Why Choose ICICI Bank Home Loans?

ICICI bank is one of the largest home loan providers in India which provides home loans to purchase, repair, renovate or redecorate and construct your home with ICICI’s range of home loan products. The bank offers you with a variety of home loan schemes at low processing fees and attractive interest rates with extended loan tenures upto 30years in addition with easy repayment options and full waiver of prepayment penalty on floating interest rate loans. ICICI Bank’s attractive interest rates start from 6.95% p.a and flat processing fees of 0.30% on the loan amount.

Advantages Of ICICI Bank Home Loans

- Wide range of products.

- Over 900 Bank Branches pan India to service your loans.

- Guidance throughout the process making home buying hassle free.

- Pre-approved home loan facility available.

- Sanction approval without having selected a property.

- Simplified Documentation.

- Flexible repayment options upto 30 years.

- Quick loan approvals.

- Faster disbursements.

- Home loan insurance options available at attractive premiums to ease the burden of loan repayments on you and your family in any unforeseen incidents.

- Attractive interest rates which starts from 6.95% pa.

- Floating and fixed interest rate option available.

- PMAY credit linked subsidy schemes available with subsidy upto Rs.2.67 lakhs.

ICICI Bank Home Loans Offers Home Loan For Following Purposes

1) Home Loan: Loan taken to purchase a new residential property, applied individually or jointly with a co-applicant.

2) Home Improvement Loan: Loan taken for renovations and repairs such as home interiors, painting, water-proofing, external repair work, electrical work, etc.

3) Balance Transfer: Loan transfer from another lender Bank/NBFC to avail the benefit of low interest rates and increased tenures.

4) Top-Up Loan: Loan taken on the already existing home loan to meet the immediate requirement of funds.

ICICI Bank Home Loan Details

Interest Rates: Starts from 6.95%p.a. The ICICI Bank’s interest rates are linked to repo rates. Below mentioned is the interest slab for salaried and self-employed as on July 14,2020. Current repo rate is 4%.

For Salaried Borrowers

| Slab | Floating Interest Rates |

| Up-to Rs.35lakhs | RR + 2.95% (6.95%) – RR + 3.60% (7.60%) |

| Rs.35lakhs- 75lakhs | RR + 3.20% (7.20%) – RR + 3.75% (7.75%) |

| Above 75lakhs | RR + 3.30% (7.30%) – RR + 3.95% (7.95%) |

For Self-Employed Borrowers

| Slab | Floating Interest Rates |

| Up-to Rs.35lakhs | RR + 3.20% (7.20%) – RR + 3.85% (7.85%) |

| Rs.35lakhs- 75lakhs | RR + 3.35% (7.35%) – RR + 3.95% (7.95%) |

| Above 75lakhs | RR + 3.45% (7.45%) – RR + 4.05% (8.05%) |

For Home Loan Balance Transfer

| Segment | Floating Interest Rates |

| Salaried (Any loan amount) | RR+3.10% (7.10%) – RR+3.35% (7.35%) |

| Self-Employed (Any loan amount) | RR+3.25% (7.25%) – RR+3.50% (7.50%) |

Note: (i) Interest rates mentioned above may vary depending upon the CIBIL score, profile, segments, different loan products, etc.

(ii) Interest rates are subject to change as per RBI’s discretion without prior notice.

Loan Amount: The home loan amount starts from Rs.5lakhs onwards. Maximum ceiling limit is of Rs.20crores.

Eligibility Criteria: A borrower with regular flow of income and within the age group of 21 years to 70 years.

| Age Bracket | |

| Applicant | 18 years – 70 years |

| Co-Applicant | 21 years – 70 years |

| NRI | 25 years – 60 years |

Who Can Apply: Salaried, self-employed- (proprietor, partner), self-employed professionals, company- partnership firm, proprietorship firm, private limited and NRI.

Loan Tenure: Minimum tenure has to be 5 years and is available till 30 years.

CIBIL Score: Required CIBIL score is 750 and above.

Processing Fees & Other Charges:

| Processing Fees (non-refundable) | 0.30%-1% on the loan amount + applicable GST. |

| Administrative Charges (one time non-refundable) | Rs.5000/- (legal and technical charge) + applicable GST. |

| Cheque/AD/ECS bounce Charges | Rs.500/- + applicable GST. |

| Document Retrieval Charges | Rs.500/- + applicable GST. |

| CIBIL Report Charges | Rs.100/- + applicable GST. |

| Cersai Charges | Rs.100/- + applicable GST. |

| Late Payment Charges | Home loan: 2% per month Home OD : 1.5% of the outstanding amount subject to minimum of Rs. 500/- & Maximum of Rs.5000/- |

| Foreclosure Charges | For home loan with floating interest rates – NIL. For home loan with fixed interest rates – 2%-4% on the outstanding loan amount + applicable GST. |

| Conversion Charges | If Prepayment charges are not applicable in the loan – Rs. 1000/- plus applicable GST. If Prepayment charges are applicable in the loan then below conversion charges are applicable Floating to Floating – 0.5% of the principal outstanding + applicable GST. Dual fixed rate to Floating – 0.5% of the principal outstanding + applicable GST. Floating to Dual fixed rate – 0.5% of the principal outstanding + applicable GST. Life time fixed to floating – 1.75% of the principal outstanding + applicable GST. |

| Miscellaneous charges viz. Title search, etc and any other charges (as applicable) that are not budgeted or specified, but are incurred by the bank on behalf of the customer. | At actual. |

Note: Figures mentioned above are subject to change as per ICICI Bank’s discretion without prior notice.

Additional Read: DON’T GET FOOLED !! MUST KNOW ALL COSTS IN HOME LOAN

Loan To Value (LTV): Varies from 75%-90% depending upon the loan amount and the market value of the property.

| Market Value Of Property | LTV % |

| Upto 30lakhs | 90% of market value of the property. |

| 30lakhs – 75lakhs | 80% of the market value of the property. |

| 75lakhs and above | 75% of the market value of the property. |

ICICI Bank Home Loan Eligibility

Home loan eligibility with ICICI depends upon various factors such as your current age, retirement age, monthly income, net profits, professional/employment details, fixed monthly obligations, property valuation and LTV. Your eligibility is determined by two means

- Income Eligibility

Income eligibility is calculated @ FOIR (fixed obligation to income ratio) % on the net income subject to deductions.

Income eligibility for salaried is calculated @ 60%-65% of the net per month income.

Income eligibility for self-employed is calculated @ 65%-70% of the net profit.

((Net income per month X FOIR %) – Obligation OR Deductions) ÷ Per lakh EMI

- Loan Eligibility as per the property funding.

As per the property valuation, your eligibility will be calculated as under:

Market value of the property X applicable LTV % (75%-90%).

The lower figure from 1) and 2) will be your final home loan eligibility.

To calculate income eligibility with ICICI bank other equally important factors considered are- your profile, segment, CIBIL score, income stability, job continuity, past repayment history, etc. Income eligibility can also be enhanced by adding an earning co-applicant to the application. (Click to Know The Co- Applicant In Home Loan). ICICI Bank uses the criteria such as gross turnover product, banking surrogate, salary multiplier, etc. to calculate the home loan eligibility.

Additional Read: What Do You Mean By Loan Eligibility In Home Loan?

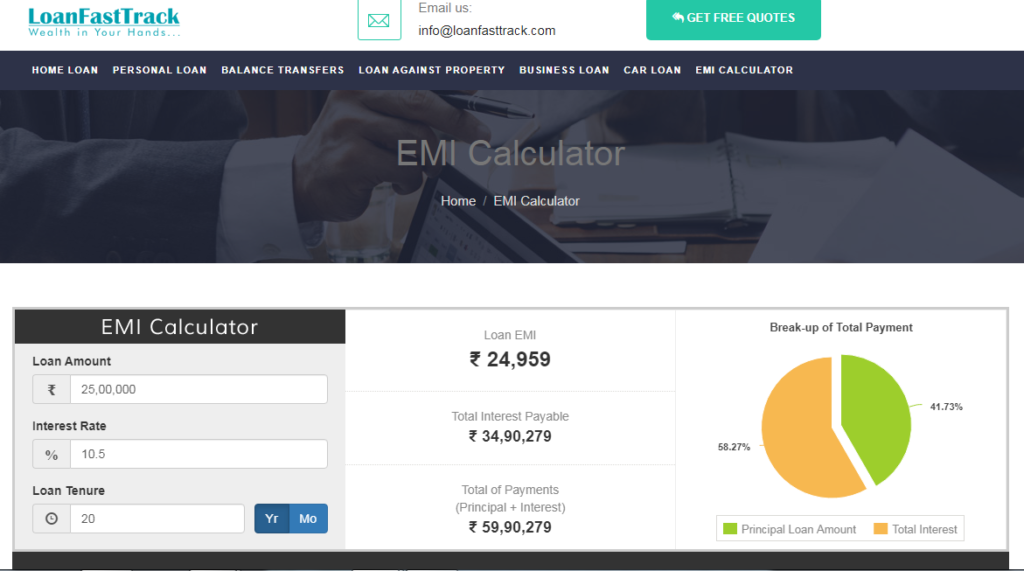

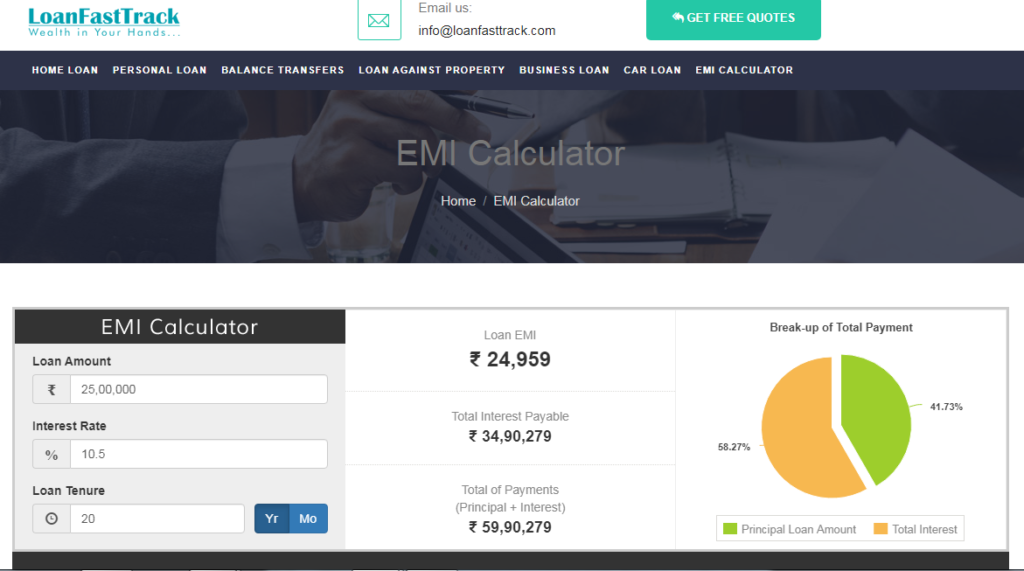

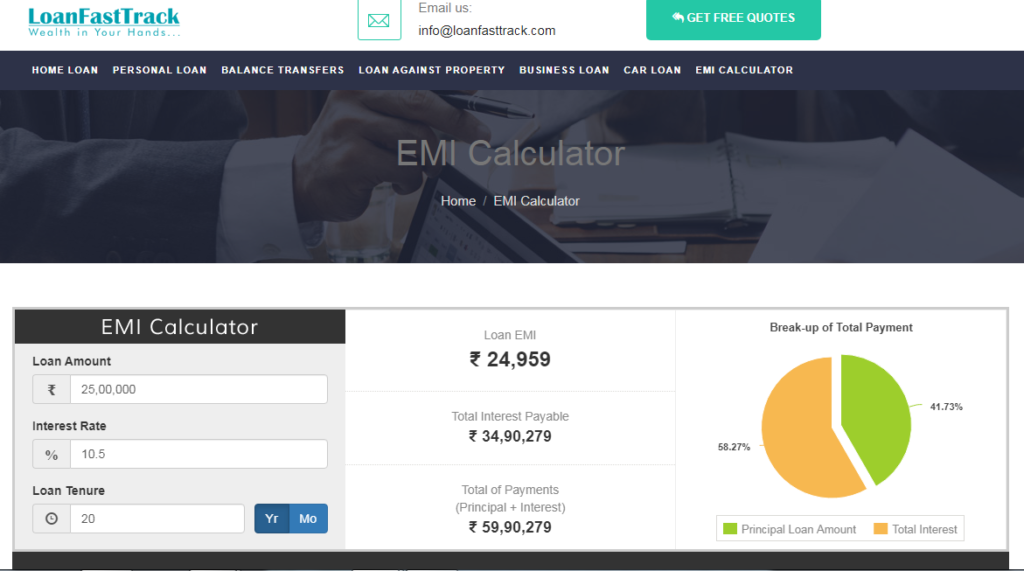

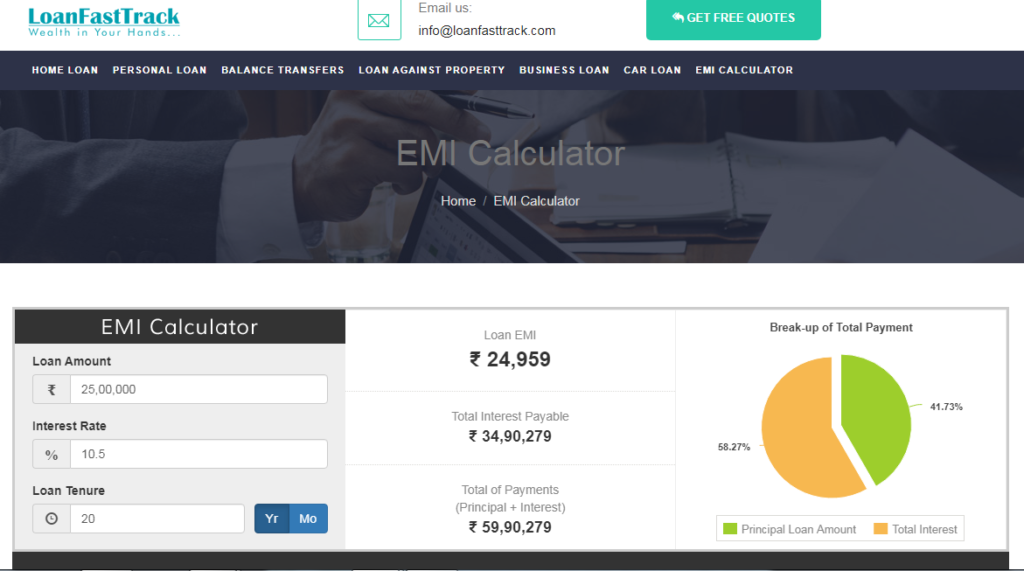

ICICI Bank Home Loan EMI Calculator

You can easily estimate your monthly installment by using the ICICI bank home loan EMI calculator. With the help of the calculator calculate how much EMI you can comfortably pay just at a single click. Knowing the kind of EMI you need to pay is important for planning a budget as lower EMIs weigh light on your wallet. The EMI calculator also calculates for you the total interest payable on the loan amount which helps you to choose a suitable loan tenure. At the same time you can also compare multiple EMIs with different loan tenures and interest rates and choose the one which is best within your budget.

The home loan EMI mainly depends on the principal amount, loan tenure and the rate of interest. With these details entered on the calculator you can easily come to know your EMI and the total interest payable till the loan tenure.

ICICI Bank’s Home Loan EMI for Rs. 1 Lakh loan amount at lowest 6.95% interest rate for different tenures

| Calculated Results For ICICI Bank Home Loan EMI | Tenure | |||

| 5 Years | 10 Years | 15 Years | 20 Years | |

| Per Lakh EMI | Rs.1,978/- | Rs.1,159/- | Rs.896/- | Rs.772/- |

| Total Interest Payable | Rs.18,666 | Rs.39,021/- | Rs.61,286/- | Rs.85,352/- |

| Total amount payable including principal and interest | Rs.1,18,666/- | Rs.1,39,021/- | Rs.1,61,286/- | Rs.1,85,352/- |

ICICI Bank Home Loan EMI Calculator @ 7.45% Interest Rates

| Loan Amount | 10 Years | 15 Years | 20 Years | 25 Years | 30 Years |

| 25 Lakhs | Rs.29,610/- | Rs.23,104/- | Rs.20,063/- | Rs.18,394/- | Rs.17,395/- |

| 50 Lakhs | Rs.59,220/- | Rs.46,209/- | Rs.40,127/- | Rs.36,787/- | Rs.34,790/- |

| 75 Lakhs | Rs.88,831/- | Rs.69,313/- | Rs.60,190/- | Rs.55,181/- | Rs.52,185/- |

| 1 Crore | Rs.1,18,441/- | Rs.92,417/- | Rs.80,254/- | Rs.73,574/- | Rs.69,579/- |

Different Home Loan Products Of ICICI Bank

Since all home loan requirements are not the same, ICICI bank offers you a variety of home loan products. There is a home loan product for renovation and repairs, home improvement, for additional loan requirements of top-ups, for loan transfers, for smaller incomes and for cash incomes earned.

1) Home Loan

Home loan with ICICI bank is available for all borrowers right from the small income earners to the maximum loan requirements @ attractive interest rates which starts from 6.95% p.a. with flexible loan tenures. Special discounted interest rates are available for women borrowers. Interest rates offered are floating as well as fixed. The interest rates are linked to repo rates -RLLR. PMAY benefits upto Rs.2.67lakhs is also available for the eligible borrowers.

Home Loan Features

| Age | 25 Years – 70 years. |

| Eligible Profiles | Both Salaried & Self-employed. |

| Tenure | For salaried – Upto 30 years. For self-employed- Upto 15 years. |

| Minimum Income | For salaried – Rs.18,000- per month. For self-employed – Rs.2.6 lakhs p.a. For affordable housing – Rs.10,000/- per month. |

| Interest Rates | For salaried – 6.95% -8.05% |

| Processing Fees | 0.30%-2% on the loan amount + applicable GST. |

| Transaction Type | Builder purchase, resale, self-construction, extension, renovation and transfer of existing loans. |

Click for Home Loan documentations – For Salaried resale case & builder case, For Self-Employed- Proprietorship Firm resale case & builder case, Private Limited Company resale case & builder case, Partnership Firm resale case & builder case.

2) Home Loan Balance Transfer

Home loan balance transfer is a loan product to switch your existing loan to ICICI bank to enjoy the benefits of low interest rate which starts from 6.95%*. The product requires a minimum CIBIL score of 750 and above and a mandatory condition of good repayment track history. With ICICI’s express balance transfer product, loan transfer is easy and quick because the loan is transferred only on the basis of your 18months repayment track record. Also enjoy the top-up benefit to meet your personal needs with balance transfer with top-up loan and get top-up upto 100% of the loan amount.

Home loan taken for under-construction property cannot be transferred.

| Minimum Loan Amount | For balance transfer – Rs.10 lakhs. For balance transfer with top-up – Rs.5 lakhs. |

| Precondition | Good repayment history of 18 months. |

| Property Type | Only completed properties are eligible for balance transfer loan. |

| CIBIL Score | Above 750 |

| Additional Documents Required | 12 months – 18 months repayment track record.Outstanding principal letter.LOD (list of documents) from existing Bank/NBFC. |

Click for Home Loan Balance Transfer documentations – For Salaried, For Self-Employed- Proprietorship Firm, Private Limited Company, Partnership Firm.

Click to switch your high interest rate home loan to 7%-7.50%.

3) Top-Up Loan

Top-up Loans are provided as additional funding on an existing ICICI bank home loan or on balance transfers of home loan. The top-up funds can be used for any business or personal use except speculative purposes. To avail the top-up you must have a good track record with ICICI bank. The top-up amount is subject to your income eligibility and the market value of the property.

| Minimum Loan Amount | Rs. 50,000/- |

| Maximum Loan Amount | 100% of original loan amount sanctioned |

| Purpose | Personal as well as business use. |

| Property Type | Only completed properties eligible for top-up loan |

| LTV | Upto 80%. |

| Maximum Tenure | Balance tenure of existing loan or 10 years whichever is higher. (subject to max tenure defined as per the customer profile) |

4) Instant Pre-Approved Loans

Instant Home Loan

The facility of instant home loan sanction is available only for the borrowers having a salary account with ICICI bank and pre-approved home loan offers (Pre-approved home loan is the loan amount based on the salary credits appearing in the bank account). You can generate your home loan sanction letter online in just a few clicks and no documents are required to get a loan sanction. Exclusive top offers are available for top corporates.

Steps for Instant Home Loan:

- View offer and select your home loan offer.

- Pay a discounted processing fee

- Download your sanction letter

| Eligible Profile | Salaried having a salary account with ICICI bank and pre-approved home loan offer. |

| Maximum Loan Amount | Rs.3 crore. |

| Tenure | Upto 30 years. |

| Sanction Validity | 6 months. |

| Interest Rates | 6.95% – 7.95% |

Instant Balance Transfer

The Instant Balance Transfer sanction is available only for borrowers having a salary account with ICICI bank and pre-approved balance transfer offer. Pre-approved balance transfer offers are generated for customers on the basis of the ongoing loan(s) of the customers. You can transfer maximum 2 loans in instant balance transfer.

Generate instant sanction letter within 3 clicks.

- View and select your balance transfer offer.

- Pay a discounted processing fee.

- Download your sanction letter.

| Eligible Profile | Salaried having a salary account with ICICI bank and pre-approved balance transfer offer. |

| Maximum Loan Amount | Rs.3 crore. |

| Tenure | Upto 30 years. |

| Sanction Validity | 6 months. |

| Interest Rates | 7.10% – 7.35% |

Insta Top-Up

Insta top-up loan is an pre-approved loan available to meet your instant financial needs. It provides an instant solution to all your business and personal requirements. The loan can be applied in 3 simple steps.

- View and select your top-up offer.

- Pay a discounted processing fee.

- Download your sanction letter.

| Eligible Profile | Salaried having a salary account with ICICI bank and pre-approved top-up offer. |

| Maximum Loan Amount | Rs.1 crore. |

| Tenure | Upto 10 years. |

| Sanction Validity | 6 months. |

| Interest Rates | 7.10% – 7.50% |

5) Home Improvement Loan

Home improvement loan is available for refurbishing your house. Home improvement loan cover a range of facilities internal as well as external to the structure without increasing in the living space. Home improvement loan is based on the estimation of the cost of improvement to be approved by the bank. It cannot be sought under Instant Home Loan.

| Loan Amount | Minimum – Rs.5 lakhs. Maximum – Rs.15 lakhs. |

| Loan Tenure | Minimum – 3 years. Maximum – 20 years. |

| Interest Rates | 6.95% – 8.05% |

6) Express Home Loan

Express home loan is available to get quick and easy home loan sanctioned online. Both salaried and self-employed can apply for this product without visiting the branch or the sales executives. By simply applying online, providing basic details, filling the application form and by uploading the required KYC & income documents you can generate your provisional sanction letter.

7) Extra Home Loans

Extra home loan provides dual advantage of improved affordability and a longer repayment period. Both salaried and self-employed are eligible to apply for this loan. It is available in 3 variants to address the needs of middle age salaried individuals (up-to 48years), self-employed professionals (earning higher income in some months of the year, given the seasonality of the business they are in) and young age salaried individuals (up-to 37years).

The product allows to enhance your home loan amount by upto 20% and therefore make yourself qualify for a higher loan amount. You can also extend your repayment tenure upto 67years of your age provided the enhancement in loan & repayment period is backed by mortgage guarantee.

The maximum home loan that can be availed under extra home loans is Rs.2crs.

The loan is offered in association with Indian Mortgage Guarantee Corporation (IMGC), a joint venture between National Housing Bank, Genworth Financial Inc., Asian Development Bank and International Finance Corporation.

8) NRI Home Loans

Both salaried and self employed NRIs can apply for a home loan to purchase a house, build a house or purchase a property in India provided he is not a citizen of Iran, Pakistan, Bangladesh, Sri Lanka, Afghanistan, China, Nepal, North Korea (Democratic People’s Republic of Korea), Cuba, Syria, Sudan, and Crimea Region of Ukraine, Macau, Nigeria, Hongkong or Bhutan.

NRI Home Loan Eligibility

| Age | Minimum: 21 Years Maximum: 65 Years or retirement age whichever is earlier at the time of maturity of loan. |

| Eligible Profiles | Salaried: Minimum 1 year of employment overseas Self-Employed: Minimum 3 years in current business overseas |

| Tenure | Home Loan: 30 Years Home Improvement Loan: 15 Years Land Loan: 20 Years |

| Minimum Income | Rs. 2lakhs |

| Interest Rates | For salaried – 6.95% – 7.95% For self-employed – 7.20% – 8.05% |

Click to know the NRI List Of Documents For Applying Home Loan.

Additional Read: Everything You Must Know About NRI Home Loans

9) Home Overdraft

Home Overdraft is a special offering only for salaried customers having salary account or savings account with ICICI Bank or are salaried with selected corporate, wherein you can avail a home loan or mortgage loan or top-up loan or balance transfer with top-up loan in the form of an overdraft. The interest will be charged only on the utilized amount. The flexibility to withdraw and use funds whenever required is the USP of this product however the amount so withdrawn as overdraft cannot be utilized for speculative and restricted purposes.

The loan amount that can be drawn under this product is Rs.5lakhs-Rs.1crore. The overdraft offered with this product is renewable annually and will attract applicable renewal charges, which will be debited to the overdraft account.

10) 24 Hours Top-Up Loan

A 24 hours top-up loan is a pre-approved top-up loan available for the customers with a good repayment record. It is a hassle free loan with minimum documents required. The loan is disbursed in just 24 hours.

| Eligible Profile | Both salaried & self-employed. |

| Maximum Loan Amount | Upto- Rs.1 crore. |

| Tenure | Upto 10years. |

| Interest Rates | 7.10% – 7.50% |

11) Pratham Home Loan

Pratham home loan is an affordable home loan product for the customers with low income earnings. Cash income is not considered under this product. Both salaried and self-employed customers can apply for this product. Pratham home loan can be availed for home loan, home improvement loan and home loan balance transfers.

Eligibility Criteria For Pratham Home Loan

| Eligible Profile | Both salaried & self-employed. |

| Age | Minimum: 21 Years Maximum: 70 Years |

| Loan Amount | Minimum – Rs.5 lakhs. Maximum – Rs.50 lakhs |

| Tenure | Upto 20years. |

| Work Experience | Salaried – 1 year (6 months experience in current organization). self -employed – business vintage of 5 years (3 years in same business). |

| Income Per Month | Minimum Rs.10,000/- |

| LTV | For salaried – as per RBI guidelines. For self-employed – maximum 65%. |

| Processing Fees | 2% of the loan amount + applicable GST. |

12) Banking Product

The product is especially designed for self-employed borrowers. The borrower is not required to submit any ITRs or financials and the income eligibility assessment is based only on their bank statements. For higher income eligibility the borrower can also provide his multiple accounts for eligibility calculation and there is no cap on the number of accounts which can be considered.

| Eligible Product | Home loan, home loan balance transfer & top-up. |

| Loan Amount | Minimum – Rs.10 lakhs. Maximum – Rs.3 crores. Loan Amounts for Professionals (CA, DR, CS, and Architect) basis savings account only – Rs.50 lakhs. |

| Maximum Loan Tenure | 15 years. |

| LTV | 70% |

| Accounts Credit | Current Account- Minimum 3 business credits in main account and 1 in other accounts. Savings Account – Minimum 3 transactions per month. |

The ADB-EMI Ratio

ADB stands for average daily balance. On the basis of your banking transactions, the bank determines your eligibility by using the ADB-EMI formula. For determining ADB, your total balance in the banking account is considered for all the subsequent dates of 1st, 11th and 21st for 36 months. The ADB figure so derived is then used to determine the eligible EMI.

Eligible EMI = ADB/ ADB-EMI Ratio.

The applicable ADB ratio depends on the ADB range. Mentioned below is the grid of ADB range and its applicable ratio along with the maximum loan amount as per the ADB range.

| ADB Range (10 years) | Applicable Ratio | Maximum Loan Amount |

| <=107603 | 2 | Upto Rs.25 lakhs. |

| >107603 and=<286942 | 3 | > Rs 25 Lakhs and upto Rs 50 Lakhs |

| >286942 | 4 | > Rs 50 Lakhs and upto Rs 3 Cr |

Learn in detail about the banking product, read more on Banking Surrogate Product Of ICICI Bank.

13) Gross Turnover Product (GTP)

The GTP product is also especially designed for self-employed borrowers to calculate their eligibility on the basis of their gross profit (lower of actual or imputed) and therefore a higher loan amount of 3.3 times the normal eligibility can be funded under this product. The imputed margins to be taken for calculations are defined as per the business category. All manufacturers, services and traders are eligible for funding under GTP.

| Eligible Product | Home loan, home loan balance transfer & top-up. |

| Loan Amount | Minimum – Rs.10 lakhs. Maximum – Rs.3 crores. |

| Maximum Loan Tenure | 15 years. |

| Imputed Margins | For manufacturer and services 10%. For trader – 7%. |

| Business Vintage | Minimum 5 years. |

14) Salary Multiplier

This product is specially designed for salaried borrowers availing home loan for the first time and working for elite corporates as per the bank’s specified list of companies. The USP of this product is that the other obligations of the borrower are not considered for determining the eligibility of the borrower.

| Eligible Profile | Only salaried resident Indians working for specified elite list of companies. |

| Maximum Loan Amount | Rs.1.5 crores. |

| Minimum Salary | Net Salary excluding overtime allowances, variable components. >= Rs 50,000 pm for MMR and NCR.>=Rs 40,000 for other locations. |

| Net salary multiplier for loan eligibility | 58% of Net Salary |

| Documents waived | Form 16. |

15) SURF

SURF product is specially designed for the borrowers who are in the initial stage of their career and are expected to have a higher and consistent salary growth in their near future. SURF is a structured repayment facility. It is designed on the basis that the repayment capacity of the borrower will gradually increase over the time. The loan eligibility in this product is therefore 18% higher than the normal eligibility.

| Eligible Profile | Salaried- Employees of Elite, Super Prime and Preferred List of companies. |

| Minimum Qualification | Professionally qualified/Post graduate. |

| Minimum Salary | Rs.20,000/- per month. |

| Income Growth For Eligibility | Elite – 7% Super prime – 6% Preferred – 5%. |

| Maximum Tenure | 20 years (including under-construction period). |

| Outflow | Primary term: Only interest on the disbursed loan amount Secondary term: EMI on the balance term |

| Particulars | Primary Terms | Secondary Terms |

| Under Construction APF Project. | 3-5 years as per completion period. | Balance tenure. |

| Completed Properties | Maximum 3 years. | Balance tenure. |

| Outflow | Only interest. | EMI on principal amount. |

| Re-schedulement Of Loan | Not allowed. | Allowed. |

| Top-Up Loan | Not allowed. | Allowed. |

16) Flexible Loan Installment Plan (FLIP)

This new variant of ICICI bank is specially designed to provide higher loan tenure to the borrower especially in cases where one or more loan applicants, whose income is considered for eligibility is retiring early. FLIP is a special repayment facility wherein the EMI in the initial period of loan is higher than the later period and the EMI alongwith the loan amount is calculated separately for all the loan applicants. The eligible co-applicant in the loan can be father, mother, spouse or son. The loan borrower can either apply for floating or fixed interest rates.

Speak to our experts on 9321020476 or log on to https://www.loanfasttrack.com/ for additional details. You can also email on info@loanfasttrack.com.

Loanfasttrack is a direct sales associate with ICICI bank.

Loanfasttrack is the best online user friendly platform to compare and evaluate the best bank for home loan in India. Loanfasttrack is a Mumbai based loan provider company since 2015 offering loan services in Mumbai on– housing loan in Mumbai, mortgage loan in Mumbai, personal loan in Mumbai, business Loan in mumbai, unsecured business loans,home loan transfer, top-up loans, car loans, educational loans and loan transfers.

It also helps you:

√ To find the best bank for home loan

√ To get lowest home loan rates in Mumbai

√ To get an instant loan in Mumbai

√ To get instant personal loan in Mumbai & business loan in Mumbai

√ To make you qualify for the maximum loan against property eligibility

√ To get a low cost home loan balance transfer

√ To get assured low interest rates for loan against property in Mumbai

Additional Read:

- Everything You Must Know Before Applying For A Housing Loan

- Know How To Deal With The Increasing Interest Rates Of Housing Loans

- Housing Loan Benefits For Women Borrower In India

- Know How Your Home Loan Inquiry Impacts Your CIBIL Scores

- Purchasing An Under-Construction Property? Here Are The Important Loan Facts You Must Know Before Making A Purchase

- Difference In Applying Home Loan With Public Bank & Private Bank

- Home Loan Interest Rates꘡Compare Rates Of Top Banks

- Why Home Loan Interest Rates Of NBFCs Higher Than Banks

- The Slow Down Home Loan Industry Is Now Reviving