-to 75% of the property value.

- SBI property mortgage loan interest rate for rent plus scheme range from 9.60% p.a. – 13.85% p.a.

- SBI loan against property eligibility for rent plus is lowest of:

- 75% of the market value of the property OR

- 75% of the total rent receivables for the residual period minus the advance deposit, estimated amount of TDS, property tax & GST).

- Processing fees of 2.02% of the loan amount subject to a maximum of Rs.1,01865/- plus applicable GST.

- Nil prepayment charges.

3. Lease Rental Discounting (LRD) Loans

SBI’s LRD loans are the term loans provided to the eligible borrowers earning rental incomes on their rented out residential & commercial property leased to Banks/MNCs/Corporates/State & Central Government offices/Municipal Corporations, etc.

- Eligible borrowers – All individuals & MSME units who are owners of residential or commercial lent-out properties.

- The minimum loan amount is Rs.10 Lakhs and the maximum is Rs.500 Crores.

- LRD LAP rate of interest SBI ranges from 9.45% p.a. – 11% p.a.

- Properties leased to social infrastructure projects such as schools, colleges, orphanages, hospitals, old age homes, nursing homes, etc are not considered as collateral.

- The maximum LTV provided is 70% of the property value.

- SBI mortgage loan eligibility for LRD will be lower of:

-> 70% of the market value of the property OR

-> 95% of the net present value of the net rent receivables as per 1 year MCLR OR

-> 70% of the net rent receivables for the residual lease period including the period covered under one renewal clause or loan tenure whichever is less for loans up-to Rs.50 Crores & 75% for loans above Rs.50 Crores – Rs.500 Crores. - ESCROW account is mandatory.

- Upfront processing fees will be charged.

Read more on LRD loans.

4. SBI Mortgage Loan Balance Transfer

Mortgage loan transfers with SBI Bank are available for eligible borrowers with an option to reset the loan tenure and to apply for an additional loan amount as a top-up.

- All eligible loan borrowers can apply to transfer their mortgage loan to SBI.

- Mortgage refinancing is also available with a top-up facility. (Also, read on home loan refinancing)

- Longer repayment tenures of up-to 15 years.

- The interest rate for mortgage loan in SBI starts from 8.45% p.a. onwards.

- Borrowers with good CIBIL scores and repayment records will be considered. (Also, read how your multiple loan inquiries impact your CIBIL score)

- Mortgage loan transfer to SBI can be done for all mortgage loans schemes. (Also, read important things before refinancing a loan)

Also, click to read how to deal with the increasing interest rates of housing loans.

5. Reverse Mortgage Loan

SBI’s Reverse Mortgage loans are provided to the Indian senior citizens above 60 years against the pledge of their owned residential property for the end-use of meeting their day-to-day expenses, medical expenses, etc.

- Eligible Profile – Senior citizens above 60 years & spouse age above 58 years in case of joint applications. (Also, read who can be your co-applicants in the loan)

- Loan tenure for reverse mortgage loan SBI is 10-15 years depending on the age of the applicant.

- The minimum loan amount is Rs.3 Lakhs and the maximum is Rs.1 Crore.

- SBI reverse mortgage loan interest rates:

-> Reverse mortgage loan interest SBI for SBI pensioners is 8.05% p.a.

-> SBI house mortgage loan interest rates for reverse mortgages for the public is 9.05% p.a. - Processing fee of 0.50% of the loan amount subject to minimum Rs.2000/- & maximum Rs.20,000/- plus applicable GST.

- Nil SBI reverse mortgage loan repayment/prepayment penalty.

List Of Other Charges

Along with the processing fees, the other charges which you need to pay for availing of a mortgage loan from SBI are listed below. These charges will be communicated to you by the SBI. GST will be applicable on all charges.

- Processing fees – up-to 1% of the loan amount.

- Stamp duty charge of 0.30% on the loan amount.

- CERSAI – Rs.50/- for loans up-to Rs.5 Lakhs & Rs.100/- for loans above Rs.5 Lakhs

- Property valuation charges i.e. the valuer’s fee for valuation report.

- Advocate’s fees for property title search & title investigation report

- Prepayment charges – Nil for floating interest rate. (also, read on fixed v/s floating interest rates)

- Property insurance premium.

SBI Loan Against Property Documents Required

KYC

| Pan Card, Adhar Card & Photograph |

| Income Documents |

| For Salaried | * 4 months salary slips. * 2 years form 16 * 6 months bank account statement. |

| For Self-Employed | * 2 years ITR with Computation of Income, Saral Copy, Balance Sheet, P&L Account, Capital Account – CA certified with membership no. and UDIN No. * 12 months bank account statement. * Business profile. * Business proofs. |

| Property Papers |

- Prior Chain of Agreement.

- OC/CC + approved plans.

- Index 2.

- Share Certificate.

- Society Registration Copy.

- Property tax.

- Property maintenance bill.

| Other Important Loan Against Property Documents Required SBI |

| Additional Documents Required For Mortgage Loan Transfer | * LOD (list of documents). * Outstanding letter. * 12 months repayment track record. |

| Additional Documents Required For LRD | * Registered valid lease agreement. * 6 months bank account statement where the rent is received. |

| Other Documents | * Duly signed Kotak Bank application form. * Processing fee cheque. * Any other document as required by the bank. |

For complete SBI mortgage loan documents requiredkindly refer to the following links:

- Salaried

- NRI

- Self-employed – Proprietorship Firm, Partnership Firm, & Private Ltd. Company.

Also, read NRI loan against property In India.

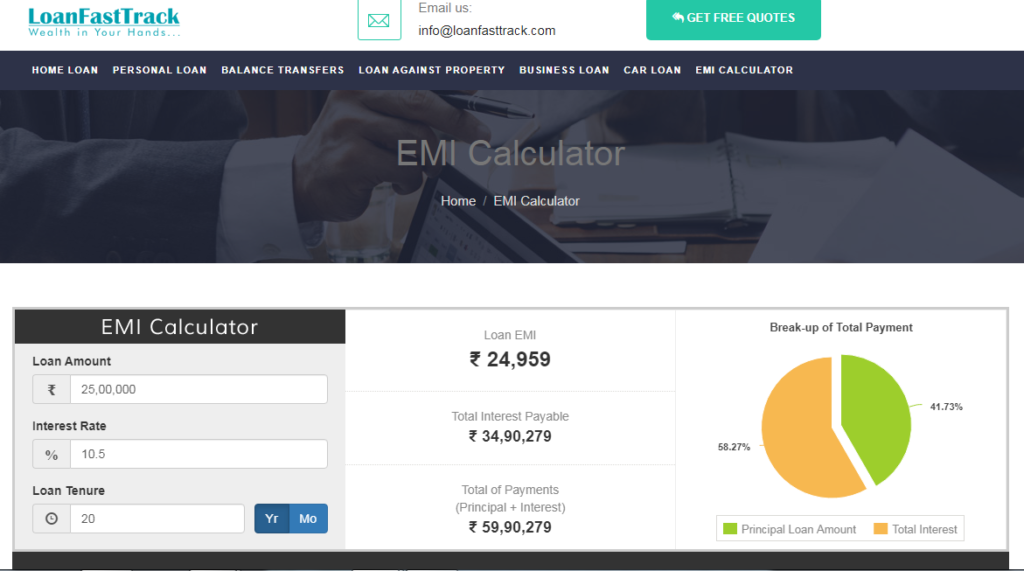

SBI Loan Against Property EMI Calculator

SBI loan against property calculator will help you to calculate your monthly mortgage loan EMIs. Knowing the mortgage EMIs well in advance is important for your financial planning. The SBI loan calculator against property helps you to know your EMI affordability and accordingly, you can apply for the loan amount. The EMIs will vary depending on the SBI rate of interest on mortgage loan, tenure in months or years & the loan amount. The tenure and the EMIs are inversely related, the longer the tenure the lower will be your EMIs and vice-a-versa. Loan against property SBI interest rate calculator will also tell you the total interest payable over the tenures. It is therefore important that you choose a suitable EMI which can be served easily and accordingly opt for the loan amount and the loan tenure. You have the freedom to choose the loan amount and the tenure for yourself. However, the LAP SBI interest rate will be decided on your repayment capacity and your creditworthiness. (Also, read how to repay your loan faster)

Also, check Loanfasttrack’s EMI calculator for loans. With Loanfasttrack’s EMI calculator, get to know your monthly outgo and breakup of the total interest and the principal repayment till the loan tenure, by simply entering your desired loan amount, tenure & the mortgage loan rate of interest SBI.

Important Highlights To Remember

- The maximum loan amount is subject to the property location.

-> If the property is in BPR Urban Centers, the maximum loan amount is 1 Crore.

-> If the property is within the municipal corporation areas of Mumbai, Pune, Ahmedabad, NCR, Chennai, Bangalore & Hyderabad Centers, the maximum loan amount is 7.5 Crores.

-> If the property is in other BPR Centers, the maximum loan amount is 2 Crores.

-> If the property is in rural & semi-urban areas with a population of up-to 1 Lakh – Nil. (Also, read Why is it difficult to get a loan on gram panchayat property)

- The maximum LTV ratio depends on the SBI mortgage loan against property loan amount.

- Mortgage loan in SBI Bank under loan against immovable property the loan is not available for business purposes.

- SBI LAP interest rates are reset every year based on the prevailing 1-year MCLR as on the date of reset.

- State Bank of India mortgage loans is not extended against the pledge of all commercial (shops & offices) & industrial properties.

- SBI’s MCLR rates with effect from 15.07.2021 are 6.65%, 6.95%, 7%, 7.20% & 7.30% for overnight/1-month/ 3-months, 6-months, 1-year, 2-years & 3-years, respectively.

- You can also apply for a loan against plot SBI & agriculture land mortgage loan SBI.

Compare SBI Mortgage Loans With Top Lenders

| Parameter | SBI Bank | ICICI Bank | HDFC Bank | Axis Bank |

| Interest Rate | 8.45% p.a. – 10% p.a. | 7.70% p.a. – 9.75% p.a. | 7.50% p.a. – 10.95% p.a. | 10.50% p.a. – 11.25% p.a. |

| Tenure | Up-to 15 years. | Up-to 20 years. | Up-to 15 years. | Up-to 20 years. |

| Processing Fees | 1% of the loan amount + applicable GST. | Up-to 1% of the loan amount + applicable GST. | Up-to 1% of the loan amount + applicable GST. | Up-to 1% of the loan amount + applicable GST. |

| Overdraft Facility | No | Yes | Yes | Yes |

| LTV | 65% | 70% | 65% | 55% |

| Maximum Loan Amount | Upto Rs.7.5 Crores | Up-to Rs.10 Crores. | Up-to Rs.25 Crores. | Upto Rs.5 Crores |

| Click for more details. | Click for more details. | Click for more details. |

Click to compare the rates of other leading banks.

FAQ

Q. How much is the SBI mortgage loan interest rate 2021 for Rs.50 Lakhs?

Ans: SBI loan against property interest rate 2021 range from 8.45% p.a. – 10% p.a. SBI LAP loan rate of interest for Rs.50 Lakhs is 8.45% p.a.

Q. How are the SBI home loan against property interest rates levied?

Ans: SBI mortgage loan interest rate today is levied on the monthly/daily reducing balance method.

Q. Can I top up my loan against immovable property?

Ans: Yes, you can avail of a top-up loan on your loan against immovable property subject to your mortgage loan eligibility.

Read more for mortgage top-up loans.

Q. How much mortgage can I get approved for?

Ans: With an SBI mortgage home loan you can apply for a maximum mortgage loan amount of Rs.7.5 Crores, subject to your income eligibility and property market value.

Q. How much is the SBI interest rate loan against property for LRD loans?

Ans: LAP loan interest rate SBIranges from 9.45% p.a. – 11% p.a.

Q. Can I get SBI OD against property mortgage for Rs.35 Lakhs?

Ans: SBI does not provide mortgage overdraft loans. Click to read more on mortgage overdraft loans.

Q. Is an SBI loan against property apply online available?

Ans: SBI mortgage loan apply online option is not available. You have to visit the nearest branch to apply for your mortgage loan. Alternatively, you can visit the SBI’s site and leave your name & contact details & a relationship manager will get back to you soon.

Q. Can I get a mortgage loan against agricultural land SBI?

Ans: Yes, you can apply for an SBI land mortgage loan.

Also, read to know more before purchasing land and availing a land loan.

Q. How much is the SBI Lap rate for a plot mortgage loan SBI?

Ans: Please contact the nearest branch to know the interest rates for a loan against land property SBI.

Also, read the difference between a home loan and a land loan.

Q. Where do I find a loan against property SBI calculator?

Ans: You can find the SBI LAP EMI calculator on the SBI’s website.

Click to read more on mortgage loan FAQs.

By,

Loanfasttrack

Loanfasttrack is a Mumbai-based loan provider company since 2015 offering loan services in Mumbai on– housing loan in Mumbai, mortgage loan in Mumbai, personal loan in Mumbai, unsecured business loans, home loan transfer, top-up loans, loan transfers and apply for a business loan in Mumbai. Loanfasttrack is a direct sales associate with leading banks namely, ICICI Bank, HDFC Ltd, Canara Bank, Citi Bank, Piramal Housing Finance, etc.

Contact Loanfasttrack:

Website – www.loanfasttrack.com

Email – info@loanfasttrack.com

Tel – 9321020476

Loanfasttrack’s specialized services include providing:

- The best bank for home loans.

- Best Banks For Mortgage Loan In India.

- Assured low-interest rates for loan against property in Mumbai.

- Lowest home loan rates in Mumbai.

- Instant loan in Mumbai &home loan in Mumbai.

- Instant personal loan in Mumbai & business loan in Mumbai

- Low-cost home loan balance transfer.

Additional Read

- ICICI Bank mortgage loan for NRI in India.

- What Are The Income Tax Benefits Of A Mortgage Loan?

- How To Apply Online For Home Loan, Mortgage Loan & Loan Transfers.

- Step-By-Step Guide Of Internal Processing Of Home Loan & Mortgage Loan.

- Difference Between Personal Loan & Loan Against Property.

- Commercial Property Loan With ICICI Bank.