Home Loan Balance Transfer @ Lowest Rate For 6.95%*p.a.

(Janakidevi, Mumbai, 35 years is a professional self-employed having a house loan with the bank since 12 months is paying a high housing loan interest rates. With the recent reduction in the series of repo rates, Janakidevi also decides to capitalize the opportunity of lowest home loan interest rates and decides to apply for a home loan balance transfer with top-up.

Janakidevi visits the most trusted website of Loanfasttrack (trusted website for Home Loan & Mortgage Loan in Mumbai), makes following conversations with experts of Loanfasttrack)

Janakidevi (over telephonic conversation): Could you please help me to transfer my home loan to another bank?

Loanfasttrack: Yes madam, I am Madhav-Relationship Manager will help you.

Q. Is home loan transferable? Can my housing loan be transferred?

Ans:- Yes. A home loan can be transferred to another bank. You will have to apply with the new bank as a fresh loan under the loan product “Home Loan Balance Transfer”.

Q. Home loan transfer kaise kare?

Ans:- You can apply for home loan transfer through Loanfasttrack. Loanfasttrack is a free service provider in Mumbai. It will help you in getting a low cost home loan balance transfer, in getting lowest home loan rates in Mumbai and will also find for you the best bank for home loan.

Q. Can I get a housing loan transfer with top-up?

Ans:- Yes, you can apply for a home loan transfer plus top-up.

Learn more on top-up loan refer link Top-Up Loans – Loanfasttrack.

Q. After how many months home loan can be transferred?

Ans:- After completing 6 months with the existing bank a home loan can be transferred. However some banks may insist for 12 months repayment.

Q. What is the current home loan balance transfer rate of interest?

Ans:- Home loan transfer rates range from 6.95%p.a. – 10.50% p.a. The best home loan transfer rate of interest is 6.95%p.a. provided by Canara Bank (for any loan amount), ICICI Bank (for loan amount up-to 35 lakhs) and HDFC Bank (for women applicants for loan amount below 30 lakhs).

For complete information you can refer our blog Home Loan Interest Rates꘡Compare Rates Of Top Banks

Q. What is the home loan transfer minimum tenure?

Ans:- The home loan is transferred for the period of outstanding loan tenure. However you can alter, decrease or increase the loan tenure with home loan balance transfer, subject to your age & income eligibility. Since tenure is inversely proportional to EMI a reduction in the loan tenure will increase your EMI. The minimum tenure for home loan is 5 years while the maximum tenure is for 30 years.

In case of home loan balance transfer with top-up loans, the maximum tenure for the top-up loan will be for 15 years.

Q. What is the home loan transfer cost?

Ans:- Since home loan transfer is treated as a fresh loan by all lenders i.e. Banks & NBFCs, you are required to pay all the relevant home loan charges once again with the new bank. Home loan transfer fees includes:

i) Home loan transfer processing fees + applicable GST.

ii) Franking & stamp duty cost of 0.20% on the loan amount + applicable GST.

iii) Administrative cost i.e. legal and technical charges which range from Rs.5000/- to Rs.10,000/- which varies between banks.

iv) Other miscellaneous expenses such as CIBIL charge, CERSAI charge, title search cost, etc.

For complete information on the transfer cost please refer to the link DON’T GET FOOLED !! MUST KNOW ALL COSTS IN HOME LOAN.

Q. What are home loan transfer terms and conditions?

Ans: – The following are the home loan transfer conditions:

1) Good CIBIL score of 750 and above.

2) Proper repayment history of the housing loan.

3) The loan is not in the lock-in period. Especially in a fixed interest rate home loan.

4) The loan is not a fixed rate home loan. (In fixed interest rate home loans, your existing bank charges you with a foreclosure charge which varies between 2% to 4% on your outstanding loan amount. It is therefore suggested to first transfer your home loan from fixed to floating interest rate before applying for a home loan balance transfer, which will cost you nominal i.e. 0.20% to 0.50% on the loan amount. It is referred to as conversion cost.)

5) An under-construction property home loan cannot be transferred. For transfer you need to have the possession of the property.

6) The top-up loans are subject to two important preconditions.

- To your income eligibility.

- To the market value of the property.

The cumulative loan amount of the balance transfer along with the top-up amount does not exceed the LTV norms of the bank.

7) The top-up amount cannot be used for trading and speculative purposes.

Q. What are the home loan transfer requirements?

Ans:- For home loan transfer in other bank you must have:

1) A good repayment track record for 12 months.

2) An uninterrupted regular flow of income.

3) Your loan must be at least 6 months old.

4) Your home loan must be a floating rate home loan.

5) Have all relevant photo-copies of the required set of documents such as KYC, Income documents & Property papers.

Q. What are the available home loan transfer schemes?

Ans: – The following are the various home loan transfer deals:

1) Home loan balance transfer for women borrowers at special discounted rate of interest.

2) Home loan balance transfer available with attractive interest rates.

3) Home loan balance transfer with top-up loans with attractive interest rates on top-ups.

4) Home loan balance transfer available with O/D facility/ saver plan (park your access funds in savings account and pay less interest).

5) Home Loan Transfer Zero Processing Fees.

Q. Current home loan transfer best offers?

Ans:- Below given are the best Home loan offers.

1) Canara Bank – 6.90% p.a. for women borrowers, processing fees maximum up-to Rs.10,000/- plus applicable GST for any loan amount.

2) ICICI Bank – 7.25% p.a. – 7.50% p.a. for self-employed, processing fees 0.30% on loan amount plus applicable GST.

3) HDFC Bank – 6.95% p.a. – 8% p.a. for self-employed, processing fees 0.50% of the loan amount plus applicable GST.

4) Home loan balance transfer with zero processing fees with ICICI bank for home loan above Rs. 1 crore.

| Click To Get Updated Home Loan Transfer Options |

Q. What will be my home loan balance transfer eligibility?

Ans:- Home loan transfer eligibility is subject to your age, income eligibility and market value of the property. Your eligibility also depends on other factors such as CIBIL score, profile, business & employment details, property details (location, age, project approved, etc), etc.

Q. Is a home loan transfer for NRI possible?

Ans:- Yes. NRI home loan balance transfer is possible. According to many private banks such as ICICI Bank, HDFC Ltd., Axis Bank, etc. the NRI has to be present in India for the loan process. The NRI in the countries such as Iran, North Korea (Democratic People’s Republic of Korea), Cuba, Syria, Sudan, and Cremia Region of Ukraine, Pakistan, Bangladesh, Sri Lanka, Afghanistan, China, Nepal, Macau, Hongkong or Bhutan will not be considered for housing loans.

For additional information on NRI home loans please refer to the link Everything You Must Know About NRI Home Loans.

Click to get NRI List Of Documents For Applying Home Loan, NRI List Of Documents For Applying Mortgage Loan.

Q. Does home loan transfer from wife to husband possible?

Ans:- Yes, but it is a rare ratio. Home loan transfer from wife to husband is possible provided the wife transfers the ownership rights on the property to husband, which means she will no longer be the owner of the property subject to the income eligibility of the husband.

Q. Is home loan balance transfer eligible for PMAY subsidy?

Ans:- If you have already taken the PMAY subsidy from the existing bank, you cannot claim the same again with the new bank.

Q. Does home loan transfer before possession possible?

Ans:- No. A home loan cannot be transferred before taking possession of the property.

Q. What is home loan transfer from seller to buyer?

Ans:- The banking language is home loan seller BT (balance transfer). It is a terminology for resale purchase of the property where the seller of the property has already taken a loan to purchase the property. When the property is sold to a buyer who also applies for a housing loan to purchase the same property, the home loan of the seller is transferred to the buyer. According to the banking process, the bank first closes the seller’s home loan with the buyer’s housing loan and the remaining funds will be transferred to the seller’s account.

Q. How does home loan transfer work?

Ans:- The home loan balance transfer works as follows:

Home loan transfer process:

1) The home loan transfer process starts by applying with the best bank for home loan, by submitting the required set of documents along with the home loan transfer application forms.

2) Documents are checked for any queries.

3) FI (Field Investigation) visits will be arranged at your residence as well as office.

4) Property technical will be conducted. Property market value is ascertained through the technical visits.

5) The file is then forwarded for the sanction process.

6) The remaining processing fees will be collected after the loan is sanctioned.

7) Legal for the property is conducted to be sure the property is a freehold property and has a clear and marketable title.

8) On successful sanction, technical & legal of the case the file is undertaken for the disbursement. Disbursement is the final process of the transfer. You are required to submit the duly signed disbursement kit along with the photocopies of property papers. The submitted documents are once again scrutinized.

9) You will have to pay the relevant loan charges which includes the administrative legal and technical charge & stamp duty charges on the loan.

10) The cheque-cut is done in the name of the bank from which your loan is being transferred.

Your loan is now transferred to a new bank with low interest rates on housing loans. The inter-bank transfer will be undertaken for transferring your original documents from the existing bank to the new bank.

Q. Is home loan transfer profitable?

Ans:- Definitely yes. A home loan transferred to a new bank with a low interest rate is definitely profitable. It saves your amount in lakhs as it reduces the total interest payable to the bank. The reduced rate also benefits you with reduced EMIs.

Q. What are the home loan transfer pros and cons?

Ans:- Home loan transfer advantages and disadvantages

| Home Loan Transfer Advantages | Home Loan Transfer Disadvantages |

| 1) Advantage over low interest rates. 2) Reduces the total interest payable. 3) Loan tenure can be enhanced. 4) EMI outgo can be reduced. 5) Top-up loans can be availed at the housing loan interest rates. 6) Change from fixed rate to floating interest rate. 7) Get a housing loan saver plan. 8) Get satisfactory services with the new bank such as generating loan statements, document requests and transferring the benefits of reduced rates, etc. 9) Get a new age banking technology and ease of access which existing banks are not able to offer. | 1) The process to switch a home loan can be lengthy. 2) The loan approval process is to be initiated all over again, which is sanction, FI visit, legal & technical, disbursement, etc. 3)All relevant housing loan charges are to be paid including the processing fees, legal & technical, stamp duty, etc. 4) If outstanding loan or tenure are more, you may not save much from a balance transfer 5) Interest component increases when the loan tenure is enhanced. |

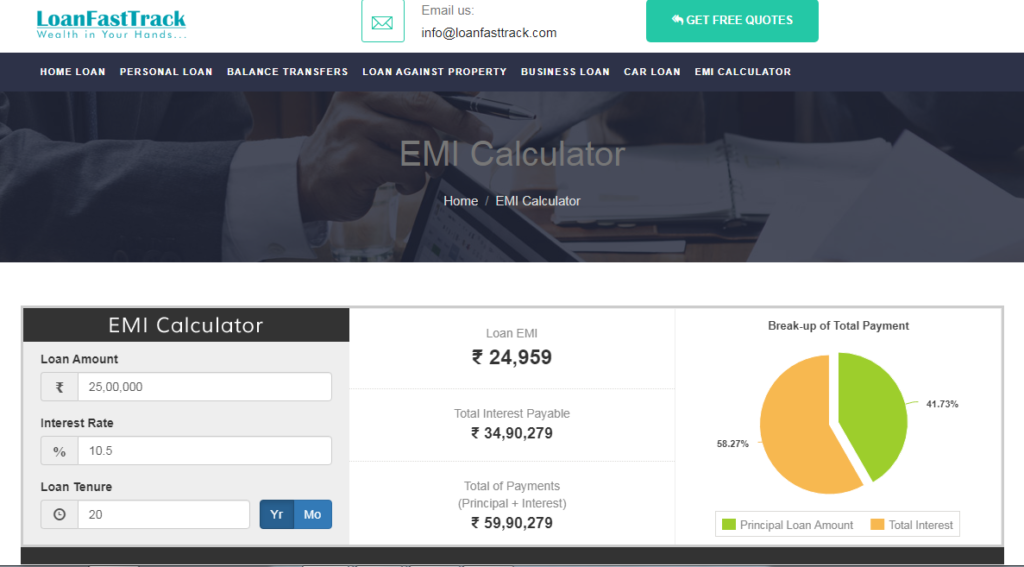

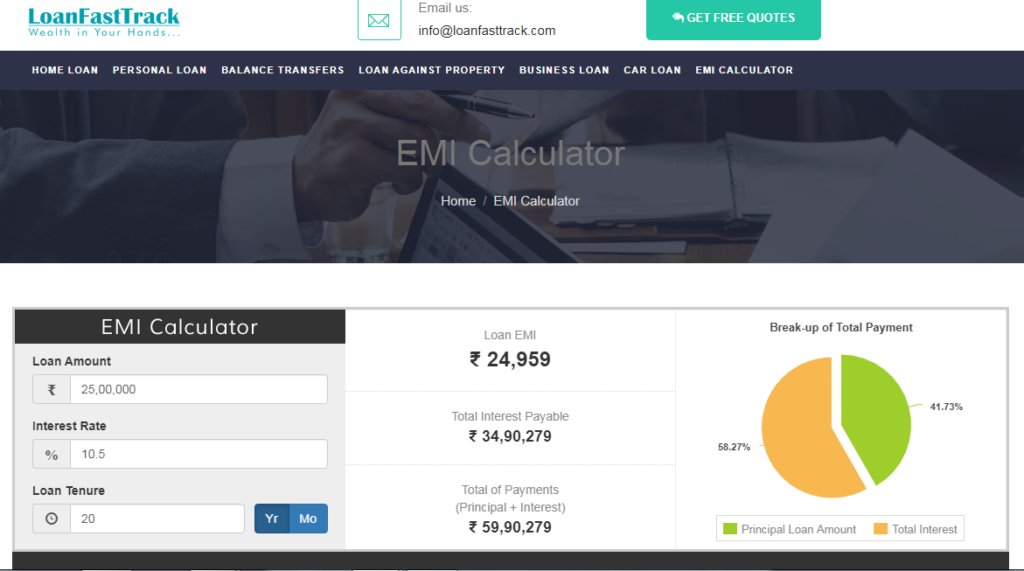

Q. What is a home loan balance transfer EMI calculator?

Ans:- Home loan transfer eligibility calculator is an online tool that helps you to calculate your EMI instantly by feeding just three simple figures, loan amount, tenure and the rate of interest.

Calculator for home loan transfer is beneficial as you can also compare multiple EMIs with different loan tenures and interest rates.

| Home Loan Transfer EMI Calculator |

Q. Where do I place my home loan transfer request?

Ans:- Loanfasttrack will assist you with the loan transfer. You may select the beneficial bank scheme, and Loanfasttrack will do the rest.

Q. How to get home loan transfer?

Ans:- Our executive will visit you in person for documentation along with the application form of the selected bank for balance transfer.

Q. What are the documents for home loan transfer?

Ans:- Home loan transfer documents include:

1) KYC- Pan card, Adhar card, residential & office proof.

2) Financial Documents –

- For Self-Employed- 3 years ITR with Saral Copy, Balance Sheet, P&L Account, Capital Account – CA certified with membership no. and UDIN No.

- For Salaried – 4 months Salary Slips, 6 months Bank Account Statement, 2 years From 16.

3) Property Documents – Prior Chain of Agreement, OC/CC + approved plans, Index 2, Share Certificate, Society Registration Copy, Property Tax.

4) LOD, Outstanding letter and 12-18months repayment track record.

Click for Home Loan Balance Transfer documentations – For Salaried, For Self-Employed- Proprietorship Firm, Private Limited Company, Partnership Firm.

| Click To Switch Your High Interest Rate Home Loan @ 6.95*p.a. |

Q. What is LOD for home loan transfer?

Ans:- LOD stands for list of documents. It is provided by the bank on its letterhead & mentions the list of documents you submitted with the bank for availing the housing loan.

(Satisfied with customer services of Loanfasttrack, Janakidevi opts for home loan balance transfer along with top-up loan with Loanfasttrack and still continues to remain the esteem customer of Loanfasttrack, through them she also fulfilled her other loan requirements such as mortgage loan, personal loan, business loan and as well as commercial loan.)

You don’t miss your chance to become an esteem customer with Loanfasttack. Loanfasttrack can be your home loan transfer agent.

For home loan transfer from ICICI Bank to HDFC, home loan transfer from HDFC to ICICI Bank, home loan transfer to HDFC Bank,home loan transfer to ICICI Bank, home loan transfer to Canara Bank visit https://www.loanfasttrack.com/. You can also email us on info@loanfasttrack.com or directly speak to our experts on 9321020476.

Loanfasttrack is the best online user friendly platform to compare and evaluate the best bank for home loan in India. Loanfasttrack is a Mumbai based loan provider company since 2015 offering loan services in Mumbai on– housing loan in Mumbai, mortgage loan in Mumbai, personal loan in Mumbai, business Loan in mumbai, unsecured business loans,home loan transfer, top-up loans, car loans and loan transfers.

It also helps you:

√ To find the best bank for home loan

√ To get lowest home loan rates in Mumbai

√ To get an instant loan in Mumbai

√ To get instant personal loan in Mumbai & business loan in Mumbai

√ To make you qualify for the maximum loan against property eligibility

√ To get a low cost home loan balance transfer

√ To get assured low interest rates for loan against property in Mumbai

Additional Read: